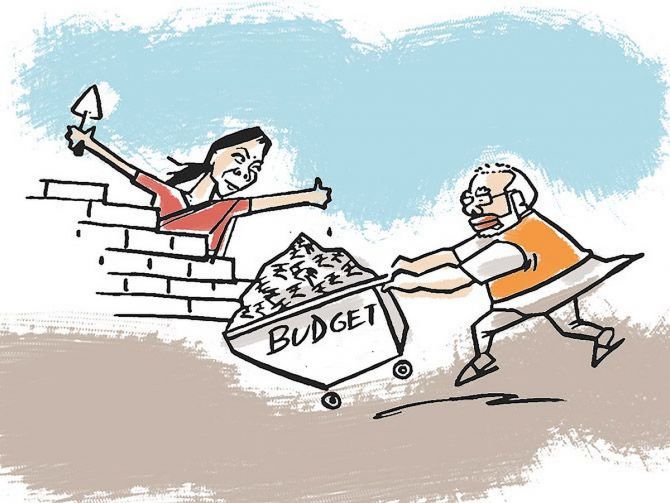

The government may save over Rs 70,000 crore (Rs 700 billion) on capital and revenue expenditure allocated towards new schemes in the FY25 Budget that are yet to be implemented.

In the FY25 Budget, the government announced three employment-linked incentive (ELI) schemes with an annual allocation of Rs 10,000 crore (Rs 100 billion).

The skill ministry was tasked with implementing the plan to upgrade 1,000 ITIs with an outlay of Rs 1,000 crore (Rs 10 billion) for the current financial year. However, these schemes are yet to see the light of the day.

The finance ministry also parked Rs 62,000 crore (Rs 620 billion) towards 'new schemes' with the Department of Economic Affairs, most of which are expected to go unspent with only a few weeks left in the current financial year.

"This allocation to DEA is usually an unallocated lump sum, which would lapse if the money is not utilised. It is a placeholder that may have been kept under new schemes since the government was coming post elections and needed time to strategise its expenditure," former DEA secretary Subhash Chandra Garg said.

Finance Minister Nirmala Sitharaman also announced the first-of-its-kind internship programme as part of the Prime Minister's package for skilling and employment, with an allocation of Rs 2,000 crore (Rs 20 billion) in FY25.

The ministry of corporate affairs has been able to launch the programme only as a pilot project with an estimated budget of Rs 800 crore (Rs 8 billion). The scheme is expected to start full-fledged in the next financial year, incorporating the learnings from the pilot programme.

The Anusandhan National Research Fund for basic research and prototype development announced in the interim Budget for FY25 is yet to be operationalised.

The National Research Fund under the Department of Science and Technology received an allocation of Rs 2,000 crore in FY25, including the provision for the Anusandhan National Research Foundation.

The purpose of this fund is 'to address the pressing need for a professional and comprehensive research framework that directs human and material resources towards carrying out well coordinated research across disciplines and across all types of institutions.'

Budget FY2025 has set a target of achieving a fiscal deficit of 4.9 per cent of GDP. The recent advance growth estimates for FY25 released by the National Statistics Office showed that the FY25 nominal GDP may grow at a slower pace of 9.7 per cent than 10.5 per cent assumed in the Budget.

This, however, may not impact achieving the fiscal deficit target due to the lower offtake of capital expenditure so far.

Experts believe that the capex target of Rs 11.1 trillion for FY25 is likely to be missed by a margin of at least Rs 1.0 trillion to Rs 1.5 trillion.

Gaura Sengupta, chief economist, IDFC First Bank, says the FY25 fiscal deficit is estimated to be lower than the budget estimate by Rs 830 billion and as a proportion of GDP, fiscal deficit is estimated at 4.7 per cent of GDP vs 4.9 per cent of GDP target.

"Expenditure savings is expected on capital expenditure, while revenue expenditure is expected to be marginally higher than Budget Estimate. Capital expenditure is likely to undershoot the target. Interest free capex loans to state governments is currently tracking at Rs 900 billion, lower than the targeted Rs 1.5 trillion. Revenue expenditure is expected to be marginally higher than budget estimates led by subsidies," Sengupta said.

Madan Sabnavis, chief economist, Bank of Baroda, says that Rs 62,000 crore was added in FY25 Budget only and is part of the government's capital account.

"This amount is part of the Rs 11.1 trillion capex target and if it remains unutilised, it surely helps to achieve a lower deficit. For other schemes, we will get the revised number in the Budget and if unspent it can help lower the deficit or compensate for any shortfall in other collections," Sabnavis added.

© 2025

© 2025