Punishments included withholding of increment, demotion for one year, and censure under provisions of the bipartite settlement, reveals RTI reply.

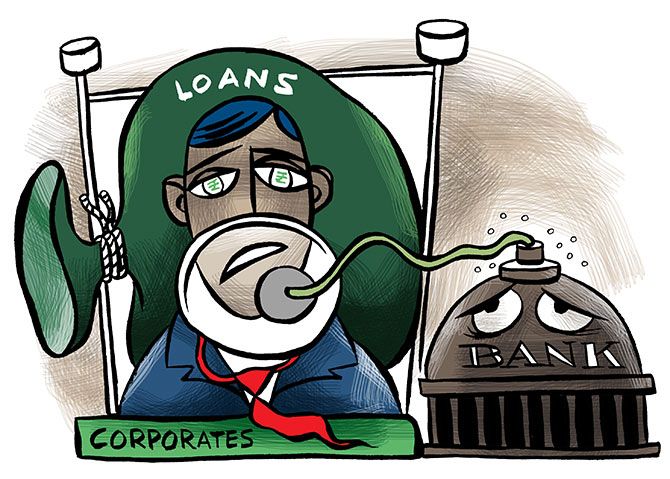

Illustration: Uttam Ghosh/Rediff.com

Not only managers but also single-window operators, clerks, cashiers, and even a peon were penalised for staff delinquency by public sector banks (PSBs) in 2017-18 in connection with the rising non-performing assets (NPAs), replies to RTI queries have revealed.

Most of those punished were managers across different scales, from Scale 7 (general managers) to Scale 1 (officers).

However, at least one bank - Oriental Bank of Commerce - revealed that 17 single-window operators (SWOs), five head cashiers, two clerks, one clerk-cum-cashier, and one peon-cum-housekeeper were among those penalised for staff delinquency.

Punishments against these employees included withholding of increment, demotion for one year, and censure under provisions of the bipartite settlement.

The RTI queries were filed by transparency activist Venkatesh Nayak and their replies were reviewed by Business Standard.

Responding to a question in the Lok Sabha on PSBs’ declining profits, the then finance minister Arun Jaitley had said in December 2018 that 6,049 PSB staffers were penalised for rising non-performing assets (NPAs) in 2017-18.

In July this year, Finance Minister Nirmala Sitharaman, informed the Lower House that 41,360 bank employees had been held responsible for NPAs in the past five financial years.

According to RTI replies, no PSB chairman, director, deputy director or managing director was penalised.

These executives do not come under the purview of staff disciplinary rules and are, therefore, exempt.

However, there is a possibility that cases might have been lodged against such executives separately, information of which was not given by most banks.

Of the 21 PSBs, 15, including State Bank of India (SBI) and Punjab National Bank (PNB), did not divulge data on staff delinquency.

This was even as SBI and PNB had the highest number of employees against whom staff accountability had been fixed in the past five financial years - 8,035 and 4,488 employees, respectively.

© 2025

© 2025