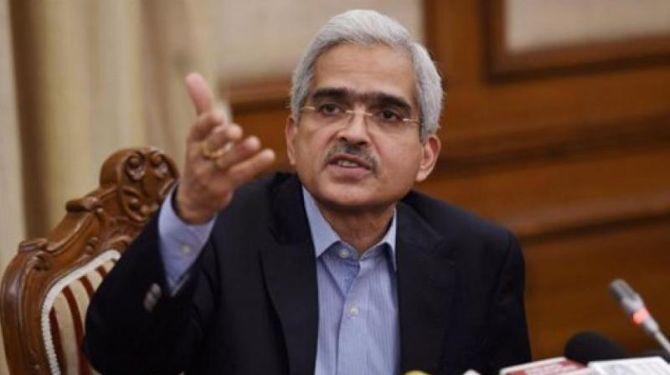

After hiking the repo rate by 0.50 per cent, RBI Governor Shaktikanta Das on Wednesday said future policy actions by the central bank will be guided by the evolving conditions.

Addressing a press conference, the governor said the RBI has changed the policy stance to drop the phrase "remains accommodative", and instead opted for "withdrawal of accommodation" for guiding its future moves.

The central bank did not hike the cash reserve ratio contrary to speculation, he said, adding that the liquidity withdrawal will be calibrated and measured.

He assured that adequate liquidity will be available for banks to lend for economic growth.

The Indian economy continues to be resilient and is well placed to deal with challenges emerging from the global worries and will be supported by a banking system having strong capital buffers, low non-performing assets and higher provisioning coverage, Das said.

At a time when the RBI upped its inflation expectation to 6.7 per cent, the governor said he is confident that the actions being taken by the central bank will help reduce inflation and also inflationary expectations among the people.

He assured that the RBI does not want to take any abrupt or rough action that will be detrimental to inflation and the markets.

Das also said that the credit offtake has improved, and the number is over 12 per cent now.

To a question on what happens when the central bank misses its target of containing inflation with the headline number overshooting for three consecutive quarters, he said the central bank will deal with it as and when the situation arises.

When asked if the government should initiate more measures on the supply side, he said the government is "mindful" of the realities and will take appropriate measures.

The governor said the RBI is in constant dialogue with the government on many issues, including cryptocurrencies, and will be awaiting the discussion paper to be floated by the Centre soon.

© 2025

© 2025