Niti Aayog will prepare the next list of central public sector companies for divestment in the next few weeks, its vice chairman Rajiv Kumar said on Thursday and expressed hope that the proposed asset reconstruction and management companies to address banks' bad loan woes will do a good job like the UTI.

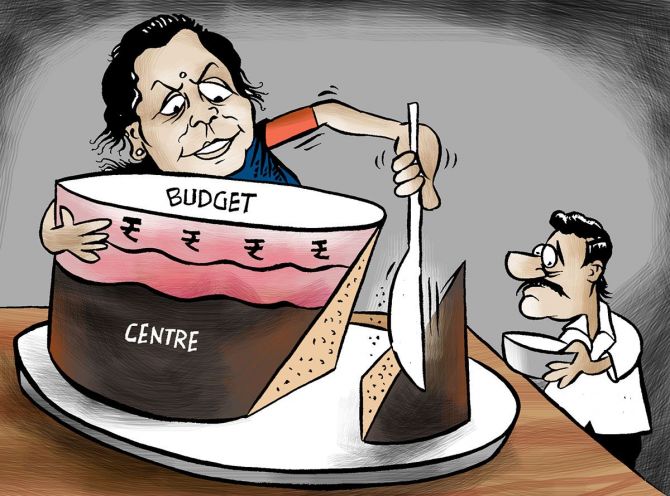

Days after Finance Minister Nirmala Sitharaman announced the Union Budget for 2021-22 laying out various measures (including disinvestment proposals) to bolster the pandemic-hit economy, Kumar also emphasised that the Modi government has shown consistent commitment for the welfare of farmers and for the improvement of the agriculture sector.

"Now the process has begun... We will complete preparation of the next list in the next few weeks, we have got the marching order," Kumar said about the list of public sector companies for the next round of stake sales.

To fast track the disinvestment process, Sitharaman, in her Budget speech on Monday, said Niti Aayog would work out on the next list of central public sector companies that would be taken up for strategic divestment.

The government think tank has already given five different sets of recommendations on divestment.

On the government's proposal to set up an asset reconstruction company and an asset management company to clean up non-performing assets in the banking sector, Kumar said that was necessary to get the banks to start lending again as they were mired in so-called twin balance sheet problem.

"Otherwise, it would have taken very long to clean up the bank balance sheet, or taken a huge amount of capital for getting it done," he told PTI, adding that the alternative was to try and take these non-performing loans out of banks' balance sheets.

"Hopefully, (proposed) asset reconstruction company and asset management company will do the same good job that the UTI (Unit Trust of India) did at one point of time.

"And help us to restart the process of greater credit flows from the banking sector to the real sector of the economy," he told PTI in an interview.

UTI was established in 1963 by an Act of Parliament and was regulated by the Reserve Bank of India.

In February 2003, following the repeal of the Unit Trust of India Act 1963, UTI was bifurcated into two separate entities.

One is the Specified Undertaking of the Unit Trust of India (SUUTI) and the second is the UTI Mutual Fund, sponsored by SBI, PNB, BOB and LIC.

Referring to criticism that there was nothing for the middle class in terms of more tax breaks, Kumar said the "middle class' (people's) unending appetite of getting handouts from the government has to be rationalised"

"I recognise the huge contributions that taxpayers made for running the economy.

"But nonetheless, in difficult times, all of us have to have some patience and agree to work together for mobilising the necessary resources required to improve the infrastructure and improve the investment climate in the economy," he opined.

Replying to a question about protests by the farmers against the Centre's new farms laws, Kumar noted that these reforms "have been on the agenda in the election manifestos of all parties".

Noting that given the government is committed to the improvement of the agriculture sector's performance and to improving the farmer's welfare in every respect, Kumar said he does not think there is any reason to distrust the government at all.

© 2025

© 2025