In times when the covid-19 outbreak is putting the entire populations under threat, and social distancing has become the norm, it does make sense to avoid transacting in cash, reports Bindisha Sarang.

Money changes hand frequently, and cash even more so.

But in times when the covid-19 outbreak is putting the entire populations under threat, and social distancing has become the norm, it does make sense to avoid transacting in cash.

Some countries have already quarantined cash, while others like South Korea, have burnt, or high-heat laundered their notes.

The World Health Organisation has advised switching to contactless payments too.

No wonder, the Reserve Bank of India Governor Shaktikanta Das, too, urged customers to go digital on Monday.

Says Vikas Saraogi, vice president, acceptance development, Mastercard: "Given the current situation, contactless cards could provide conscious consumers with a new option to pay."

Adds Mandar Agashe, managing director and founder of Sarvatra Technologies: "Considering the current situation, contactless payments could be the way ahead, and payment modes like UPI, IMPS, RTGS, mobile wallet and net banking could contribute effectively in reducing human interactions."

Unified Payments Interface

It offers instant money transfer without the bank details.

Instead of bank account number and IFSC code, the virtual payment address (VPA) is used to pay through UPI.

If you choose this mode, which is the most popular payment option in India, keep a few things in mind.

UPI has a feature where you or a merchant can send the user a request to collect money.

You don't need to authorise a transaction if money is being transferred to your account.

However, due to this simplicity, a common type of fraud is when a fraudster convinces you to share the PIN, and money gets debited.

Says Agashe: "You should never share your PIN. If you share it, it's like sharing the key to a lock."

Net banking

Due to the virus, RBI has now made NEFT, IMPS, and UPI available round the clock to facilitate fund transfers, purchase of goods/services, payment of bills, etc.

Says Rajesh Mirjankar, MD and CEO, InfrasoftTech: "Phishing is the most common type of fraud for wallets and all online transactions. Regardless of what the context of the conversation in an email is, the client should never provide login credentials or other details on an email or should not click any links within an SMS or email."

At times, due to heavy traffic or technical glitches like server down, funds cannot be transferred.

The user needs IFSC code, account number and other details to be submitted. Check these details thoroughly.

Mobile wallets

These gained popularity post demonetisation in 2016.

Right from Paytm to PhonePe and Mobikwik, to name a few.

Bala Parthasarathy, CEO and co-founder, MoneyTap says: "The advantage of mobile wallets is that it allows you to go cardless. It doesn't require any card number, CVV, Pin or mobile number.

"It is independent of such information and can't be manipulated or hacked. Cashback or discount rewards are available."

However, a necessary precaution while using wallets, Mirjankar says, is that mobile users should not click on any images or links from unknown sources on SMS or any messaging app.

Also, it's best to download only popular apps and mobile wallets.

Adds Mirjankar: "Do not install and use any remote screen mirroring tool (such as AnyDesk). These tools are indeed convenient for genuine use-cases such as remote technical support, but if a trickster gets access to your device remotely, he can wipe out the account."

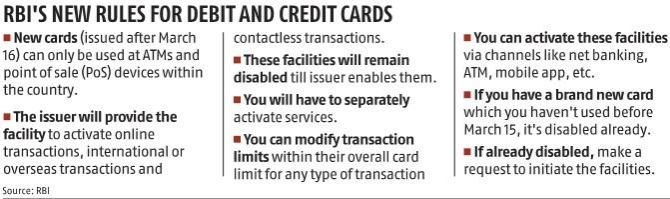

Cards

Tap and pay, or what's commonly known as wifi card by shopkeepers, is a contactless card.

You don't even need to punch in a PIN in the point-of-sale machine, and payments of Rs 2,000 can happen without a PIN.

As far as regular cards go, ensure you take customary precautions when doing online or offline transactions.

Irrespective of the types of digital payment, Sanjay Katkar, joint managing director and chief technology officer, Quick Heal Technologies, says: "Buy and install good antivirus software. Yes, pay for it! It won't cost you more than a dinner in a fancy restaurant."

Diversify

Many top private sector banks have suffered technical difficulties.

So, relying on just one bank isn't a good idea.

Have two or three options. Use e-wallet for smaller payments, UPI for home deliveries, contactless cards or net banking for larger payments and QR code at a shop.

Finally, just because it's safer not to handle cash doesn't mean you don't keep some handy.

Ketan Doshi, managing director, Paypoint India, says: "There's no question there's merit in going contactless at the moment. But, there's another side to this story. In panic situations, shopkeepers and other vendors will seek cash."

In situations of cash shortage at ATMs, make use of micro ATMs installed in grocery shops or mom and pop stores that allow payments using Aadhaar.

© 2025

© 2025