Following are the highlights of the seventh bi-monthly monetary policy statement for 2019-20 by the RBI amid the covid-19 pandemic:

- Monetary Policy Committee (MPC) advances meeting scheduled for Apr 1-3

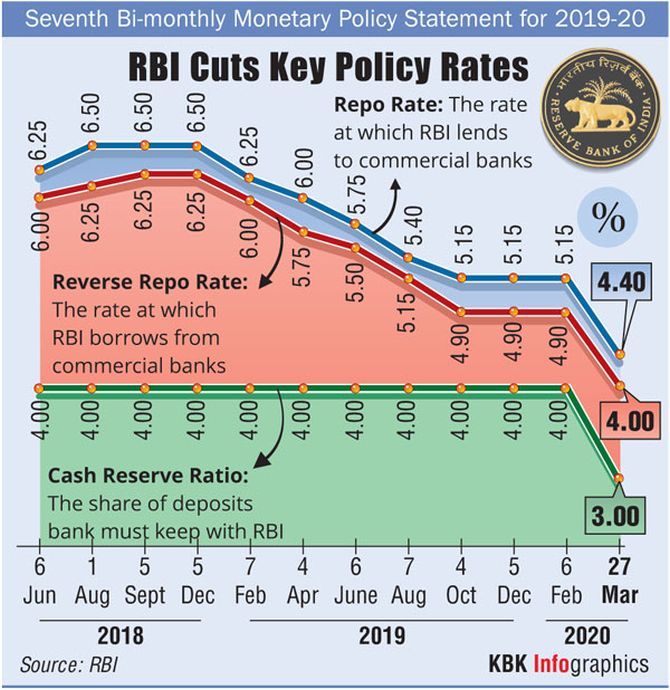

- Repo rate slashed by 75 basis points to 4.4%

- Reverse repo rate cut sharply by 90 basis points to 4% making unattractive for banks to deposit funds

- MPC votes unanimously for a reduction in the policy repo rate

- MPC decides to continue with the accommodative stance as long as it is necessary

- Committee votes 4:2 in favour of rate cut; unanimous on change in stance

- 2 MPC members Chetan Ghate and Pami Dua voted for a 50 bps rate cut

- Several measures taken to infuse liquidity of about Rs 3.74 lakh crore into the financial system

- RBI to undertake repo operation to infuse Rs 1 lakh crore

- Cash Reserve Ratio (CRR) cut sharply by 100 bps to 3 per cent releasing Rs 1.37 lakh cr into the system

- RBI assures to work in mission mode, monitoring the evolving financial market and macroeconomic conditions

- MPC for the first time advances meeting date and refrains from giving next meeting date in the wake of evolving situation

- GDP growth rate of 5% for 2019-20 at risk from the impact of pandemic

- Global slowdown to deepen with adverse implication for India; crude oil slump upside for country

- Upside growth impulses to emanate from monetary, fiscal measures and the early containment of covid-19

- Food prices to soften further on back of record foodgrain production

- MPC refrains from giving out growth, inflation outlook for coming fiscal on uncertain outlook

- RBI permits all lending institutions to allow 3-month moratorium on payment of installments on term loans

- Moratorium on term loan, deferring of interest on working capital will not classify as default

- RBI urges banks and other financial institutions to do all they can to keep credit flowing

- All instruments -- conventional and unconventional -- on table to support financial stability and revive growth

- RBI assures that banking system in India safe; deposits safe in private bank; public should not resort to panic withdrawal

- RBI says macroeconomic fundamental stronger than that in aftermath of 2008 financial market crisis

- Last tranche of the capital conservation buffer (CCB) for banks deferred for 6 months to September

- The minutes of the MPC to be published by April 13

© 2025

© 2025