CII said working capital limit enhancement should be accompanied by relaxing norms related to collaterals.

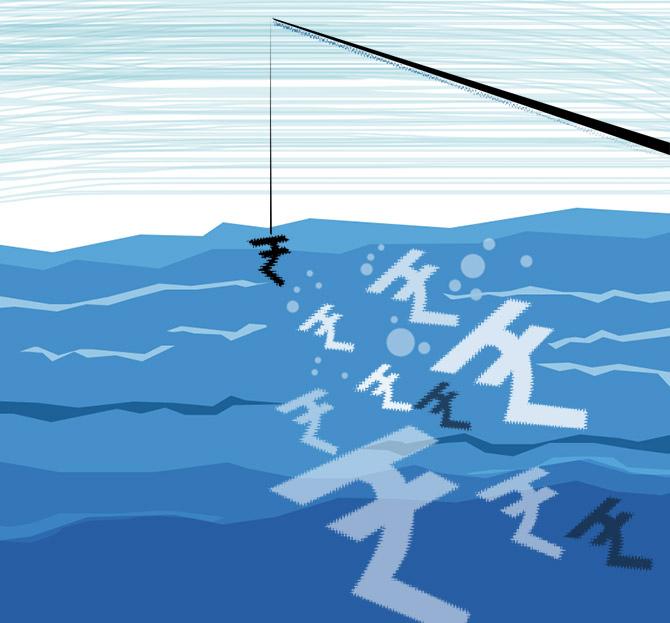

Lenders will need more time to firm up an additional working capital line for large corporates in the wake of the coronavirus (COVID-19) outbreak.

This is because most funding happens through consortiums or multiple banking arrangements.

A senior State Bank of India (SBI) executive said in the case of large corporates, where there is consortium and social banking, the decision will be taken in consultation with all the lenders.

Such a decision can’t be taken on a standalone basis because there are collateral issues and the need to get no-objection certificates.

If a fresh assessment of working capital requirement is to be done in view of the COVID crisis, that will have to be by the lead bank of a consortium.

It (leader) will do that in consultation with other lenders.

Asked whether large companies have approached with a demand, the bank executive said it is too early.

All of them are in the process of assessing the impact like disruption in cash flows.

At present, since they are working with half or even lower capacity, large companies may not need that now.

Many of them will try to assess how much working capital will be required when they resume operations after the lockdown is lifted partially or fully.

The SBI executive said, “No one has approached us so far. We have got in touch with large borrowers to assess the likely impact (of COVID).

Some ‘well-rated’ corporates are using the bond market route to raise money.

Like Tata Steel’s plan to float a debenture issue for Rs 10,000 crore.

The company will not like it to be in midst of an over-crowded place, where many throng the market, as it would jack up coupon (interest rate).

Many units have adopted a strategy to drawdown existing lines of credit to maintain liquidity.

But they also realise that in the event of a prolonged lockdown, a company would need to have more cash.

So, time to visit the market is now, that is, before all make a beeline, said the head of commercial banking with a large public sector bank.

Meanwhile, the Confederation of India Industry (CII), in a statement, said working capital limit enhancement should be accompanied by relaxing norms related to collaterals.

It should be based on the earlier track record of corporates, especially medium and small enterprises.

The additional working capital should be allowed to be repaid in three equal instalments from January 2021 to March-end 2021.

On the funding assistance for paying wages, the CII said banks should provide additional working capital limits, equivalent to the April-June wage bill of borrowers.

It should be backed by a government guarantee, at 4-5 per cent, with a refinance guarantee from the Reserve Bank of India.

© 2025

© 2025