The Department for Promotion of Industry and Internal Trade has notified the establishment of the Credit Guarantee Scheme for Start-ups, CGSS.

It would provide collateral-free debt funding up to Rs 10 crore (Rs 100 million) for start-ups extended by commercial banks, non-banking financial companies (NBFCs) and the Securities and Exchange Board of India (Sebi)-registered alternative investment funds (AIFs).

The scheme, earlier envisaged as part of the Start-up India Action Plan, was proposed to have a corpus of Rs 2,000 crore (Rs 20 billion).

However, the latest notification doesn't mention the corpus amount.

The credit guarantee cover under the scheme would be both transaction-based (for single eligible borrowers) and umbrella-based (for a group of eligible borrowers).

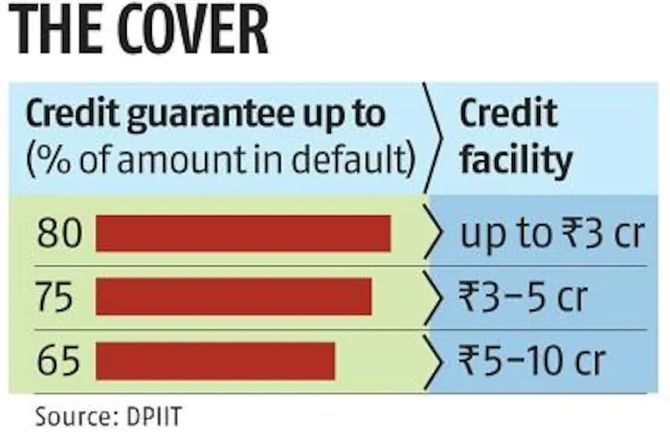

The extent of transaction-based cover will be 80 per cent of the credit facility up to Rs 3 crore, 75 per cent of the credit facility between Rs 3 and 5 crore, and 65 per cent of the credit facility between Rs 5 and 10 crore.

'The umbrella-based guarantee cover will provide guarantee to venture debt funds (VDFs) registered under AIF regulations of Sebi (a growing segment of funding in the start-up ecosystem),' DPIIT said in a statement.

'This is in view of the nature of funds raised by them and debt funding provided by them. The extent of umbrella-based cover will be the actual losses or up to a maximum of 5 per cent of pooled investment on which cover is being taken from the fund in eligible start-ups, whichever is lower,' DPIIT added.

'It is subject to a maximum of Rs 10 crore per borrower,' DPIIT explained.

Along with institutional mechanisms for operationalising the scheme, DPIIT will be constituting a management committee (MC) and a risk-evaluation committee (REC).

They would review, supervise and provide operational oversight of the scheme.

The National Credit Guarantee Trustee Company (NCGTC), which runs other credit-guarantee trust funds, will be operating the scheme.

'The framework of CGSS has been prepared in consultations between the stakeholders and line ministries, banks, NBFCs, VDFs, academia and experts from the start-up ecosystem.

"The scheme will act as a key enabler and risk-mitigation measure for lending institutions. It will enable collateral-free funding to start-ups,' DPIIT said.

Prime Minister Narendra Modi launched Start-up India Action Plan on January 16, 2016, to create a vibrant start-up ecosystem in the country.

'A dedicated credit guarantee for DPIIT-recognised start-ups will address the issue of unavailability of collateral-free loan. It will enable flow of financial assistance to innovative start-ups through their journey to becoming full-fledged business entities,' DPIIT stated.

'The scheme further reiterates the government's focus towards promoting innovation and fostering entrepreneurship for making Indian start-ups the best in the world,' DPIIT said.

CGSS is expected to complement the existing schemes under Start-up India initiative.

These include fund of funds for start-ups and Start-up India Seed Fund Scheme (SISFS) to mobilise domestic capital for Indian start-ups.

The government set up the fund of funds for start-ups in 2016 with a corpus of Rs 10,000 crore (Rs 100 billion) to increase capital availability as well as to catalyse private investment for start-ups.

Fund of funds does not invest in start-ups directly, but provides capital to Sebi-registered AIFs, known as daughter funds.

These funds invest money in high-potential start-ups.

SIDBI has been given the mandate of managing the fund of funds through the selection of daughter funds and overseeing the disbursal of capital.

As of August 31, 2022, SIDBI has committed Rs 7,385.45 crore (Rs 73.85 billion) to 88 AIFs.

A further Rs 2,899.48 crore (Rs 28.99 billion) has been distributed to 63 AIFs. A total of Rs 11,206 crore (Rs 112.06 billion) has been injected to boost 720 start-ups.

Last year, DPIIT notified the SISFS with an outlay of Rs 945 crore (Rs 9.45 billion) to provide financial assistance to start-ups for proof of concept, prototype development, product trials, market entry and commercialisation.

The scheme aims to support an estimated 3,600 entrepreneurs through 300 incubators in the next four years.

Feature Presentation: Aslam Hunani/Rediff.com

© 2025

© 2025