As vice chairman of the Reliance-Walt Disney JV, Uday Shankar is expected to create a content engine that feeds both digital and TV and push up the value.

As the chief executive officer of Star India from 2007 to 2020, Uday Shankar took the company from Rs 1,600 crore in revenues to Rs 18,000 crore.

In 2018, when Walt Disney Company bought Star's parent Fox's entertainment assets, the India business was valued at $13-15 billion.

Shankar, 61, is part of a group of investors that now gets Star India at a valuation that analysts peg at a third of that.

Shankar would be vice-chairperson of the entertainment giant that would emerge from the coming together of Reliance Industries and Walt Disney, announced on Wednesday.

“The most striking thing at this juncture is the price,” says Daoud Jackson, senior analyst, media and entertainment, at UK-based Omdia.

“If you had asked two years ago the price of Disney's India operations, it might have been around four times. This is a rapid turnaround to being worth less than $5 billion dollars.”

The press release announcing the deal pegs the post-money value of the merged entity at $8.5 billion. However, it is not clear what portion of it is for Star India.

The second striking thing is the level of consolidation it creates.

The broadcast, digital, and studio assets of Disney-Star include Star Plus and 70 other channels, a large pay-streaming app in Disney+Hotstar, and movies such as Neerja and Brahmastra.

Combine these with the 58 news, entertainment, digital brands, and films from Network18 and its subsidiary, Viacom18 (Colors, Moneycontrol, Drishyam 2, OMG2).

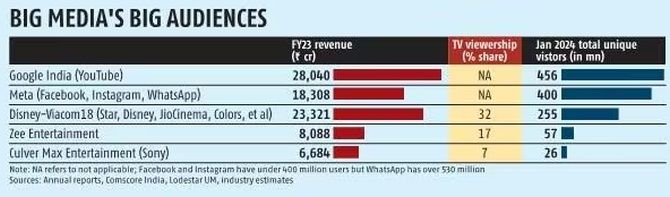

You have a media conglomerate that would have a 32 per cent share of all TV viewership in India.

If Voot, JioCinema and Disney+Hotstar are merged into one entertainment app, the resulting streaming service will be at 255 million unique visitors (see chart). That is about half the India reach of the world's largest streaming app, Google's YouTube.

“The whole narrative will change from TV is dying to TV-plus-digital is the future,” says an industry observer.

He reckons Shankar will do what he did at Star -- create a content engine that feeds both digital and TV and push up the value.

Note that TV gets four times the ad rates digital does. With its dominance of linear (traditional) television and digital, the Reliance-Disney duo is well placed to leverage the rise of smart TVs (connected to internet broadband), which is now bringing rates for streaming as well.

How would the Competition Commission of India react? Many within and outside the firms say Reliance and Disney would have thought this through.

It might mean creating a holding company structure or paring down businesses. For example, both Viacom18 and Disney Star are strong in Marathi, Hindi, and Kannada television.

This, analysts say, could lead to rationalisation. “Some of the antitrust concerns seemed to have abated, but they can reappear,” says Jackson.

If it goes through, the Reliance-Disney combination would worry as well as thrill advertisers.

The thought of the combined synergies of the firm that owns both the digital and linear TV rights for, say, the Indian Premier League is exciting. But it will make both TV and digital a sellers' market.

Fragmentation has meant that the media space in India has been a buyer's market for long.

As a result, the Rs 2.1 trillion Indian media and entertainment business has been high on potential and low on investor returns.

The per-unit monetisation of everything from ad seconds to per subscriber revenues here are among the lowest in the world.

“Average revenues per user and revenue remain low by global standards, which also contributes to the volatility we have seen. If this deal goes through, it may help to puncture some of that volatility,” says Jackson.

Will it create wealth and improve investor returns? That will become clear when the JV raises its next round of capital.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025