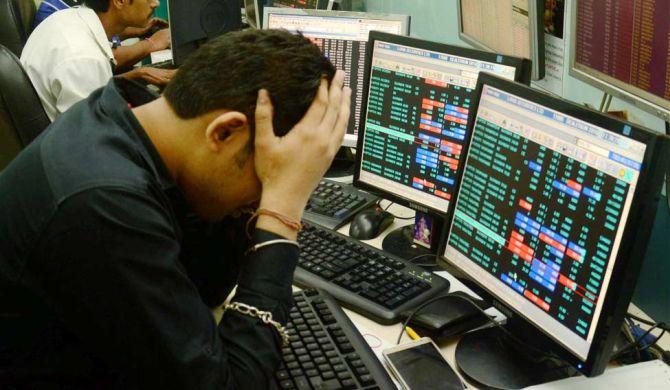

Shares of brokerages and market infrastructure institutions (MIIs) witnessed heavy selling pressure following the Securities and Exchange Board of India’s (Sebi’s) pivot to a uniform fee structure, which analysts fear could dent revenues.

Discount brokerages, which currently benefit from a spread between client charges and exchange fees, are expected to be most affected.

Shares of Angel One, the third-largest brokerage by active clients, fell 8.7 per cent. Groww and Zerodha, the largest brokerages, are not publicly listed.

“The difference between what brokers charge clients and what the exchange charges brokers is a rebate, common in major global markets.

"This rebate accounts for about 10 per cent of our revenues and up to 50 per cent for other brokers.

"With the new circular, this revenue stream disappears,” said Nithin Kamath, founder and chief executive officer of Zerodha.

Listed firms like Geojit Financial Services, Share India Securities, and Emkay Global Financial Services saw their shares drop over 5 per cent each.

BSE fell 3.4 per cent, and Central Depository Services declined 2 per cent, despite announcing a one-for-one bonus issue.

Currently, exchanges charge brokers a slab-wise fee structure for both cash and derivatives segments to incentivise higher turnover.

“While exchanges currently levy regressive slab-wise fees (higher the turnover, lower the fees), brokers usually charge their customers at the highest prescribed slab rate, resulting in excess profit residing with brokers, especially discount brokers, which is accounted as ‘ancillary transaction income’.

"Our analysis of Angel One’s disclosures suggests that this revenue stream contributes about 8 per cent to revenues and a material 20 per cent to pre-tax profits, which is likely to be vulnerable to the Sebi’s mandate that calls for a complete pass-through from customers to MIIs,” said a note by HDFC Securities.

The brokerage has slashed Angel One’s price target by over 20 per cent.

Motilal Oswal’s note said that brokerages would devise ways to offset Sebi’s blow.

“Angel One has multiple levers to offset this change: increasing the brokerage rates by ~3 per order and levying account opening charges as other brokers do.”

It added that the brokerage might charge Rs 10 for delivery-based trades, currently nil.

Kamath hinted at potential fee increases, noting, “We were one of the last remaining brokers that offered free equity delivery trades.

"We could do this because futures and options (F&O) trading revenues were subsiding equity delivery investors.

"With the new circular, we will, in all likelihood, have to let go of the zero brokerage structure and/or increase brokerage for F&O trades.

"Brokers across the industry will also have to tweak their pricing.”