Bombay Dyeing is betting on creating a range of unique, customised textile products, a route that is largely unexplored by the home textiles players although several industry reports and consumer behavior studies have talked about the potential for personalisation.

After decades, the one-time textile major is rebuilding its brand in a segment that it earned its spurs in.

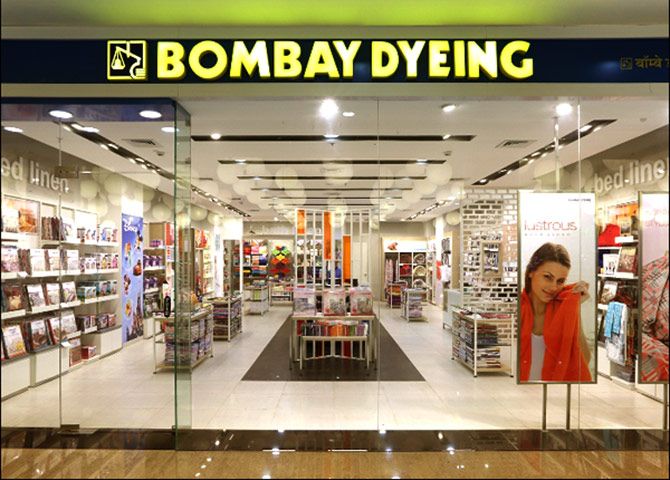

With a strategy to push through its retail footprint in small towns and online channels and with millennial buyers as its target group, the Wadia group company is stitching together a new story for its flagship textile brand. But while Bombay Dyeing has the advantage of a near 140-year-old legacy, breaking into the new marketplace with a radically different set of competitors and consumers is a challenge say experts.

Customisation and aggressively building an online retail footprint are how the company sees itself re-establishing the brand. Aloke Banerjee, CEO, retail business, Bombay Dyeing says they are looking at smaller towns and the millennial generation through a resurgent offline and online marketing strategy.

“While the home textiles market is largely unorganised, Bombay Dyeing has been a legacy brand already carrying a high recall value among consumers. Unlike other brands, Bombay Dyeing can start something new and still gain traction across India, even online,” said Prashant Aggarwal, joint managing director, Wazir Advisors, a retail consulting firm.

The offline retail strategy involves new stores being opened up in Tier-2 and Tier-3 towns as well as working with a new franchise model. Bombay Dyeing is also investing in product and design innovations that suit customer preferences in the new markets.

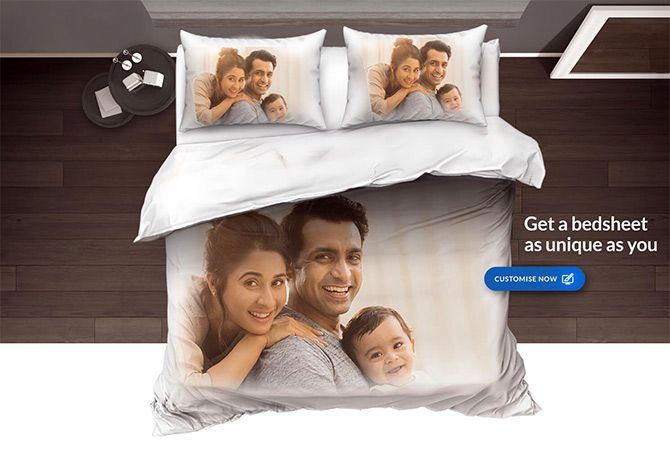

But the gamble is bigger for the brand’s online expansion plans. Bombay Dyeing is betting on creating a range of unique, customised textile products (on the lines of a made-to-measure strategy that is being explored by several apparel brands). This is route has been largely unexplored by the home textiles players although several industry reports and consumer behavior studies have talked about the potential for personalisation.

Personalisation is the gateway to the world of the millennial shopper and also allows brands to operate within the premium category. It is also an opportunity that is best explored via online marketing channels and having seen a steady traction, with currently 10 per cent of its business coming from online sales, Bombay Dyeing is keen to dig deeper.

“We are on major e-commerce platforms. At present, it is contributing to around 10 per cent of our business. We expect it to grow further. Also, to target the millennial we launched customisation of bed sheets. People want detailing to take place as per their need and requirement. We enable that at a very affordable price point,” Banerjee said.

According to several industry analysts, this could be a way to differentiate the brand in a crowded market. The brand’s new television commercial, its first one in several years, also talks about the customised offering. The Make Your Own Bed Sheet campaign is expected to be part of the larger brand story throughout the year and Banerjee said, “This year we plan to invest a substantial sum for branding and promotion activities of Bombay Dyeing.”

Currently, bed linen contribute around 50 per cent to Bombay Dyeing's turnover, followed by 20 per cent by bath linen such as towels, and rest 30 per cent from other products put together.

The online experience has been rewarding, the company says and that has helped frame even its offline expansion.

It plans to add another 100 franchisee-owned stores in small towns. “We have seen from e-commerce (purchase patterns) that our responses have been very good from Tier-2 and 3 towns. So, we are getting into hinterland also. The places have been identified and we are waiting for opportune moment for rolling them out,” said Banerjee.

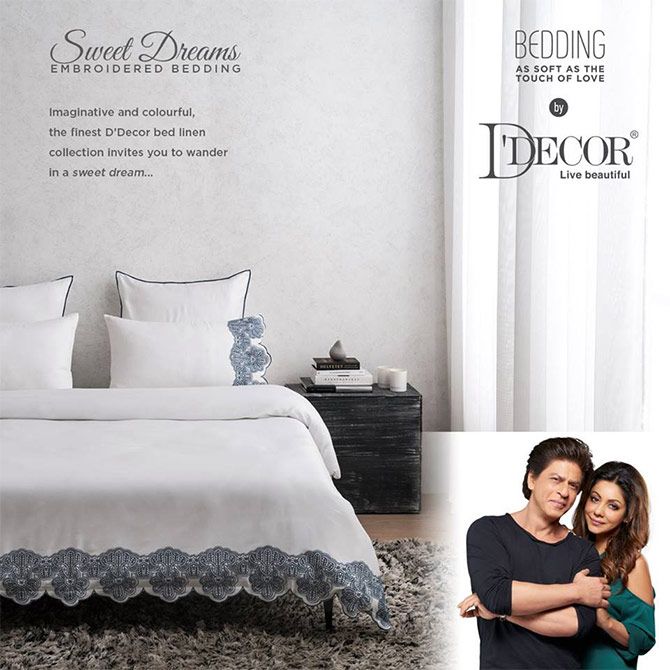

The big challenge is retaining the brand’s premium positioning and legacy status in a market where a number of newer labels have carved out a niche. Among its big competitors today are D-Décor, Portico, Trident, and Welspun, among others.

Market research firm, Euromonitor International, estimates the organised home textiles market is valued at around Rs 142.2 billion (2017), up from Rs 129.2 billion in 2015. However, the market is growing at 10 per cent (compound annual growth rate) CAGR and the overall Indian domestic home textiles market size (including unorganised) is expected to touch Rs 480 billion by 2021, as per consulting firm Wazir Advisors. Currently, the organised home textiles market is estimated to be 15-20 per cent of the entire domestic industry.

To further boost its online offering that could help Bombay Dyeing reach younger consumers, the home textiles brand is also learnt to be in talks with a major e-commerce player for a strategic partnership.

“In online channel, based on our engagement, one of the major e-commerce partners has expressed interest in expanding their product portfolio with Bombay Dyeing in home furnishing category. Together we have identified new products with maximum potential basis their consumer demand,” added Banerjee.

Bombay Dyeing is also banking on its advertising spend this year at seven per cent of its annual revenue to boost its online-cum-offline retail strategy. On the back of the advertising spend and retail expansion, Bombay Dyeing expects its fiscal 2017-2018 turnover worth Rs 4 billion at MRP level to jump to Rs 6.5 billion in FY 2018-2019.

© 2025

© 2025