Undisclosed foreign assets and funds worth Rs 350 crore detected; these are separate entities from those featured in Panama Leaks and Paradise Papers

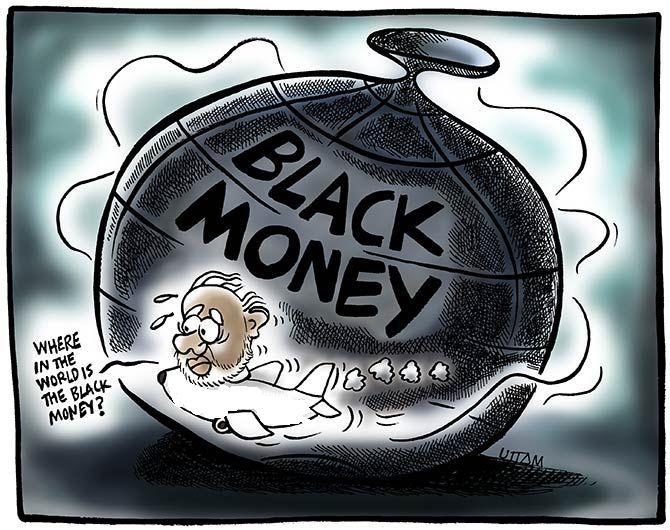

Illustration: Uttam Ghosh/Rediff.com

The Income-Tax department has initiated action in 13 cases related to undisclosed offshore income stashed abroad, under the new anti-black money Act, an official source said.

Undisclosed foreign assets and funds worth Rs 350 crore, which were being parked in foreign countries, have been detected and the tax department is pursuing these cases under provisions of Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.

These are separate entities than those featured in various global leaks, such as Panama Leaks and Paradise Papers, which are also being probed under the Act.

Of the 13 cases, the tax department has ordered a fresh assessment of the income in four cases.

On the basis of evidence and information from its foreign counterparts, the I-T department started prosecution in two cases and has initiated provisional attachment of their assets.

In the other cases, notices and summons were issued and search operations conducted on their premises, the sources said.

“The criminal prosecution was started against entities, who had not disclosed their foreign assets to Indian tax authorities in their tax profile,” said another source.

In some of the cases, it was observed that assessees have not disclosed any of the foreign financial assets and interest on their income tax returns.

In some of the cases, even the bank account was not declared despite there being a column in the return filing where assessees are supposed to furnish their details with respect to their foreign assets.

“It was established that assessees wilfully concealed their foreign accounts to evade a significant amount of tax.

"During the search operation, some of these entities have even admitted the non-disclosure of the foreign assets,” said an I-T official.

Under the new black money Act, the tax department can probe illegal assets parked overseas, which would attract 120 per cent tax, along with penalty on undisclosed foreign assets and a jail term of up to 10 years.

“Entities will be also be prosecuted under Prevention of Money Laundering Act (PMLA), as the anti-black money Act also qualifies to be a predicate offence for money laundering investigation,” the official explained.

The official said the department had received preliminary foreign intelligence regarding these cases.

“On the basis of foreign intelligence, the undisclosed income or assets has been identified as bank accounts in Singapore and investment in specific funds in Cayman Islands in some of the cases.

"However, to determine its quantum, the Foreign Tax and Tax Research division has sought further details from its counterparts in Singapore and Cayman Islands and their reply is awaited,” said the official, citing the status report.

India had also sought information from Bermuda and Jersey, as some of these entities held accounts in these countries as well.

Apart from these cases, the department is also probing entities mentioned in the global leaks under the anti-black money Act.

Searches have been conducted in over 50 cases, while enquiries are on in 426 cases.

© 2025

© 2025