The meltdown in Dalal Street that wiped out investor wealth to the tune of ₹44 trillion in 2025 also seems to be having a ripple effect on the country's vibrant automobile retail sales.

Weak earnings, declining job market, global uncertainty, and tougher financing norms spoiled customer interest in the automobile sector, resulting in a downslide in retail sales.

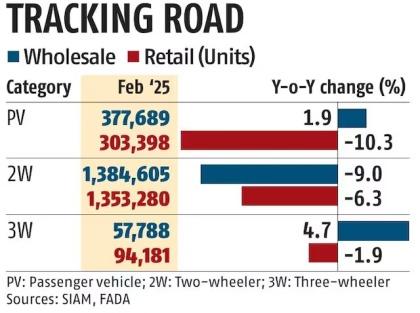

While the passenger vehicle (PV) segment witnessed a 10 per cent dip in sales in February 2025 versus last year, the two-wheeler (2W) market also declined by 6 per cent.

Additionally, the meltdown in Dalal Street that wiped out investor wealth to the tune of ₹44 trillion in 2025 also seems to be having a ripple effect on the country's vibrant automobile retail sales.

During the period under review, the entire auto retail sales also weakened by 7 per cent, with other segments like commercial vehicles (CVs), tractors, and three-wheelers (3Ws) declining by 9 per cent, 15 per cent, and 2 per cent, respectively, according to data shared by the Federation of Automobile Dealers Association (Fada).

The market capitalisation of BSE-listed companies slipped to ₹398 trillion on Thursday, after touching an all-time high of ₹478 trillion on September 27 last year, leading to a total loss of ₹80 trillion in investor wealth over the last five months.

“For the last five months, the stock markets have not been doing well. Because of this, discretionary spending has come down, and customers are holding off on their purchases. People are cautious. The conversion from the enquiry stage to retail is taking a long time, mainly in two-wheelers and passenger vehicles. In addition to this, the availability of finance is also an issue,” said C S Vigneshwar, president of Fada.

The decline this year is compared to a 12 per cent rise in passenger vehicles and 13 per cent in two-wheeler sales in February 2024, leading to a 13 per cent rise in total auto retail sales in February last year to 2.05 million units. On the other hand, in February 2025, it came down to 1.89 million.

In the passenger vehicle segment, for the first time, Mahindra & Mahindra (M&M) became the number two player.

Except for Toyota Kirloskar Motor, which posted a 5 per cent rise in sales, and M&M, which remained flat, all other top players saw a declining trend.

Market leader Maruti Suzuki was among the most hit, with an 11 per cent drop in sales, while Tata Motors witnessed a 15 per cent and Hyundai Motor India around a 19 per cent fall.

Dealers also raised concerns about the rising inventory levels of 50-52 days, alleging that companies are pushing up inventory without their consent.

“While this can support market objectives of original equipment manufacturers (OEMs), aligning wholesale with genuine demand is crucial for healthy dealer viability. Inventory levels should come back to 21 days; anything beyond 30 days will be loss-making for dealers,” Vigneshwar said.

He added that sales of entry-level vehicles are still a concern in the segment. According to Fada, rural performance of two-wheelers was better due to better agricultural sentiments and seasonal marriage demand, raising the rural market share to 58 per cent from 56 per cent in January 2025.

In CVs, dealers pointed to a challenging commercial environment, with weak sales in the transportation sector, tightening finance norms, and pricing pressures delaying customer decisions -- particularly in bulk orders and institutional contracts.

“While robust order bookings, notably in the tipper segment driven by increased government spending and steady supplies, offered some relief, the prevailing negative sentiment and structural market shifts call for a more adaptive approach. There is cautious optimism that the market will improve in March as dealers recalibrate their targets to better align with current demand,” he added.

On a month-on-month basis, overall retail sales in February dipped by 17 per cent, with passenger vehicles suffering a 35 per cent decline, commercial vehicles around 17 per cent, and two-wheelers an 11 per cent fall.

This comes after a stellar performance in January 2025, which witnessed a 59 per cent jump in PV sales, a 27 per cent increase in two-wheeler sales, and a 38 percent rise in CV sales, taking the overall retail sales up by 30 per cent.

The January numbers were driven by a lower base in December 2024, which saw a massive 45 per cent decline in monthly sales due to poor market sentiment.

In December, two-wheeler numbers were down by 54 per cent, PVs by 9 per cent, and CVs by 12 per cent.

Passenger vehicles record best February sales as 2Ws continue to skid

According to data released by the Society of Indian Automobile Manufacturers (SIAM), PV wholesales reached an all-time high for February, hitting 377,689 units, a 1.9 per cent increase.

Anjali Singh, Business Standard/Mumbai

The wholesale passenger vehicle (PV) numbers for February posted highest ever sales rising 2 per cent year-on-year (Y-o-Y) whereas the two wheeler (2W) sales posted a decline of 9 per cent.

This follows the trend of retail sales for the month as two wheeler sales were down by 6 per cent whereas PVs were down by 10 per cent. This is a worrying trend, as inventory with dealers tends to rise.

According to data released by the Society of Indian Automobile Manufacturers (SIAM), PV wholesales reached an all-time high for February, hitting 377,689 units, a 1.9 per cent increase from the same month last year.

This surge, however, is not mirrored in retail sales, as PVs plummeted by 10.34 per cent Y-o-Y as per data from the Federation of Automobile Dealers Associations (FADA), indicating a disconnect between factory output and consumer demand.

“The Passenger Vehicles segment remained resilient and posted its highest ever sales of February in 2025 of 3.78 Lakh units,” stated SIAM Director General Rajesh Menon.

Yet, this resilience at the wholesale level is not seen in the retail market, where weak consumer sentiment, particularly in the entry-level segment, and delayed purchase conversions are plaguing dealers.

FADA also cautioned OEMs against excessive inventory loading as highlighting the risk of unmanageable stock levels. The current inventory levels at dealerships stand between 50-52 days.

The two-wheeler segment faced an even sharper decline, with wholesales falling by 9 per cent to 13,84,605 units.

Motorcycles registered a steep 13.1 per cent drop in sales, while scooters declined marginally by 0.5 per cent and mopeds witnessed the sharpest decline of 18.2 per cent.

Retail sales in the segment followed a similar trajectory, dropping by 6.33 per cent Y-o-Y.

The decline was steeper in urban areas falling 7.38 per cent compared to rural markets falling by 5.5 per cent.

This slowdown was attributed to inventory imbalances, aggressive pricing adjustments following OBD-2B norms, weak consumer sentiment, lower inquiry volumes, and restricted financing availability.

Despite these challenges, SIAM remains optimistic about the upcoming festive season.

“Upcoming festivities of Holi and Ugadi in March are likely to continue to drive demand, thereby closing FY 2024-25 on a reasonably positive note,” Menon said.

However, FADA’s insights suggest a more cautious outlook. While positive agricultural output and festive demand might provide some relief in the 2W segment, and government spending could boost commercial vehicle sales, the PV sector faces challenges.

Dealers are hoping that attractive schemes and fiscal year-end advantages will stimulate demand in March.

In contrast to two-wheelers, the three-wheeler wholesale segment saw a 4.7 per cent growth, with total sales reaching 57,788 units.

Passenger carriers led this segment with a 6.8 per cent increase, while goods carriers saw a 5.9 per cent rise.

However, electric rickshaws and e-carts experienced significant declines of 50.9 per cent and 30.6 per cent, respectively.

However this was not seen in the retail segment as the segment saw a decline of 2 per cent reaching 94,181 units compared to 1,07,033 units in the same period last year.

With OBD-2 emission norms set to take effect in April 2025, March wholesales is expected to lead to a further dip as OEMs focus on clearing existing inventory before the new norms take effect.

From April 1, two-wheelers made in India are supposed to comply with OBD-II B norms for emission standards that requires an OEM to put a monitoring system that does real-time monitoring and reporting of emission levels.

While some buyers may prepone purchase fearing a price hike from April, others may also opt for holding purchase.

Furthermore, PV manufacturers have already signaled muted growth projections for the fiscal year 2026, reflecting a cautious approach in the face of current market uncertainties.

PV makers are bracing for sluggish 1-2 percent growth in domestic PV sales in FY26 pressured by weak demand, stagnant first time buyer base and declining entry level car sales, and a fading post-pandemic surge, inflation, rupee depreciation as well as geopolitical uncertainties affecting markets.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025