Proliferation of home chargers of around 7 KWh and above, which take six to seven hours to fully charge a car depending on the model, bring running costs down by a third or so. That, coupled with the increasing range of modern electric cars, can lead to a massive increase in sales.

At the Bharat Mobility Global Expo in Delhi last month, three carmakers -- Maruti Suzuki, Hyundai, and Vinfast -- unveiled their newest electric cars.

At the same time, they also spoke at length about their plans to set up an extensive charging infrastructure in the country.

Hyundai Motors India's Managing Director Unsoo Kim said it would set up 600 fast-charging stations in the next seven years.

Of these, 50 have already been installed. In addition, Hyundai has forged partnerships with third-party players with companies such as Statiq and Shell for more than 10,200 charging points.

Not to be outdone, Maruti will provide fast charging support in more than 100 cities to ensure a charging point every five to 10 km.

Vietnamese Vinfast's CEO Pham Sanh Chau spoke of getting the company's charging station subsidiary, Vin-Green, and also its battery company to build a charging network in India.

The big push for charging stations is understandable. Range anxiety remains a worry for customers, more so in the case of electric cars.

For electric two-wheelers, 80 per cent owners charge their vehicle at home and their average daily run, at about 28 km, entails charging only about once a week or so.

Range anxiety is far more pronounced in the case of electric cars, whose usual daily trek is much longer than two-wheelers.

This is an area that needs to be addressed not only through advancements in battery capacities, as is being done already, but also by facilitating easier access to charging stations in cities as well as on highways.

That will be crucial to increase sales volumes, especially with18 new models raring to enter the Indian market this year. But in 2024, electric passenger car penetration was just above 2 per cent (sales still did not hit the 100,000 mark), and the market leader, Tata Motors, saw its numbers go down.

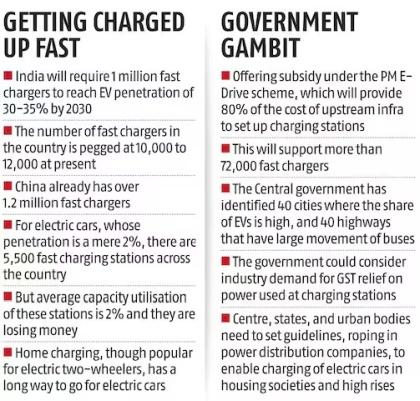

India, according to government estimates, requires more than 1 million public fast chargers to reach the NITI Aayog's goal of 30 to 35 per cent EV penetration across all vehicle segments by 2030. China already has 1.2 million fast chargers.

Minding the gaps

According to rough industry estimates, India, with its overall EV penetration at 7.5 per cent, currently has 10,000 to 12,000 fast chargers, most of which support two-, three-, and four-wheelers.

Federation of Indian Chambers of Commerce and Industry estimates that expanding the charging infrastructure to support the 2030 EV goals will require an investment of Rs 16,000 crore.

The Confederation of Indian Industries, in a paper in 2023, envisaged that in order to achieve a ratio of one charging station for every 40 vehicles will need installing 400,000 chargers every year to reach the 2030 target.

NITI Aayog's has prescribed an ambitious average EV penetration of 15 to 18 per cent for electric cars running as taxis and those being used as personal vehicles.

Most of the public fast charging stations are for electric cars, but most of them are losing money, thanks to a low average utilisation of around 2 per cent.

Breaking even requires utilisation of at least 8 to 10 per cent because of a high initial investment of Rs 3-5 lakh for each machine, going up to as much as Rs 30 lakh. But there are just not enough electric cars using public chargers.

“It takes at least four years for a charging station to break even. Our advantage is that we manufacture them. In this business, you have to make the investment upfront,” says Priyanka Rai, Head-Infrastructure and Network Expansion at Statiq, which has installed more than 2,500 fast chargers across the country.

About 70 per cent of its chargers are powered with 60 KWh capacity and the rest at 120 KWh and above.

“We are upgrading this 70 per cent to 120 KWh to expand the overall capacity,” says Rai. That will mean faster charging for more cars and quicker turnaround time.

The government, aware of the need to make the business viable, has taken measures under the PM E-Drive scheme.

The draft guidelines envisage providing 80 per cent of the cost of upstream infrastructure for 72,000 fast chargers of which 22,000 will be for electric cars.

The focus is on the key 40 cities that have a high share of EVs and 40 national highways that have high bus traffic.

But some see challenges because the subsidy will be given to states which in turn will pass it on to the companies that win the contracts.

“It is a complex and cumbersome process to get the subsidy as disbursements will be done by states. Money will be given by the Centre to them. States will identify the land and choose the companies for putting them up. The focus is on creating the backend infrastructure, such as step-down transformers, rather than providing support for building charging stations,” says a senior executive of an EV company.

He argues that for electric scooters the requirement is to set 12 KWh-powered charging stations which will struggle to become viable because the requirement for power for two-wheelers is not that much; 3 KWh could suffice.

Running cost

As big a hindrance range anxiety is to adoption of electric cars, it does not help that the cost of charging them is turning out to be higher than anticipated. And that has to do with the cost of the power used at public charging stations.

The industry has petitioned the finance ministry to remove the 18 per cent goods and service tax (GST) on this power so that the price comes down.

Another challenge is to enable home charging in housing societies and high rises.

This is not an issue for electric two-wheelers, which plug into a normal household socket for charging, like the ones used for refrigerators.

Commercial power rates at fast-charging stations are three to four times higher than household electricity.

A senior executive of a leading car company says that for a customer the running cost of an electric car that charges at public fast charging stations is close to the running cost of a hybrid.

Of course, a fast charger can take your car battery to 100 per cent in just over an hour.

Household chargers take seven to eight hours. But the convenience of having a charger at your regular home parking lot -- where you can simply plug in for the night -- has a high emotional value.

However, the executive quoted above says resident welfare associations at housing complexes reject installation of chargers due to lack of state or municipal laws, saying they do not have enough load from their electricity board.

Proliferation of home chargers of around 7 KWh and above, which take six to seven hours to fully charge a car depending on the model, bring running costs down by a third or so. That, coupled with the increasing range of modern electric cars, can lead to a massive increase in sales.

Electric car owners also face problems in discovering charging stations, especially along highways.

There is no single integrated app to provide information on all the companies running fast charging stations across the country, compelling customers to jump from one app to another.

MG Motors, for one, has tried to integrate third-party players and Statiq is tying up with carmakers.

There are no minimum service level agreements imposed on charging station operators to ensure they are up and running.

Collaboration is the new buzzword. As Statiq has tied up with Hyundai and BMW for electric cars, for two-wheelers Ather and its shareholder, Hero MotoCorp, have experimented with a successful model of building 3,400 fast charging stations across the country which are open for use to rivals' models.

The company has received approval from the Bureau of Indian Standards for its indigenously developed charging connector, which can be used for two-, three, and some four-wheelers.

Clearly, carmakers have realised that building and launching new EVs is not enough. They need to be charged -- easily and quickly.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025