Alternative investment funds (AIFs) — investment vehicles favoured by the affluent — have topped $50 billion (Rs 4.3 trillion) in total investments for the first time during the April-June quarter, according to the latest data from the Securities and Exchange Board of India.

The industry’s commitments have approached Rs 12 trillion ($140 billion), marking a 40 per cent increase over the past year. The amount raised and deployed stood at Rs 4.74 trillion ($56 billion) and Rs 4.32 trillion ($51 billion), respectively, the data shows.

The real estate sector remains the dominant investment portfolio for AIFs, accounting for over 17 per cent of total investments.

Of the Rs 4.32 trillion in total investments, Rs 74,300 crore is allocated to real estate.

The sector recorded a quarter-on-quarter (Q-o-Q) growth of 8.5 per cent in total investments.

The pharmaceutical and financial services sectors reported higher Q-o-Q growth rates of 16 per cent and 15 per cent, respectively, albeit from a lower base.

Typically, AIFs receive and deploy funds in tranches. Investment managers request funds from committed entities when suitable investment opportunities arise.

The industry has attracted investments from high-net-worth individuals and family offices seeking high returns through alternative investment opportunities.

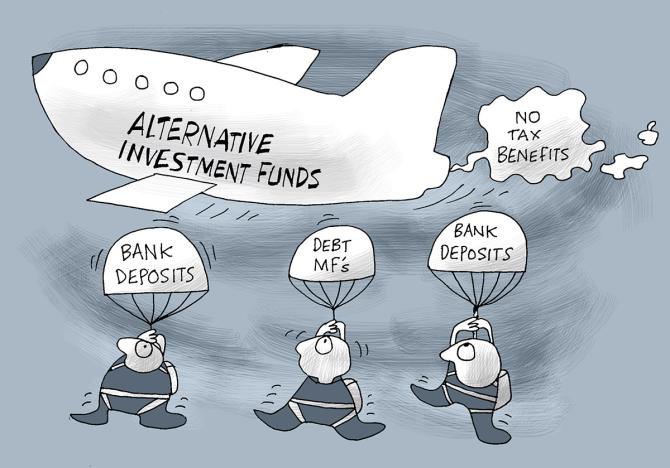

AIFs are niche investment products structured as pooled investments with higher entry barriers.

AIFs invest in startups, infrastructure, stressed assets, private credit, and housing projects.

Consequently, nearly three-quarters — Rs 3.1 trillion — of their investments are in the unlisted space.

© 2025

© 2025