'Many were caught in a burnout race, chasing unsustainable growth without innovating.'

Kindly note the image has been published only for representational purposes.Photograph: Dado Ruvic/Reuters

India's once-thriving edtech sector is witnessing a significant downturn with 2,148 startups having shut operations in the past five years, according to data shared by Traxcn exclusively with Business Standard.

Edtech platforms, which witnessed unprecedented growth during the pandemic-induced lockdown, continue to face funding slowdown, shifting market needs, and operational challenges post-pandemic.

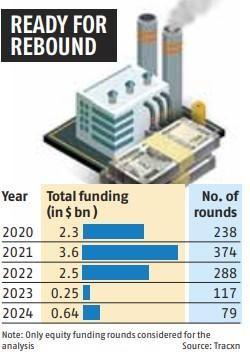

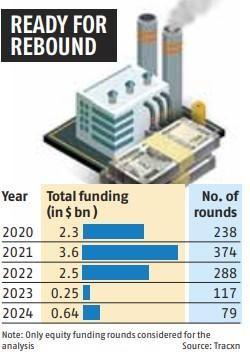

Based on the data from equity funding rounds, edtech startups collected $0.64 billion in 2024.

This is significantly less than its high of $3.6 billion in 2021. Interestingly, the count of deadpooled companies was the highest in 2021, at 933.

Stating that adaptability and innovation remain key drivers of success in the edtech landscape, Ravi Kaklasaria, CEO and co-founder of edForce, a workforce upskilling accelerator, said, "The edtech sector has witnessed a wave of shutdowns as startups relying on classroom training and generic materials struggled to adapt to evolving demands. Many were caught in a burnout race, chasing unsustainable growth without innovating."

According to the Tracxn Feed Geo Report: EdTech India 2024, at its peak in 2021, the sector raised $4.1 billion in 357 funding rounds.

While 2021 marked the highest-funded year for edtech, the third quarter stood out as the highest-funded quarter, attracting $2.48 billion.

A total of 16,028 startups were founded in the country with companies largely located in Bengaluru, Delhi, Mumbai, Hyderabad, and Noida, the report added.

However, the reopening of physical classrooms, coupled with reduced investor confidence, led to a sharp decline in the sector's fortunes.

Recently, Stoa School, an alternative business education platform, which was backed by Zerodha founder Nithin Kamath, announced its closure.

Elevation Capital-backed Bluelearn, an upskilling and job search platform, also ceased operations in 2024.

Other startups that reportedly shut shop include QuizMind, Vedu Academy, and Tribac Blue, among others.

Besides the small players, major ones in the sector have also felt the impact. Byju's, once valued at $22 billion, faced multiple rounds of layoffs, restructuring exercises, debt issues, and legal troubles.

Similarly, as part of its restructuring efforts, Unacademy and upGrad streamlined operations and handed pink slips to several employees.

Going forward, experts predict a consolidation phase, with only innovation-driven, specialised companies likely to thrive.

Lloyd Mathias, an angel investor, said, "The edtech industry will move towards consolidation where large companies with deep pockets will establish/strengthen their online arms offering quality education while adding real-world value."

Outlook 2025: Strong Edtech Sector To Emerge

The Indian edtech sector faced a turbulent 2024, marked by leadership exits, mass layoffs, and restructuring efforts.

According to Venture Intelligence, edtech funding stood at $608 million in 2024, significantly less than $4.1 billion in 2021.

As 2025 begins, experts say the sector has a chance to rebuild by focusing on personalisation, impact-driven solutions, and better governance.

Shailesh Haribhakti, a management expert, said the 2024 downturn has paved the way for sensible approaches and stronger governance.

"We will see a much stronger edtech sector emerging. The focus will be on catering to personalised learning needs, allowing individuals to learn at different levels and on varied subjects. This will be the leading area where the sector will make its innovation," Haribhakti said.

Echoing similar sentiment, policy researcher and corporate advisor Srinath Sridharan highlighted the need for edtech companies to rethink their strategies.

"These companies must personalise programmes for individuals and similar cohorts. They have to focus on impact rather than just outcomes," he said, suggesting gamification as a way to enhance personalisation and engagement in the sector.

While Haribhakti remains optimistic about edtech's outlook for this year, business strategist and angel investor Lloyd Mathias predicted a flat to sluggish trajectory.

The edtech sector, once a shining star in the country's startup ecosystem, experienced a rise during the COVID-19 pandemic.

The shift to online learning as schools and universities shut down drove exponential growth, Mathias said.

The sector raised $4.1 billion in 2021, its highest-funded year, according to the Tracxn Feed Geo Report: Ed-Tech India 2024.

Between 2018 and 2022, PhysicsWallah, Eruditus, upGrad, Vedantu, and Byju's achieved unicorn status.

According to the Internet and Mobile Association of India, over 75,000 jobs were created in this sector.

However, as the pandemic waned and offline education returned, funding dried up, triggering restructuring and widespread layoffs.

Byju's, a major player, announced restructuring after the company's India CEO Arjun Mohan resigned in 2023, laying off over 500 employees.

The edtech firm had earlier handed pink slips to more than 10,000 staffers.

Legal and debt troubles, financial losses, and a sharp decline in valuation added to its woes.

Mathias, who sits on the boards of nearly half a dozen companies, said Byju's contributed significantly to the bad news surrounding edtech.

As several investors burnt their fingers, Mathias said the Byju's fiasco led to a rethinking of business and governance models across the sector.

While several edtech firms continue to face challenges and opportunities, Stoa School, an alternate business education platform, and Bluelearn, an upskilling and job search platform, shuttered operations in 2024.

Other firms like Unacademy and upGrad also streamlined operations, reflecting the broader trend of restructuring.

Feature Presentation: Aslam Hunani/Rediff.com

© 2025

© 2025