'Out of the 20 trading days in January up to January 28, FIIs have sold shares on 19 of those days.'

'A notable question arises: when has there historically been such intense FII withdrawal? This situation is unprecedented.'

'During the 2008-09 financial crisis, following Lehman's collapse, a 19-day streak of selling by FIIs never occurred. '

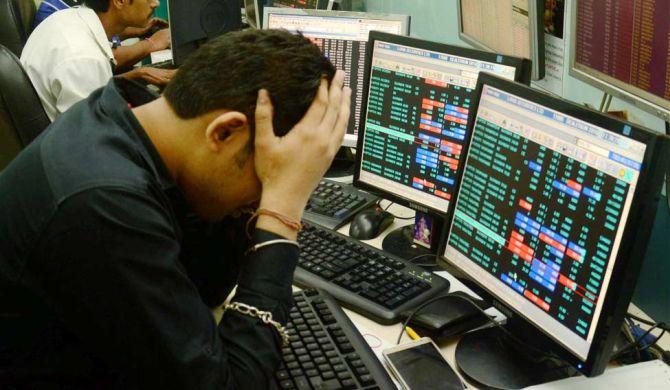

Akshay Chinchalkar, head of research, Axis Securities, in a two-part interview to Prasanna D Zore/Rediff.com, explains threadbare the likely reasons behind the relentless selling by foreign institutional investors (FIIs).

FIIs have been on a selling spree. Beginning October 2024 they have sold Rs 256,418 crore worth equity in cash markets till January 28, 2025. This would be the fourth consecutive month when Nifty will be closing in the red.

What do you think is happening in the market right now? Why are FIIs selling relentlessly?

There are both global and domestic issues. Obviously, global issues are kind of overshadowing everything that's happening locally.

There are both global and domestic issues at play, but global issues tend to overshadow local matters.

Three major reasons for the current situation include the US bond markets, the rising US dollar against the Indian rupee, and potential policies from the Trump administration that may make US investments more appealing.

US Bond Markets: US bond markets are becoming increasingly attractive to global investors. Recently, the 10-year Treasury yield was close to 5%, and it is currently around 4.6%.

For context, on January 1, the yield was at 4.571%, jumped to 4.8% on January 13, and subsequently fell to 4.5280 on January 27.

This rally in US yields significantly influences current market dynamics. For Foreign Institutional Investors (FIIs), this represents risk-free money.

US Treasury bonds are viewed as one of the safest investments in the world, so if the 10-year paper offers a 5% yield, it raises the question of why investors would opt for an emerging market like India, looking for an additional 1% or 2% while facing currency risk.

Based on purchasing power and interest rate parity, it is expected that the rupee will depreciate by 3.5% to 4% annually.

In reality, between October 2024 and January 27, 2025, the rupee depreciated by nearly 3.7% against the US dollar. Given this context, it seems unwise to take on currency risk for a mere 1% or 2% gain when a 5% risk-free option is available in the US.

Rising Dollar: For US investors, the question arises: Why convert dollars into another currency in search of higher yields, especially with uncertainty surrounding that currency's performance?

Many investors prefer to seek refuge in the strength and stability of the US dollar rather than worry about whether currencies in targeted investment markets will hold up against significant declines.

For instance, the Indian rupee has fallen from 83.4825 in October to 86.5675 now, equating to a 3.7% drop, which complicates profit conversion for FIIs.

Potential Trump Policies: The third important factor to consider is the potential policies from the Trump administration that could enhance the appeal of US assets.

For large US investors with a global investment mandate, the administration signalling that US assets will be prioritised presents a compelling reason to keep funds within the country.

If an investor is already experiencing returns of 20% to 30% in emerging markets like India, it becomes tempting to cash out and reinvest in a market that appears more promising.

This sentiment has been evident since before the election, as market behaviours have anticipated potential gains should Trump secure a second term, mirroring trends observed in 2017.

With influential figures like Elon Musk backing Trump, a strong message is communicated about improving the average American's situation. If America prospers, investing domestically becomes an attractive option.

What's your sense as far as Indian markets are concerned?

Where are we headed in calendar year 2025, given that Trump administration has just begun on January 20th?

How do you see the Indian markets behaving to Trump tantrums?

Can investors expect some decent returns or is it going to be a bad year for Indian investors?

An overview of the current market situation and expectations based on historical data is provided here.

The Nifty Index has already declined approximately 12% to 13% from its record high of 26,270, reached in September 2024. Since early October, foreign institutional investors (FIIs) have withdrawn a significant amount, totalling Rs 2.56 lakh crore as of January 28, 2025.

Out of the 20 trading days in January up to that date, FIIs have sold shares on 19 of those days, with the exception being January 2.

A notable question arises: When has there historically been such intense FII withdrawal? This situation is unprecedented. During the 2008-2009 financial crisis, following Lehman's collapse, a 19-day streak of selling by FIIs never occurred.

On January 28, the Nifty was observed rising by about 300 points, but it lost half of those gains in the last 30 minutes of trading -- so volatility is very elevated.

It is essential to acknowledge that something is amiss. That said, the market stands just about 1% away from a line drawn from the COVID lows (the straight black line in the image above) when the Nifty fell to around 7,500 in March 2020. It has historically provided support during declines we have seen since the 2020 trough.

In technical terms, a trend line that offers support is created by connecting the lows over time. When the market bounces off such a line, it is said to support the market's ascent.

While predictions about whether the market will hold this line and recover or break below it remain uncertain, the significance of an already established trend line cannot be understated.

Should the Nifty fall below this trend line, a quick recovery seems unlikely. The range between 22,500 and 22,800 is seen as absolutely critical from here.

While the FIIs are selling domestic institutional investors (DIIs) are pumping in money. By some estimates anywhere between 25,000 crore to 26,000 crore SIP money that is invested into mutual funds is coming into the market.

Isn't that money enough to stem the fall in the Indian markets?

Or are mutual funds also sitting on cash?

Are domestic institutions also sitting on cash?

Are they thinking that sitting on cash is also a strategy to make money?

The selling by Foreign Institutional Investors (FIIs) has been quite significant. Domestic Institutional Investors (DIIs) have limits on how much cash they can invest, as they need to perform well relative to benchmarks.

Even when DIIs have extra cash, they must consider market volatility, which can change quickly. Many investors have hoped for a market recovery, only to see prices drop by the end of the day.

The global economic situation also adds uncertainty.

Although many expected President Trump to introduce tariffs right away, that hasn't happened, which has allowed the US market to outperform at the expense of emerging markets like India.

If the push to 'Make America Great Again' continues to attract capital to US assets, money will likely flow out of emerging markets.

However, if the US market starts declining, it's unlikely that this money will return to emerging markets; It's hard to imagine the S&P 500 dropping 10% while Indian markets scale new highs. So, it's a very tricky situation out there.

Domestic institutions also need to consider their available capital. The approach of buying aggressively while FIIs are selling hasn't worked well.

If large foreign funds decide to exit India for an extended period, they may be okay to sell at low prices in expectation of even lower prices down the line, indicating a lack of confidence in market recovery.

Domestic investors often hesitate to buy under these conditions due to their responsibilities to their investors.

Typically, DIIs don't excel at timing market highs and lows. They prefer to wait for signs of stability before investing. This means they might jump in after a 5% market rally, but persistent selling can erode their confidence and resources.

Additionally, market behaviour in recent years has changed. Previously, markets would recover quickly from downturns, but this time they have been consistently falling for months, which is a new experience for many new investors.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

© 2025

© 2025