'My understanding is this: Yes Bank's suitor has already been identified; the strategy to revive and rehabilitate the bank has already been put in place. Of course, certain regulatory forbearance is needed, which will take time. So the moratorium is for that purpose.'

Tamal Bandyopadhyay, columnist, expert on banking and author of several books like HDFC Bank 2.0: From Dawn To Digital, From Lehman to Demonetisation: A Decade of Disruptions and Sahara: The Untold Story, tells Rediff.com's Prasanna D Zore why the money of Yes Bank depositors is safe and they should not panic and why the current crisis at India's fifth largest private lender does not pose any systemic risk.

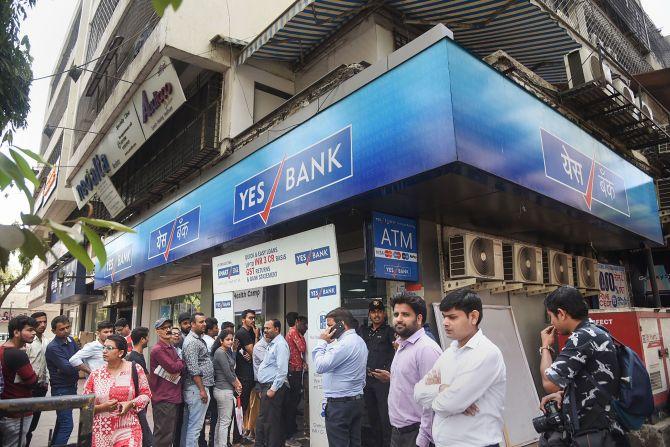

"I don't think any depositor is going to lose money and the moratorium may not last for a month (till RBI-mandated date of April 3). I would like to believe that in a week's time, the withdrawal cap of Rs 50,000 will be removed," Bandyopadhyay, below, says.

What was the immediate cause that triggered the RBI move to supersede the board of Yes Bank for 30 days?

To cut a long story short, essentially the Reserve Bank of India was not exactly happy with the way the former CEO, Rana Kapoor, who was also the promoter of Yes Bank, was running the bank. So, he was not allowed to continue as CEO and the RBI had chosen the then Deutsche Bank MD and CEO, Ravneet Gill (in March 2019) to head Yes Bank. RBI also put its own person on the board. The perception was, the apprehension was, Yes Bank over the years had too many bad loans or NPAs, which were not in the public domain and so it had to go through a cleansing process.

Once the bad loans started coming up, then its capital started getting eroded and so the bank needed capital. To get this capital, Gill was in search of investors. Now he (Gill) continuously made statements from various fora, on TV channels, that investors were there (willing to invest in Yes Bank) and it was just a question of timing.

Every second day you would hear some stories, that Yes bank had identified certain investors.

My presumption is that he did not himself know how deep the rot was. When investors are coming and checking the books (of Yes Bank's for due diligence), they were presumably not happy and were walking out. Banks need to be 'fit and proper' as per RBI's definition, to have impeccable credibility.

So when the capital was not coming, and under the Basel norm, I am not getting into all the technicalities, you need to have the capital (to continue banking operations). Otherwise, you cannot run a bank. Running a bank without adequate capital is like driving a car without fuel. You can't do that. (Given these issues), the quarterly results which were supposed to be made public by January (2020), had to be done by February (2020).

Now, once you announce the result, you end up showing more bad assets, which means you end up making more provisions for which you will need more money, which will erode your capital further. You would only announce the results if you have money from investors, which was not coming.

Yes Bank took SEBI (the stock market regulator, Securities and Exchange Board of India) permission to delay the results. SEBI gave them time and Yes Bank said they will announce the result by March 15, which is about a week away. But still Yes Bank was not able to get the investors. Had they got investors this would not have happened.

Technically, Yes Bank had some interest payment due yesterday (March 5) and the Bank was not in a position to service this payment. It was running the risk of default on this interest payment. So, I think that was the (immediate) trigger for RBI's action.

How sound is the measure to supersede Yes Bank's board and cap withdrawal limit to Rs 50,000?

Prima facie I don't think this is the right thing to do, particularly in (the month of) March. You are a large corporate-facing bank and there are companies which have to make advance tax payments, individual depositors have their tax and insurance investments to make, and then you have MSMEs and SMEs with their credit lines and payments to be made to their suppliers. So, it (the Rs 50,000 cap on withdrawal) creates inconvenience for the customers, both borrowers and depositors; it creates panic in the system. This is the last thing one should do.

My understanding is that under the Banking Regulation Act, Section 45, when you are doing things like forced merger or supersede boards of banks, then there's no choice but to apparently do this (what the RBI has done).

Finance Minister Nirmala Sitharaman has assured depositors that their money is safe. Will it help reduce panic among the depositors?

I don't know whether that will help reduce (the panic), but one thing is certainly sure that (depositors') money is safe. I don't think anybody will lose any money. So far as the depositors are concerned, they are inconvenienced because they will not be getting their money (when and as much as they need).

I don't think any depositor is going to lose money and the moratorium may not last for a month (till RBI-mandated date of April 3). I would like to believe that in a week's time, the withdrawal cap of Rs 50,000 will be removed.

You need certain SEBI norms to be followed, and if this is true that the State Bank of India is likely to pick up 49 per cent stake without making any open offer, and getting relaxation in terms of pricing and so forth. So, I think the moratorium period will be used not for one month. I will be surprised if it goes beyond mid-March.

I would like to believe that the resolution will be reached by March 15-16 and a new management will take over (Yes Bank).

Having said that, the way of doing this, particularly in the month when financial year comes to an end, is not the right thing to do.

Besides, recently, the deposit insurance cover has been raised from Rs 1 lakh to Rs 5 lakh. Depositors should not fear losing their money.

The banking mess at Yes Bank comes close on the heels of PMC Bank going belly up. Do you see this crisis as a regulatory failure?

The PMC Bank case was an out-and-out fraud.

But the RBI was also looking at resolution of the mess at PMC Bank but it couldn't?

I am not supporting the RBI but PMC Bank was a scam. Definitely, there are loopholes in RBI's inspection, which has been tightened now, but you also need to understand that inspectors are not investigators. So, if somebody is committed to do a fraud, it is very difficult to stop it. It is like a suicide bomber.

If PMC is a case of fraud, Yes Bank is a case of misgovernance. Rana Kapoor was running a very high risk-high reward business.

Did RBI fail? Yes, and no.

RBI did act. RBI did remove him but it also allowed this to fester for so long both in detecting (the mess at Yes Bank) and removing the CEO.

Since almost a year you have your own CEO in place (Ravneet Gill) and a member on the board (of directors of Yes Bank). Why did you take so long to sort this out?

I think one of the reasons could be that the CEO was looking for the right kind of pricing (to sell), but investors were not willing to pay the kind of price Yes Bank was looking for.

Globally, the government (of US) took over Citibank for one dollar. Or when JP Morgan Chase bought Washington Mutual and Bear Sterns it was for two dollars.

Why didn't you sell (Yes Bank) for that kind of money? The SEBI relaxations that you are looking for now, why didn't you do that six months back and you could have sold it off.

What took the banking regulator so long to conclude that there is 'serious deterioration in the financial position of the bank?' When should the alarm bells have started ringing about the health of Yes Bank?

Alarm bells started ringing some time back and that is the reason they (the RBI) removed Rana Kapoor and brought in a new management under Ravneet Gill.

But I think the new CEO took his own time to appreciate the gravity of the situation and the extent of the rot. So without actually doing his own due diligence, he started inviting the investors and telling the world that there are investors who are happy to buy the bank.

Investors were coming and taking a deep dive and finding it (buying stake in Yes Bank) is not worth it. It is a complete failure by the new management in appreciating the rot. It was allowed to fester for so long.

My understanding is this: the suitor has already been identified; the strategy to revive and rehabilitate the bank has already been in place. Of course, certain regulatory forbearance is needed, which will take time. So the moratorium is for that (purpose) because under the Banking Regulation Act -- banks can merge willfully without any moratorium – when a bank management is changed, new investors are walking in and by force as a rescue operation, under the banking law, you need to put a moratorium. So that's why it happened.

The RBI is playing safe by using the 30-day period. My presumption is they will be able to sort this out much faster, because it is not that after putting the bank under moratorium they will look out for a strategy. The strategy is already in place, and to make that strategy effective the moratorium had to be put in place.

In a worst case scenario, if the banking regulator doesn't find a solution to Yes Bank's woes, what kind of systemic impact could it have on India's banking sector? Is Yes Bank too big a bank to fail?

We need to discuss this because based on my understanding the solution is in place. The solution is on the table. If I am not mistaken, State Bank of India will step in and buy out probably 49 per cent stake and then it will be sort of warehousing (this stake). The bank (Yes Bank) will not be merged with State Bank of India. It will be kept as a separate entity. With SBI coming in other investors will also be encouraged to come on board and then they will get a new CEO. Things can only get better from here.

So far as depositors concerned, their money is safe. As far as the financial system is concerned, it is shaken but safe.

Why is the banking and financial system in India getting shaken on a regular basis? After the IL&FS crisis we are facing a similar situation in Yes Bank?

Basically, this is a governance issue, whether it is public or private (financial institutions – IL&FS -- or banks – Yes Bank or PMC Bank).

It is said that when the tide recedes you see yourself naked.

As long as things were going good everything was fine but the economic slowdown actually exposed the soft underbelly of the system, and we are seeing many of the banks and non-banks (financial intermediaries) are naked.

How much money is needed to rescue Yes Bank now and where will the capital come from?

There are no straightforward answers to that.

You need to scale down the balance sheet through securitising and selling off the assets. It has to be a much smaller balance sheet than what it is now; you have to strip your assets out of it.

People are talking about bad loans to be as much as Rs 30,000 crore which is much higher than what we know in the public domain. Yes Bank does have huge exposure to large corporates that are in trouble (like Reliance Anil Dhirubhai Ambani Group, Essar Group, DHFL, Cox & Kings, Café Coffee Day) but that does not mean all is lost. I don't know if 30 per cent, 40 per cent or 50 percent of this money can be recovered but it will take some time.

I would like to believe that SBI will bring in some money (to capitalise Yes bank so that it can resume lending operations) in the form of equity and once SBI is on board and a new CEO is appointed other investors will also come in.

But for the time being, retail investors (who have invested in Yes bank shares) need to forget the value of their investment. Over a period of time, value will be created.

© 2025

© 2025