'Covid-related claims were almost 2.5 times the normal claims size.'

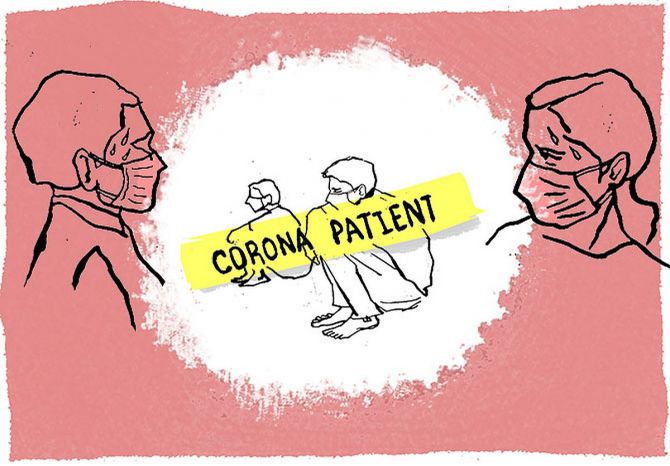

The first quarter saw a huge spike in Covid cases in the country, resulting in loss ratios of insurance majors getting impacted.

Anamika Roy Rashtrawar, MD and CEO, IFFCO Tokio General Insurance, in an e-mail interview with Subrata Panda, discusses the raging issues in the general insurance sector such as high claims in the health segment and motor insurance returning to a growth path.

Did the second wave impact business growth?

Yes, the growth of retail lines of business did get impacted due to the overall concern and anxiety among consumers.

The uncertainty of future income opportunities and many facing personal losses deterred customers from buying insurance.

What was the firm's experience in Q1 as far as the health segment is concerned?

Our experience has been a bit different as growth was on expected lines, but there was a huge spurt in health claims.

We also saw an increase in claims outgo across all hospitalisation-related treatments.

In fact,

Covid-related claims were almost 2.5 times the normal claims size.

How did the motor segment perform as the April-May period saw lockdown-like situations all over the country?

In Q1, the motor segment saw a small growth of 3.1 per cent.

However, there is negligible growth in the liability part of the motor business.

The news about various auto manufacturers launching several new models to entice consumers is a clear indication that revival of the auto industry is near.

How much did the company pay in terms of health claims due to Covid?

Health claims did witness a huge spike in Q1 due to the rising cases.

We paid all eligible claims to the tune of over Rs 150 crore (Rs 1.5 billion).

What kind of an impact has that had on the loss ratio in the health segment?

The loss ratio in the health segment increased to over 120 per cent in Q1. However, it was on expected lines due to the second wave.

Is a price hike in the health segment imminent due to the Covid cost that the insurers have borne?

Yes, a hike is imminent looking at the loss ratio, especially in certain product segments.

Is growth in the health segment sustainable?

The pandemic has provided the much-needed fillip to the growth potential of health insurance.

I feel that at correct premium rates, everything is sustainable.

What are the other segments that have done well so far and the company is banking on in the upcoming quarters?

Our commercial lines portfolio has done very well. In the coming quarters, we will continue to focus on having a balanced portfolio mix.

We feel that our enhanced distribution and presence in rural areas will also start delivering growth in the coming quarters.

Has the company stopped underwriting crop business? If so, why?

We are an active player in the crop business and will continue to do it and participate in the tender process.

Are there any plans to go public in the near future?

This is a shareholders' call and I will leave it to them to make an appropriate decision.

Feature Presentation: Aslam Hunani/Rediff.com

© 2025

© 2025