'We have gone through more than what any company will go through.'

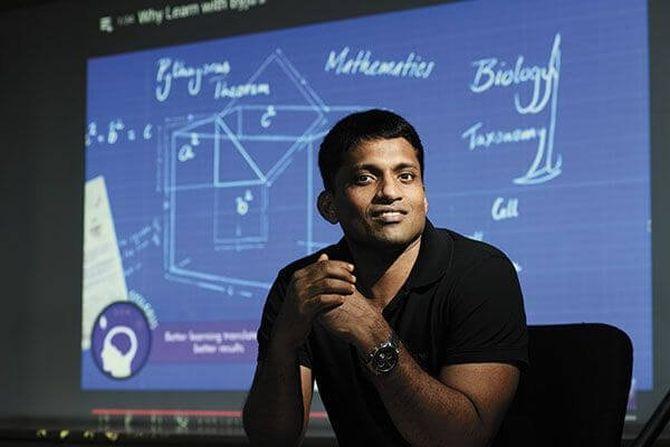

The last six months have been the toughest of his life, says Byju Raveendran, the founder and CEO of India's highest valued start-up and edtech giant, Byju's.

However, in an interview with Suveen Sinha and Peerzada Abrar, he says he is not about to slow down in his pursuit of growth, organic or inorganic, because edtech needs at least five Byju's, not one.

The delay in declaring your FY21 accounts brought you under intense scrutiny.

The last six months have been the toughest for me and everyone else involved.

The good news is that that's over. We have gone through more than what any company will go through.

If life is this tough, a lot of people will not get into this.

We do not have an option. This is what we have been doing for 15 years. This is what you will see us doing for 20 or 25 years...

When you become big, everyone wants to scrutinise you.

You are a privately-owned company. But the scrutiny has been as if you were a public company.

Life as a public company will not be this difficult. This has been a good learning experience, but I don't want to go through this again.

For us, this is our life. We did not start this as a business. If you are doing it for the money, you cannot overcome these many challenges.

Perhaps this is the price you pay for being the highest valued start-up.

Highest value obviously gets more people's attention. But the real thing is that if you do not follow up valuation with value creation... we have been able to create value.

What are the lessons you learn from this?

Now we are prepared. This kind of thing happens only once. We are strengthening the finance function. We will also hire a global CFO soon.

We are well prepared not only for the next year, but also to live the life of a public company, whenever we decide to do that, though those plans got pushed by nine to 12 months.

Right now no one is going public. We will wait for the macro environment to improve.

The recent period has not been pretty for edtech. You yourself laid people off.

A lot of roles and functions were redundant because of so many acquisitions in the same space. Annual attrition of 15 to 20 per cent is what any company of this size will go through.

We are the largest employer among start-ups with more than 50,000 employees, and we are still net hiring. We are hiring a lot more in a month than what we laid off. Our total number of employees is going up.

Does edtech need a new strategy in the post-pandemic period, now that online is not the only option nor the most desired one.

Yes. Edtech is a broad term. Many businesses flourished due to specific challenges during Covid, like platforms supporting teachers in teaching at home, or tools that were helping them make the transition from offline to online. With schools going back, those in the B2B segment supporting schools online are struggling.

Our core offerings are for after-school and supplementary or complementary learning.

At the end of the two-year Covid cycle, we saw digital fatigue setting in. But now that schools are back offline, the only online option for them is platforms like ours.

There are not many alternatives. Our organic growth in India is huge.

If someone is replicating our model thinking we are just a sales and marketing engine -- though we do sales and marketing well... what we have built over the last 10 years, there are no shortcuts to that.

What have you built over the last 10 years?

Five out of our six founding partners are teachers. As a teacher, you have a student-centric approach.

In the initial years, we over-indexed on the ed part of edtech. Once we made enough content, we used our platform for personalising and scaling up. We moved to the learning app to make a much bigger impact.

Our student-centric approach has played a big role.

We could not have created an edtech company of this scale if we were not teachers. Most large edtech companies globally are built by teachers who embraced tech as an enabler.

So, it is ed first and tech later for you?

Only in the initial years. Today, there is tech, there is media, and there is content. We are at the intersection of all three.

In the initial years it was important to think like teachers and from a students’ point of view. Today, it is equal focus on engagement, effectiveness, and personalisation.

Are you growing too fast? Are you trying to buy revenues to justify your valuation?

It's a segment that requires at least five Byju's, not one.

Even at our scale, we are talking low single digit percentage of students where we are able to make an impact.

I always think how can I do in five years what I am planning to do in 20, so I can make a bigger impact and make it faster.

In growing fast, we would have overlooked a few things and that's why we are being penalised a lot more than we should have been. We are taking a measured approach to integrating acquisitions well.

We are not just going for more and more acquisitions. If you see each acquisition, there is a reason we did it. Because it added more value to the user base we have created, be it a new subject or a new format. Fundamentally, these are strong businesses.

We had to make those changes because everything suddenly changed during Covid and we launched so many things so fast. We are now optimising. We will also go for growth, but efficient growth.

As growth becomes efficient, will the pace of acquisitions continue or will it change?

It is a win-win in most cases when two platforms come together. If there is fine synergy, we will continue.

Right now, because of the macro environment, we are taking it slow. But over the next 12 months if we find products that add value, we will continue looking for both organic, which is strong, and inorganic growth.

Especially in new markets, we will also go for inorganic growth.

© 2025

© 2025