When it comes to Mr Portnoy, it is hard to claim that his trading patterns are any more logical than his fictional namesake's methods of entertaining himself, notes Devangshu Datta.

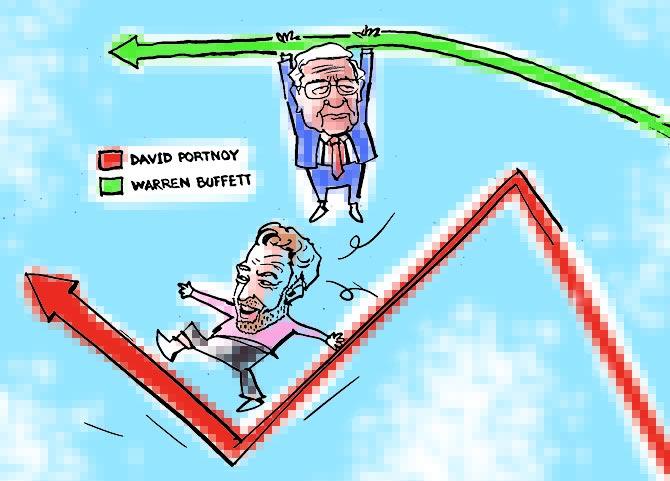

Illustration: Dominic Xavier/Rediff.com

A few days ago, David Portnoy characterised Warren Buffett as 'Washed up'.

Mr Buffett, the mega-billionaire chief executive officer of Berkshire Hathaway, is generally acknowledged to be the most consistently successful investor of the last 60 years.

Mr Portnoy by his own admission, bought his first share less than six months ago.

Most readers will have heard of Mr Buffett.

Mr Portnoy is a 43 year old, mainly famous for setting up the popular American blog, Barstool Sports.

This has created waves by its irreverent gossipy style of posting.

It has monetised pizza reviewing, sports analysis and sports betting.

When it was taken over by investors like The Chernin Group and Penn National Gaming, Mr Portnoy received a payout of nearly $100 million.

He parked $5 million into a day-trading account when organised sports shut down.

He has traded insane amounts on a daily basis, while hyping up his trades on social media.

At times, he's been a million down, or up, on a daily basis.

He has also garnered a large following, which slavishly follows him and amplifies his opinions.

Many of these newbies are millennials who see day-trading as just another video-game.

They've gravitated to sites such as Robinhood, a discount brokerage, which offers no-fee trades, insane amounts of leverage and even freebies such as shares.

You can do crypto, you can do options or futures, anything you please.

The site signed up over 3 million new accounts in the first three months of 2020.

There have been suicides when Robinhood traders have hit large negative balances and faced margin calls.

One of the classic day-trading stories which has made waves involves Hertz, the iconic car-rental.

Hertz is in bankruptcy -- the shares have literally no value.

The company has been hurt for several years by ride-sharing models such as Uber, and the lockdown may be the last straw.

However, Robinhood traders have piled into the stock enthusiastically, driving the price up.

The company actually asked the court for permission to issue new shares to take advantage of this and raise a little cash! This cannot even be described as speculation -- it is a casino play.

It can perhaps be described as an extreme case of the 'Greater Fool Theory': A fool is prepared to buy a stock when he knows there is a greater fool who will take it off his hands at a higher price.

In the case of Hertz, traders know the stock is worthless.

However, they also know that there are plenty of traders speculating in it because, well, it's listed and liquid.

So the trader enters the stock hoping to get on the right side of some move when a greater fool will buy it off him.

Similar speculation (often in non-bankrupt businesses) has kept the stock markets around the world from diving into the depths even as the global economy has tanked.

Valuations are highly inflated by any conventional metric at the moment.

Part of this is due to central banks propagating an easy money policy.

That money has to go somewhere.

In the absence of opportunities in the real economy, it is headed into equity.

But some of the speculation is clearly due to behavioural quirks.

All around the world, there are young people -- millennials in many cases -- sitting at home and chafing with nothing to do, and time on their hands.

A lot of them play World of Warcraft (WoW), and now some are playing the markets.

In cognitive terms, these traders assess the risks of being killed at WoW (high) and being wiped out in the market (even higher) as precisely the same: These are not real-world risks so far as they're concerned.

While all this has happened, Mr Buffett has been notably unenthusiastic.

He's bought nothing, and sold a lot.

One sector he divested was airlines. Mr Portnoy's complaints and criticism were sparked by Mr Buffett selling airline stocks, when Mr Portnoy was buying them.

One can follow the logical rationale behind Mr Buffett's moves.

When it comes to Mr Portnoy, it is hard to claim that his trading patterns are any more logical than his fictional namesake's methods of entertaining himself.

Perhaps there is a real-life Dr Spielvogel out there, who will eventually make some sense of it.

Feature Production: Aslam Hunani/Rediff.com

© 2025

© 2025