'In the headlong rush to 5G, pause to ponder: How much capital invested in 4G will be destroyed? What happens to the outstanding debt of Rs 4.3 trillion? If an auction is held, can the domestic banking industry fund the requirements? Would a hasty auction end up helping only deep pockets and move the industry to a monopoly?' asks Rahul Khullar.

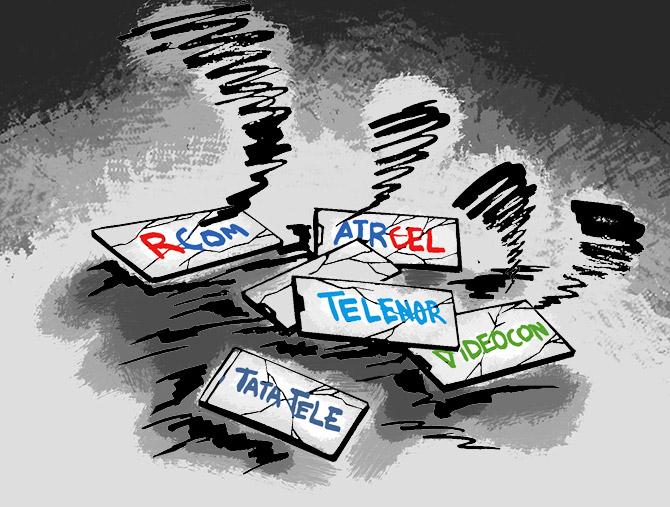

Illustration: Dominic Xavier/Rediff.com

The telecom sector has been in crisis for quite some time.

The warning signs have been clear as daylight: Exit of the smaller firms, RCom going into bankruptcy, huge losses of incumbent firms, mounting debt and stressed bank assets.

The government’s insouciance and inaction defies all logic.

Consider the industry-level facts.

Revenues normally grew at a steady clip of 5-9 per cent per annum.

In the past four years, however, the industry’s revenues fell by 20 per cent.

The telcos debt (excluding the tower business) has tripled and is now a whopping Rs 4.3 trillion.

The debt is now 2.6 times its annual revenues.

Government revenues (licence and spectrum usage fees) have fallen by 36 per cent.

Disaggregating, look at the private sector.

Tata Teleservices, RCom, Aircel, Telenor and Videocon have exited.

Debt has nearly quadrupled in four years, increasing by Rs 2.8 trillion.

Idea-Voda and Jio each have debt of Rs 1.5 trillion.

In 2018-19, the debt was thrice the annual revenues.

Two of the majors have reported losses for the past three years.

In 2015-16, when debt levels were relatively low, the EBITDA margin for the three majors was 34 per cent.

In 2018-19, this margin had collapsed to 25 per cent; for one firm it was barely 13 per cent.

The public sector picture is even bleaker. In the last four years, BSNL’s revenues have fallen by 40 per cent and MTNL’s by 30 per cent.

BSNL and MTNL have reported operational losses continuously since 2013-14.

In 2018-19, BSNL’s losses are more than Rs 14,000 crore; cumulative losses exceed Rs 0.9 trillion.

MTNL’s losses are greater than its revenues and its debt is nine times its revenues.

Except for hand-wringing, the government has done scant little.

Some distress was inexorable. A shakeout was necessary -- there were far too many firms. Exit and bankruptcy were the only options.

Further, Jio’s entry had to be disruptive -- it was the only way it could succeed. Zero price became its USP. The resultant price war wreaked havoc on the finances.

But, it was not a level playing field. Regulatory action became the new invisible hand determining economic fortunes.

The Telecom Regulatory Authority of India (Trai) turned a blind eye and let the zero price regime go on and on.

Its questionable order on termination charges reduced Jio’s payout (costs) and reduced its rivals’ revenues.

Then came Trai’s egregious order on predatory pricing: Jio was free to price below cost because it could not be a predator and all others were potential predators because they had market share.

This order had other odious and anti-competitive provisions.

The Telecom Disputes Settlement and Appellate Tribunal (TDSAT) set aside provisions of the order 18 months later.

By that time, the damage was done. The secretary in the department of telecommunications who drew attention to the falling industry and government revenues was peremptorily transferred.

The severe financial stress raises the spectre of more NPAs for public sector banks.

More importantly, it raises questions of long-term commercial viability.

Do the math. If the debt-to-revenue ratio is 2.5, then with 8 per cent as the cost of debt, 20 per cent of revenues are required just to service the debt.

Then add on the amortisation for spectrum and depreciation (as replacement cost).

For two firms where data is available, depreciation and amortisation are, respectively, 20 per cent and 11 per cent of revenues.

Even if the latter are judged too high, at today’s debt levels, the minimum EBITDA margin to survive is 40 to 45 per cent.

The industry is capital-intensive but its defining characteristic is rapid technological obsolescence.

The 3G spectrum auction was held in 2010. 3G systems became operational in 2012 (some later).

In 2019 comes news that 3G will be “shut down”. The unforeseen obsolescence destroys capital -- networks and equipment.

Add on the costs of reconfiguring spectrum. Depreciation will nearly always run behind actual replacement cost.

In the headlong rush to 5G, pause to ponder: How much capital invested in 4G will be destroyed? What happens to the outstanding debt of Rs 4.3 trillion? If an auction is held, can the domestic banking industry fund the requirements? Would a hasty auction end up helping only deep pockets and move the industry to a monopoly?

Exorbitant spectrum prices are the main reason for the spike in debt.

The low availability of spectrum has pushed prices to absurd levels.

India has 8.6 million subscribers per MHz of spectrum.

The counterpart figures are: Germany (170,000), Japan (262,000), Korea (137,000) and the United States (589,000).

In India the average holding is 31 MHz per operator; the counterpart numbers: Europe (61) and Asia (49).

The desperate need is for the government to locate and then release a large chunk of spectrum. Only then should auctions be held. Releasing spectrum in driblets will result in the same outrageous prices.

The race-to-the-bottom price war has to stop. Even Jio, the only firm posting profits, is not “making money” like its parent. If firms do not have internal resources, future investment is jeopardised.

(Joseph) Schumpeter’s creative destruction was predicated on innovation and competitive markets.

Competition has been anything but free and fair.

Regulatory capture is openly discussed but sotto voce.

Perversely, telecom has seen destructive creation -- value destroyed for the creation of a new behemoth.

The paramount need is to restore a semblance of balance and impartiality to all regulatory decisions, be they of Trai or DoT.

The purpose of regulating the industry was, inter alia, to “protect interests of service providers…and promote and ensure orderly growth of the telecom sector”.

Regrettably, this has been all but forgotten. This is a wake-up call to DoT.

Rahul Khullar is former chairman of Trai.

© 2025

© 2025