In the coming months, globally as well as in India, rice might remain a hot potato.

A fortnight or so ago, Kunwar Bahadur Yadav, a small farmer on the outskirts of Lucknow, was staring at a loss on his paddy crop, due to the deficient rains. However, rains arrived as August was drawing to a close.

"The showers saved my paddy," says Yadav.

Hundreds of miles away in Kerala, popular actor Jayasurya has been facing the ire of the supporters of the Communist Party of India-Marxist for highlighting the plight of paddy farmers in the Onam season and blaming the state government for it.

For millions of paddy farmers across India, this year's kharif season has been a picture of contrasts.

First, the southwest monsoon, kharif paddy's lifeline, arrived late, and just when it was showing signs of strain, it began to pour in July.

Then, in August, just when the crop was beginning to mature, the rains went into hibernation.

In eastern India, the rains revived in August, but the sowing was already running late.

As a result, the area under paddy across the country is around 4 per cent more than last year, but there is a dark cloud over the actual production.

As the weather played truant, the government stepped in to do its bit to control prices.

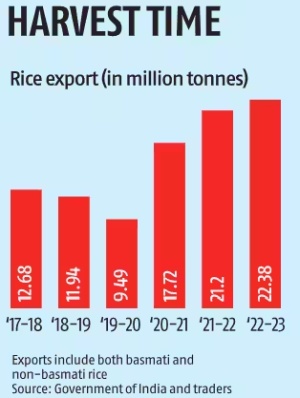

In a span of a few weeks, it restricted rice exports, stopped discounted surplus rice for making ethanol, and enhanced the quantity of stocks it liquidated in the open market.

This further affected the growers. Already the price of some early-sown paddy varieties, along with basmati rice, has seen a sharp drop in the domestic market in the weeks leading up to harvesting.

The export curb could have been prompted by the low-priced stocks in the central pool.

The stocks at the start of August, at 24.29 million tonnes, excluding the 1.96 million tonnes of unmilled paddy lying with the millers, was 13.09 per cent less than in the same month last year.

"The decision to curtail rice exports is affecting us more than the rain,: says Tamil Nadu Farmers Association's Subbu Muthuchammy.

In Punjab and Haryana, farmers say production costs rose as the excessive showers in July inundated the fields in Amritsar, Ferozepur, Mohali, Mansa and Patiala and filled them with silt leading to re-sowing of the crop.

Field reports from West Bengal, one of the country's largest paddy-producing states, show production this year might be lower than normal due to the initial deficient rains.

Normally, West Bengal produces 25.3 million tonnes of paddy in both seasons -- kharif and boro. Boro, or rabi rice, is sown in winter and harvested in summer.

The rainfall deficit in Purulia, Bankura, Paschim Burdwan, Nadia and Murshidabad in South Bengal was 26 to 45 per cent till early August.

Though the August recovery in rains did push up the acreage, it is still lower than the target.

The state had targeted to sow 4.3 million hectares under paddy this kharif, of which 4.0 million hectares had been covered till early September.

"But there will be a reduction in production as the coverage is 200,000 hectares less," says Onkar Singh Meena, West Bengal's agriculture secretary.

"Rice in West Bengal is grown in summer as well. So we hope to make up for the production loss in the kharif season during the summer. But, yes, there will be some deficit in production, though it might not be as significant as last year."

In Uttar Pradesh, another major rice-growing state, 99 per cent of the targeted area under paddy had been sown till late August.

However, with rainfall remaining sub-optimal, the Yogi Adityanath government is bracing up for the potential adverse impact.

Between June 1 and September 5, 46 of the state's 75 districts had deficient rains, the paddy-growing ones being among the worst hit.

Surya Pratap Shahi, the state's agriculture minister, says it is early to analyse the final impact of the rains on kharif crops, since September usually is good for rain-fed farming.

"In recent years, we have seen a trend of flood-like situations in September, If the rainfall gains momentum in September, the ground situation will improve and more than make up for the deficient showers," says Shahi.

The agriculture department is coordinating with the state's irrigation and energy departments to ensure optimum supply of water and electricity.

Shahi says the state government is prepared to provide succour to farmers if the monsoon remains deficient.

Kerala has a different problem, with 25,000 farmers yet to receive the price for paddy procured from them six months ago.

Those who have been paid allege that the government provided it as a loan.

The farmers were on a hunger strike on Thiruvonam Day, the main day of the Onam festival, to highlight their plight.

According to Kerala farmers, it is issues like this that are hurting them more than the rains.

Around the world, rice markets are in a turmoil due to the advent of El Nino, aided by India, which contributed 40 per cent of the global supplies, curbing its exports.

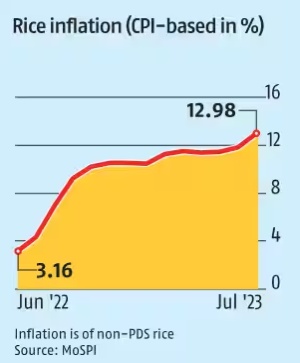

In country after country, local governments are struggling to control the rising rice prices.

The Food and Agricultural Organisation's rice price index rose to its highest level in 12 years in July due to the supply squeeze.

India, Thailand, Vietnam, Cambodia and Pakistan are the leading exporters of rice.

China, the Philippines, Benin, Senegal, Nigeria and Malaysia the biggest importers.

A recent Bloomberg report said the onset of El Nino this year threatened to parch many key growing regions across Asia, with Thailand already warning of drought conditions in early 2024.

The rice crop in China, the world's biggest producer and importer, appears to have escaped the poor weather so far, but India's major growing areas need more rain.

Sometime back, said the report, the Philippines was forced to place a cap on rice prices due to an 'alarming' increase in retail costs and reports of hoarding by traders.

Other worried nations are opting for the diplomatic route. Guinea sent its trade minister to India, while Singapore, Mauritius and Bhutan requested that New Delhi exempt them from the curbs on the grounds of food security.

The restrictions have provided an opportunity for Thailand, the world's second-biggest shipper, which has been on a roadshow in recent weeks.

The Bloomberg report said the message at the roadshows was, if you want rice, we have it.

Vietnam is offering support to the market, saying last month it could exceed its export target for the year without jeopardising its own food security.

The Thai Rice Exporters Association is also keeping a close eye on its 5 per cent broken white rice price to ensure that the domestic markets are not impacted.

In the coming months, globally as well as in India, rice might remain a hot potato.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025