Most of India's oil supplies are expected to stay safe because of the country's good relations with both Russia and Iran. That would take care of over a third of India's supplies.

The conflict in the Red Sea region is unlikely to disrupt delivery of energy supplies to India or leave a lasting impact on its economy, despite around half of the country's oil imports transiting that area, suggest industry officials and shipping data.

So far, at least seven vessels carrying crude oil and fuels to India have been diverted via the Horn of Africa to avoid the Red Sea route.

This might have meant longer voyages and higher shipping costs, according to London-based market intelligence agency Vortexa. But the overall impact is likely to be minimal as "these diversions... represent a small proportion of the total imports into India", says Serena Huang, an analyst at Vortexa.

"If tensions escalate, however, we might see more vessels diverting, prolonging voyage time for cargoes from West of Suez to India," Huang adds.

Overall, there have been 24 attacks on ships by Houthi rebels in the Red Sea since November 19, according to Washington.

The US has accused Iran of aiding Houthi rebels -- members of a Shia Islamist political and military organisation which controls large swathes of Yemen. But Tehran has denied the charge.

As for vessels carrying supplies to India, Vortexa data shows that Sonangol Cabinda, and Front Cruiser, a Suezmax vessel carrying one million barrels of crude oil, had to take the longer route around southern Africa.

While Front Cruiser went around the Cape of Good Hope and discharged at Sikka on December 26, Cabinda is scheduled to unload on January 25.

Among other tankers, diversion of Amber Ray, Chem Silicon and Lyderhorn around southern Africa added 5,000 to 6,000 nautical miles to the typical journey from Europe to Asia, potentially increasing delivery time by up to four weeks.

Petroleum Minister Hardeep Puri said there had been no disruption in supplies due to the attacks by Houthi rebels on oil tankers transiting the Suez.

Higher freight rates would be offset by savings from the Suez Canal fee, he explained.

India Ratings and Research Associate Director Bhanu Patni sees no immediate threat to supply, but cautions that "inflationary pressures might be felt eventually on account of higher freight rates, if the issue prolongs."

Vandana Hari, a Singapore-based energy expert and founder of Vanda Insights, says the diversion of some cargoes to a longer route increases freight costs "and will undoubtedly cause additional work on logistics and scheduling”. But she does not foresee a supply crunch."

"In an abundantly supplied market, the additional sailing time does not seem to be causing a supply shortage," Hari adds.

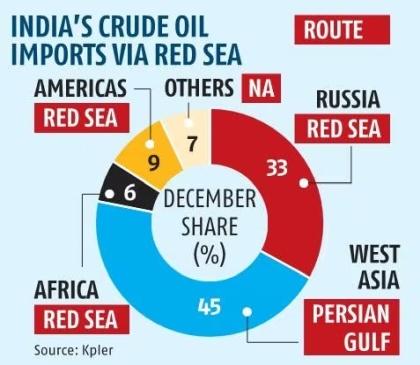

In December, India imported 4.4 million barrels per day (bpd) of oil, according to ship-tracking data from Kpler.

Of this, less than half (around 45 per cent), was sourced from West Asia, and sailed through the Persian Gulf.

Around 33 per cent came from Russia, and the rest from Africa and South America.

While vessels of up to the Suezmax size use the Suez Canal, very large crude carriers (VLCCs) -- those that carry 2 million barrels of oil -- cannot use the canal.

Russian supplies come in tankers smaller than VLCCs, while West Asian nations use the largest carriers to ship oil to India.

Most of India's oil supplies are expected to stay safe because of the country's good relations with both Russia and Iran. That would take care of over a third of India's supplies.

Over 1.5 million bpd of oil which India sources from Russia transits the Suez Canal. But, as a Mumbai-based refiner points out, there have been no attacks on vessels carrying Russian oil.

Another industry official says: "Russian oil supplies are unlikely to be targeted, given Russia's close ties with Iran."

Besides, if the Red Sea situation worsens, Indian refiners also have the option of taking additional cargoes from West Asian suppliers via the Persian Gulf.

There is plenty of slack there, says Vandana Hari, thanks to the ongoing output cuts.

Saudi Arabian supplies may be more expensive than Russian oil, which is offered at a $4/bbl discount, but there is no threat of supply disruptions to the Indian economy.

Moreover, Iraqi Basrah crude, which is most suited to Indian refineries, will be available in greater volumes.

At present, Europe competes with India for Iraqi oil and pays a premium to get volumes diverted.

The Houthi attacks have hurt Iraq's crude exports to the EU, with volumes plummeting from 959,000 bpd in October to just 420,000 bpd in November-December, according to US publication Energy Intelligence.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025