'The mood in Beijing is already nervous and feverously watchful.'

'Developments in China will be scrutinised as intensely and nervously as the ones in Washington,' says Claude Smadja.

2017 will be a crucial one for China, an inflection point for the country's economic policy, its foreign policy and standing the world, its internal balance of power and social order.

This is the last year of Xi Jinping's first presidential mandate and it will shape the course that the Chinese leader will follow in his second term, his policy orientations and his ability to implement them successfully.

Regarding the economy, 2017 will determine the ability of the Beijing leadership to pursue the restructuring of the economy, while sustaining the level of growth necessary for social stability.

The key challenge is addressing the priorities and urgencies of the short term while preserving the longer term goal of putting firmly China on the path of a knowledge-based, innovation-driven growth.

The government claims to have achieved its target of 6.7 per cent growth in gross domestic product for 2016 -- thanks to a revival of activity since last summer -- and express confidence in reaching 6.5 per cent for this year.

But major challenges are involved in fulfilling this commitment: The real estate's role as a driving economic engine is set to decline, exports are not expected to increase significantly and despite continuing solid growth household consumption cannot yet be the alternative booster of activity needed.

So, achieving 6.5 per cent will require continuing injection of public money into the system through capital investments in infrastructure and the financial support of State-owned enterprises in traditional industry sectors -- many of them kept alive artificially to avoid the laying off of hundreds of thousands of workers.

The leadership has for now put on the back-burner any major reform of the SOEs sectors, given the extreme sensitivity of the issue in a year marked by the major milestone of the 19th Congress of the Communist Party.

This means that the distortion in the allocation of resources to the detriment of the productive private sector will continue, with a major implication: China closed 2016 with an overall debt of about 260 per cent of GDP, and this might rise to close to 300 per cent of GDP by the end of 2017.

While debt is rising, especially corporate debt, the real level of bad loans is now at eight to nine per cent of the loans portfolio of Chinese banks.

While there is no risk of a 'collapse' of the financial system, these factors added to the strength of the dollar have put the yuan in a tight spot, with a significant increase of capital outflows that the government is now trying to stem.

The management of the yuan will be a major challenge in the coming months with Beijing walking a tightrope between its goal to establish the yuan as a major international currency and the need to manage a smooth additional downward adjustment of its value.

There is a lot of prestige and political capital here at stake.

The challenges are of the same magnitude on the foreign policy front.

Beijing has used the disarray and uncertainties created by Donald Trump's election in the US to portray itself as a responsible, stable, reliable international power, while engaging in major international initiatives to strengthen its position and expand its global footprint.

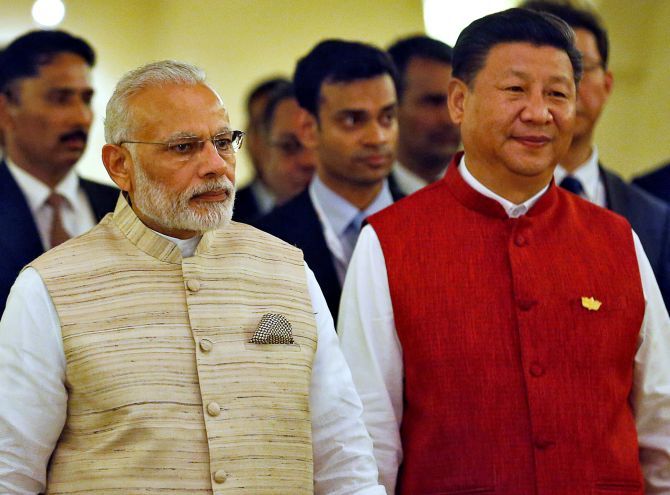

In addition to the BRICS summit that China will host with much fanfare in September, Beijing is planning a major One Road One Belt Summit in May, gathering more than 40 top leaders among the countries involved in this strategic initiative.

The aim is to create a sphere of co-prosperity from Asia to Europe with China at the centre, thus generating new markets and new sources of growth for the Chinese economy, especially in infrastructure.

But the geopolitical dimension of the initiative is obviously there: If successful, One Belt One Road will help create the kind of sphere of influence that China still misses and would strengthen Beijing's hand in establishing itself as an equal counterpart to the US.

Here again, there are major challenges: Beijing was initially seeing favourably Trump's election -- as there was no love lost with Hillary Clinton -- but the phone conversation of the then US president-elect with Taiwan's president has been a shock for the leadership as well as his putting into question the 'One China' policy Washington has pursured for the last 38 years, which is the anchor of the US-China relationship.

No Chinese leader could envisage being the one who 'lost Taiwan' and surviving that setback.

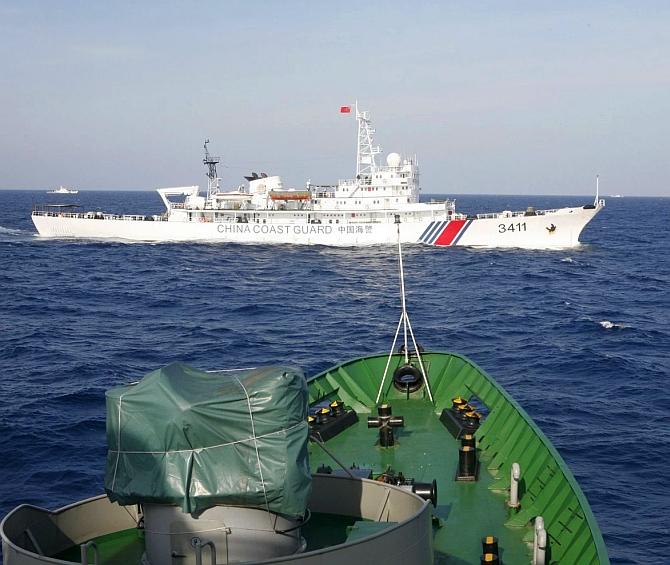

In the same way, Xi has already gone too far with China's territorial expansion in the South China Sea to consider any significant backtracking.

Xi will have to calibrate very carefully his answer to Trump's bellicose tone against China, especially if the US president engages in a trade war against China and tries to challenge, even more forcefully than the Obama administration, the Beijing build-up in the South China Sea.

Taiwan, the South China Sea and unilateral harsh trade measures are red lines that the Chinese leader cannot afford to let Trump cross without strong retaliatory actions.

Will Beijing be able to convey that message as convincingly as needed to Washington, and will some voices in the Trump administration in the US Congress and in the business community be strong enough to restrain the new president's impulses?

The way things evolve on the economy and the international front will play an important role in helping to shape the outcome of the 19th congress of the Communist party.

Xi confirmed his position as core leader last October, a position not held by his predecessor Hu Jintao.

But he has yet to anchor his 'strongman' position despite the elimination or the weakening of other power centres through his relentless anti-corruption campaign.

The 19th congress will endorse a major reshuffle of the leadership structure that should allow Xi to populate the central committee and the politburo with 'his' people -- which is not the case until now -- and even more importantly to replace with his allies the five of the seven members of the standing committee of the politburo due to retire at the end of the year.

Last but not least, the party congress should also allow the Chinese leader to consolidate his control on the military and to enshrine the key domestic and foreign policy orientations he will have set for the next five years.

Another element to watch for is whether the congress will be the occasion for Xi to bring forward his heir apparent or will he fuel speculation that he is in fact looking at a third term, breaking with the two terms rule observed since Deng Xiaoping.

No wonder, then, that the mood in Beijing is already nervous and feverously watchful, and that developments in China will be scrutinised as intensely and nervously as the ones in Washington.

Claude Smadja is president, Smadja & Smadja, a strategic advisory firm.

© 2025

© 2025