If the thought of buying a term life cover and then choosing a mutual fund sounds tough, and you prefer the investing discipline enforced by that periodic call from the agent for the premium, then you look like a consumer who would prefer a unit-linked insurance plan.

Our problem with the bulk of Ulips has been that in case of an untimely death, the family of the deceased gets only the higher of the sum assured or the fund value; we will call these Type I Ulips. In a term cover plus MF approach, one would get the sum assured as well as the fund value.

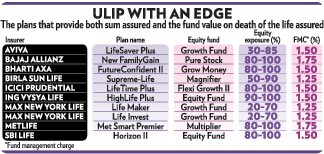

There are, however, a few Ulips, we will call these Type II, which offer the twin advantage of getting both the fund value, as well as the sum assured as death benefit (see Ulip With an Edge).

Differentiators

Say, you pay a premium of Rs 100,000 every year for a 20-year Ulip with a sum assured of Rs 20 lakh (Rs 2 million). How does a Type II give you greater death benefit than Type I? At the end of five years, having paid Rs 5 lakh as premium, you find the fund value to be about Rs 562,000 under Type I, and Rs 535,000 under type II, after adjusting for all expenses and growth. Under Type I, the death benefit to the nominees in the sixth year would be Rs 20 lakh, (higher of Rs 20 lakh or Rs 560,000). Under Type II, the payout would be Rs 25.35 lakh (Rs 535,000 + Rs 20 lakh).

The chief difference between the two polices is the way the mortality cost is charged, making Type II policies more expensive than Type I. But then, they assure a larger benefit in the case of an untimely death. Depending on the age of the individual, every insurer fixes its rate, expressed in rupees for every Rs 1,000 of sum assured. For instance, for a 40-year-old, it may be Rs 2.22. If the sum assured is Rs 20 lakh, the total yearly mortality charge would be Rs 4,440.

Taking the same mortality rate, let us assume that a person turns 40 at the end of the 10th year of the policy; the fund value at that time being Rs 14 lakh (Rs 1.4 million). Under Type I, the mortality charge would be only on Rs 600,000, the sum at risk for the insurer as Rs 14 lakh of the Rs 20-lakh sum assured is already in the fund. That would leave a  bigger part of the premium to be invested.

bigger part of the premium to be invested.

Rahul Aggarwal, CEO of insurance brokerage Optima Risk Insurance Service, explains: "When the first premium is paid, the fund value is a small part of the sum assured.

So, the insurer has to buy the complete sum assured with the risk premium. As the fund value grows, it becomes a larger part of the sum assured. So, the insurer has to pay a smaller amount to buy the remaining sum assured."

Therefore, under Type I, if the fund value grows, larger amounts can be invested. In contrast, in Type II, the mortality cost is charged every year on the entire sum assured and keeps increasing with the age of the policyholder.

For a sum assured of Rs 20 lakh, the mortality cost may be about Rs 3,000 at age 30, but could rise to Rs 10,000 at age 48. In most cases, this gives Type I a higher fund value than Type II.

But the advantage of Type II is that apart from the fund value, the death benefit includes the sum assured. And that is where the difference arises, making it a smart move for a Ulip buyer to buy a Type II over a Type I policy.

© 2025

© 2025