Russian oil supplies to India will continue to flow unhindered and suppliers will come up with ways to sidestep secondary sanctions, a Russian official told Business Standard.

Russian traders are considering options to stay one step ahead of Washington as the US resorts to a slew of secondary sanctions on the export of Russian crudes to weaken burgeoning oil trade between India and Russia, according to government and industry officials from both nations and ship-tracking data.

External Affairs Minister S Jaishankar, speaking at the Munich Security conference, reiterated India's stand to buy Russian oil for the country's energy security.

Oil Secretary Pankaj Jain told reporters at the India Energy Week in Goa that Russian barrels are not sanctioned for countries like India, but if the ships they are delivered on come under sanctions then India cannot buy such shipments.

Indian refining officials told Business Standard that there was no question of paying for cargoes arriving on sanctioned vessels, and in many cases such shipments are rejected even before the oil is loaded.

It is precisely this weakness that Washington has targeted, Indian officials told Business Standard.

By zeroing in on vessels that supply crude to India they have ensured that participants in trade like shippers, insurers, and most importantly Indian banks, with operations in Washington and dealing with US dollars, are forced to review their operations to process Russian trade flows.

India is not the only nation staring down Washington's sanction barrel. Mounting roadblocks to trade are beginning to affect oil supplies and Russia's economic relations with Turkiye, the United Arab Emirates, and to a lesser extent with China, industry officials said.

"While the US has every interest in discouraging India-Russia bilateral trade ties, and will use the threat of secondary sanctions, it is not likely that the logic of ever-closer trade relations between the two BRICS partners can be thwarted by the Biden administration easily," said London-based energy expert Tilak Doshi, who has decades of experience in the sector.

There was a noticeable 5 per cent monthly decline in oil tanker shipments from Russia to India in January compared to December, said Petras Katinas, an analyst covering Russia for Finnish think-tank CREA, attributing part of the decline to factors, such as OFAC (US) sanction enforcement.

An official from the Russian consulate told Business Standard at the India Energy Week that Russian oil supplies to India will continue to flow unhindered and suppliers will come up with ways to sidestep secondary sanctions.

The latest sanctions by the US are aimed at shipping companies.

In late December, Dubai-based shipping company Sun Ship Management, a key shipper of the biggest Russian grades like Urals and Sokol to India on over 50 vessels in the past year, was sanctioned.

The Sun Ship fleet has special ice-class vessels that are needed to transport a light, sweet premium grade like Sokol from Sakhalin-1 project, subject to extreme weather conditions, and in which state-run explorer ONGC has a 20 per cent stake.

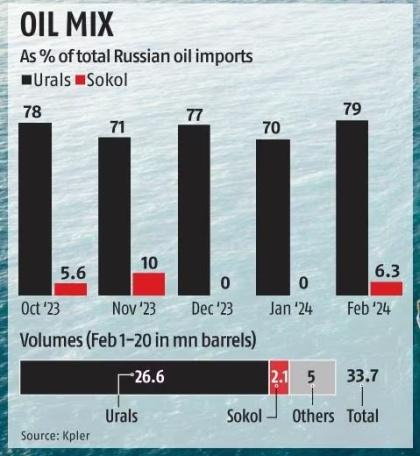

Sokol, which is used by refiners to blend with comparatively heavier, higher sulphur Urals to make it more palatable in Indian refineries, constituted around 8 per cent of India's Russian crude purchases in 2023, and 10 per cent in November. Urals, Russia's biggest export, constitutes over 70 per cent.

Initially, these secondary sanctions targeted ships carrying higher-priced grades like Sokol.

Washington has now expanded it this month to cover ships loading Urals. NS Leader, a vessel that typically carries Urals grade to India, came under sanctions this month.

Russian traders are now seeking ways to counter these sanctions, refining officials said.

One such mechanism adopted by Rosneft to supply the Sokol grade, which may be used to ship Urals also, is the use of non-sanctioned carriers for the last leg of the journey to Indian ports.

Two Mumbai-based refining officials said that banks typically look at the ship that discharges the cargoes at the Indian port, and do not investigate all the ships that brought the fuel from Russia.

Rosneft succeeded in sending three Sokol cargoes of a combined 2.1 million barrels of oil this month to discharge at Vadinar, Mumbai and Visakhapatnam ports; two more cargoes may land end February at Visakhapatnam and Jamnagar.

Volumes still trail the 5 million barrels of Sokol received by Indian Oil in November but are still a jump from none received in December and January -- when 10 Sokol laden vessels, most owned by Sun Ship, had to turn back en route to India after fresh US sanctions.

None of the Sun Ship vessels are now directly delivering Sokol cargoes to India, refining officials said.

"There are several STS transfers happening," said Viktor Katona, an analyst for Kpler.

"STS is not necessarily a violation of sanctions but might indicate one," he added.

STS can also be an optimisation of routes for sanctioned vessels, Katona said, with nice, clean drops to the destination.

In case sanctioned vessels are idle, then there are fewer vessels available to ship Russian crude, which leads to an increase in freight rates, an Indian refining official said.

For instance, Stealth Maritime-owned Jaguar delivered a Sokol parcel on February 5 at Vadinar after receiving the crude from a Sun Ship-owned ice-class tanker Viktor Titov at ship-to-ship transfer point in Yeosu in South Korea, according to ship-tracking data from Paris-based market intelligence agency Kpler.

Leah Shipping-owned Seagull discharged a Sokol cargo at Mumbai on February 13 after loading at Yeosu STS the oil from the Sun Ship-owned Yuri Senkevich.

Similarly, Rani, owned by Grand Maritime, may deliver a Sokol cargo to Visakhapatnam after receiving the cargo from Pavel Chernysh, another Sun Ship ice tanker, at Yeosu STS.

In addition to the above shipments, there are over 11 million barrels of Sokol cargoes floating in Asian waters, according to Vortexa data.

Feature Presentation: Rajesh Alva/Rediff.com

© 2025

© 2025