Don't go by the names - MIPs may not always provide monthly returns. But you can surely rely on them to deliver steady income

Myths vs reality

Myth

- MIPs give you monthly income

- MIPs are income funds

- They are very safe investment avenues

- They give monthly dividends

- They are meant only for conservative investors or for retirees/semi-retirees

Reality

- They don't guarantee monthly income, but give steady returns

- MIPs are not income funds. Income funds usually invest only in fixed income securities (corporate bonds, government securities, treasury bills, cash/call) and fall under the income/debt fund category. MIPs invest 15-20 per cent of their corpus in equity

- As MIPs invest in equity, they are not very safe. They are less risky than balanced funds, but riskier than pure debt funds or income funds

- They do not give monthly dividends. It depends on availability of a distributable surplus.

- They could be better investment avenues for achieving short-term goals, whether you are a conservative investor or aggressive. They provide a better option for investors looking for a combination of debt and equity combination in a single product

There is no dearth of eye-catching advertisements by mutual fund houses, trying to get you to buy their monthly income plans. Many of us jump into schemes with a mere look at the ads, without doing proper research on whether they meet our requirements or not.

There is no dearth of eye-catching advertisements by mutual fund houses, trying to get you to buy their monthly income plans. Many of us jump into schemes with a mere look at the ads, without doing proper research on whether they meet our requirements or not.

In many instances, investors get misled by the name of the product as is the case with MIPs. While the name would suggest that it will entail monthly returns, it's not necessarily so. Few days back, one of our readers asked us to name some good MIPs that can provide regular returns.

Myths Vs facts

MIP is not an instrument which assures you of a monthly income. On the contrary, it is a debt-oriented MF scheme.

It invests 75-80 per cent-in some cases, more than that-of its corpus in debt instruments and the remaining in equity instruments.

So, while the debt investments ensure a certain amount of stability and consistency, the equity allocation boosts the returns. Though MIPs aim to provide investors with liquidity through regular dividends, they don't assure you of any monthly income.

MIP report card

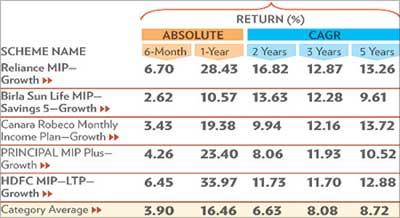

Returns as on 23 February 2010 Top 5 MIPs based on three-year performance Schemes in bold are part of OLM 50 - Outlook Money's recommended schemes across categories CAGR: Compounded Annual Growth Rate Source: mutualfundsindia.com

As MIPs are market-linked, the declaration of dividends is subject to availability of distributable surplus, and it's done at the discretion of the fund house. Though MIPs offer a monthly dividend option, many of them don't do so when the market is going through a rough patch.

For instance, ING MIP (monthly dividend) and DSP BlackRock Saving Manager-Moderate (monthly dividend) did not declared dividends during the downturn. After May 2008, it was only in April 2009 that ING MIP declared dividends. Similarly, after declaring dividends in December 2007, DSP B R Saving Manager did so only in March 2009.

Portfolio

Like other MF schemes, MIPs also utilise market opportunities. When higher volatility is expected, they take the conservative approach. Currently, as interest rates are volatile, most MIPs have reduced their average maturity from five years to less than two years. Since they hold most of their debt securities till maturity, they can mitigate interest rate risks to a certain extent.

Return does matter

Over the past two years, MIPs have returned 16.87 per cent and 6.8 per cent respectively. Some funds, such as HDFC MIP-LTP and Reliance MIP have given returns as high as 33.94 and 28.42 per cent, respectively.

These are, however, exceptions as MIPs invest a small part of their portfolio in equity (up to 20-25 per cent). This helps them bring steady returns with little capital erosion and limited volatility, as was the case during the 2008 market crash.

Taxing issues

A dividend distribution tax (DDT) of 14.16 per cent (12.5 per cent tax, 10 per cent surcharge and 3 per cent education cess) is levied on debt funds. If you sell the units before a year and there is a gain, short-term capital gains tax is applicable.

The net gain will be added to the current income and tax will be levied on that amount. If you sell units after a year, 10 per cent long-term capital gains tax will be levied, or 20 per cent with indexation.

How it compares with others

MIPs vs Bank FDs. Unlike MIPs, returns on bank fixed deposit (FDs) are assured. Moreover, unlike MIPs, FDs' returns are taxable as per your tax slab. So, the post tax return could be lower than the actual return.

MIPs vs Post Office MIS. To an extent, MIPs score over Post Office Monthly Income Scheme (MIS). There is an upper limit on Post Office MIS - Rs 450,000 for single account and Rs 900,000 for joint account.

There is no such maximum limit with MIPs. As far as liquidity is concerned, MIPs don't attract any exit load after one year of investment. But, MIS comes with a 2 per cent charge for withdrawal before two years. Unlike MIP, MIS gives you an assured return. It also has premature encashment penalities.

What to choose

If you're a die-hard conservative investor, and looking for better returns than bank FDs, then MIPs could be a good option. Invest in MIPs if you have a time horizon of more than two years. Don't expect MIPs to provide you monthly returns, but you can surely bank on them for a steady income.

© 2025

© 2025