A columnist, who is also a high-profile investment advisor, recently made a killing in the secondary market by selling shares of Wartsila India. What is so special about this? Wartsila's financial performance has not been inspiring over the past few quarters, yet he had the foresight to anticipate an open offer from its Finnish parent to delist from the Indian bourses.

The listing guidelines provide for companies where promoters hold more than 75 per cent stake to either delist from the bourses through an open offer to minority shareholders or reduce their holding to less than 75 per cent. (Public sector companies are, however, exempt from this provision).

The Securities and Exchange Board of India has also made an open offer mandatory if the acquiring company takes over 15 per cent stake in the target company.

For an open offer to be successful, it has to be at a significant premium to the market price, benefitting minority shareholders. And, this is where an investor, who is informed about the company, can make his money -- by timing his transaction with a potential open offer.

Outlook Money looks at some ongoing and some potential open offers, to help you make the most of the phenomenon.

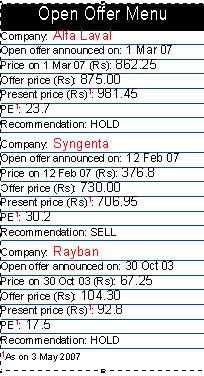

Ongoing Offers

Rayban Sun Optics's open offer arose from regulatory need when Luxottica, Italy, acquired the eyewear business of Bausch & Lomb Inc on 28 April 1999.

After much delay, an offer has been made to Rayban shareholders to hike promoter holding to just under 75 per cent by acquiring up to 30.82 per cent of the equity share capital at a price of Rs 104.30 per share. Interest at Rs 80.95 per share will be paid to shareholders who hold shares continuously from 27 August 1999 and sell them in the open market.

It is very likely that the proposed wholly owned subsidiary will adversely affect the prospects of the listed company. The stock at Rs 92.80 (PE 17.6) may not sustain the open offer price in the short term since it is out of regulatory compulsion and not to delist the company.

Short-term players can tender their shares while long-term investors can hold the stock since promoters may try to gain complete control in future if the floating of the unlisted subsidiary hits a regulatory road block.

Syngenta's product portfolio comprises crop protection products and seeds -- which should see robust growth considering the entry of big players like ITC, Reliance, Bharti and Godrej in agri-retail. The Indian subsidiary will benefit from the strong research-pipeline of the parent, which is the third largest player worldwide in the crop seed business and second largest in vegetable seed business.

Syngenta's product portfolio comprises crop protection products and seeds -- which should see robust growth considering the entry of big players like ITC, Reliance, Bharti and Godrej in agri-retail. The Indian subsidiary will benefit from the strong research-pipeline of the parent, which is the third largest player worldwide in the crop seed business and second largest in vegetable seed business.

Syngenta South Asia AG, which had come out with an open offer, has set an exit price of Rs 730 per share for delisting shares of its Indian subsidiary. LIC, which holds about 3 per cent stake in Syngenta is rumoured to be instrumental in the exit price getting fixed at Rs 730.

This is a pleasant surprise to shareholders, especially with the floor price set at about Rs 350. The parent, which already had 84 per cent stake, has garnered more than 7 per cent stake from the open offer, thereby clearing the 90-per-cent hurdle. Tendering the shares is a better option than holding on since it is trading at Rs 706.95, that is a trailing PE of 30.2, which is quite expensive for an agrochemical stock.

Alfa Laval is an engineering services provider to process industries like chemicals, F&B, and pharmaceuticals. It offers expertise on centrifugal separation, heat transfer and fluid handling. The ethanol business is expected to be a major growth driver for the company.

The Swedish parent holds 64 per cent stake and has made an open offer at Rs 875. Domestic financial institutions are expected to bargain for an upward revision in the open offer price.

The flip side is that the delisting plan may not happen as the parent is under no statutory compulsion to proceed with the offer. Our recommendation to existing shareholders is to hold as the current valuation is not excessive. Fresh exposure is not advisable as some control premium has been factored into the stock price.

Prospective Candidates

AstraZeneca Pharma India is present in six therapeutic segments. The Swedish parent has an unlisted subsidiary, AstraZeneca India Pvt Ltd, set up in 1996, which focuses exclusively on discovering new drugs or therapies for tuberculosis. A new R&D facility became operational in mid-2006 in Bangalore.

AstraZeneca plans an investment of Rs 150 crore over the next 5 years. Since the promoter stake in the listed subsidiary is at 90 per cent, there is a strong delisting possibility and an eventual merger with the unlisted subsidiary.

At Rs 689.40, the stock has a trailing PE of 33.8. But the company has free reserves of about Rs 125 crore, which on an equity base of Rs 5 crore, translates to about Rs 50 per share (Rs 2 paid up). Adjusting for that, the trailing PE is 31.34. The stock has scope for around 25 per cent appreciation based on an estimated trailing PE of 40 considering the high-end work it does.

Atlas Copco is a beneficiary of the capex boom in our country. It makes air and gas compressors, generators and industrial tools, among others, which should benefit from the brisk momentum in infrastructure, oil and gas exploration, engineering, cement, mining, auto and power sectors.

Mining and CNG dispensing pumps are expected to be the growth drivers for the company. The topline and bottomline are both expected to surge especially with the mining policy expected to attract FDI worth Rs 100,000 crore over the next few years. Barring the March 2007 quarter, which was flat on the profit front, the company has enjoyed growth rates much higher than its PE of 23.4 at Rs 751.75.

Bosch Chassis Systems is an 80 per cent subsidiary of Bosch AG Germany, and makes braking systems and components for passenger cars, tractors, two- and three-wheelers. About 75 per cent sales come from the four-wheeler segment, where Maruti is the largest customer. BCS is the sole supplier of hydraulic brakes to Mahindra for its Scorpio model.

This deal with M&M holds great potential since it may be extended to the upcoming model Ingenio, an expected volume seller. Its two-wheeler clientele includes Honda Motorcycles & Scooters, Bajaj, Hero Honda, and Yamaha. It has a 50:50 JV with Brembo, Italy, for two-wheeler braking systems. Brembo is expected to outsource its Asia-Pacific business from this JV.

The outsourcing opportunity from the parent will give a fillip to exports with the parent expected to step on the gas from FY09. Bosch's commitment to its Indian subsidiary is clear as it bought 40 per cent stake of the Kalyani Group in July 2005 at Rs 686 per share to take its stake to 80 per cent. There may be delisting in this counter, quoting at Rs 944.75 at a PE of 21.6.

Caveat. With all these buyback options, investors have to be patient and not expect the Godzilla kind of returns as happened in the case of Wartsila.

© 2025

© 2025