| « Back to article | Print this article |

The graph of inflation and that of the blood pressure of the United Progressive Alliance ministers have become highly positively correlated, what with national election not very far away.

Not surprisingly, we are witness to a flurry of frantic actions and threat of even more frantic (read fanatic actions) to show to the whole world (nay the electorates) that the fight against inflation is very much on.

And, whenever that fails, one can always fall back on the tried and tested formula of blaming the global phenomenon having engendered the local problem.

Not that this attribution is baseless. There is indeed no gainsaying the fact that inflation has indeed taken a global hue with food and oil prices running amok all over the world. And, the rise in food and oil prices is more a reflection of runaway commodity prices.

The fast growing developing economies, especially China and India, have been industrialising rapidly on the back of still energy intensive technologies while growing incomes of a greater part of the population is stimulating food demand. However, it does seem that price increases are not merely because of demand supply mismatch.

The fact that commodity prices are still rising despite perceived threat of global growth slowdown including that of Indian and China makes one believe that speculative activity is at play, especially in a commodity like oil which has seen substantial built-up in speculative demand.

This is not surprising. With a slowdown in equity markets, there seems to have been a shift in asset class in favour of commodities, leading to some speculative influence.

Question, however, is should global phenomenon be treated as a villain in the piece especially given the fact that galloping food prices is a nightmare for any government facing inflation?

I would say no. And, the sorry state of the Indian agricultural sector explains why.

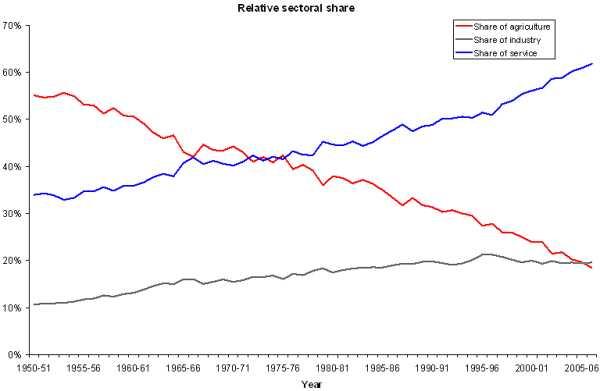

The following graph probably explains it all.

Source: Handbook of statistics, RBI

Just look at the red line. This represents the share of agriculture in India's GDP and this has been on a secular downtrend. Falling share of agriculture is not necessarily bad as an economy progresses. However, for a sector that supports nearly 70 per cent of a country's population, a mere share of 18.46 per cent of GDP (at factor cost, at current prices) is disastrous.

The latest economic survey rightly talked about the lopsidedness of our economic growth. The manufacturing and the service sectors are doing relatively very well while the agricultural sector is lagging. Indeed, this lopsidedness is taking a toll on food price inflation in India.

Agricultural productivity for example, is quite deplorable. If we compare the productivity of Indian agriculture to that of the productivity in other countries, we will find that our's is way behind the leading nations. Take for instance China. With only 100 million hectare of agricultural land, China is producing 400 million tonnes of grain while India with its 146 million hectares of agricultural land produces on an average only 108 million tonnes of food.

If we take the production per hectare of individual crops too we will find that the country is way behind other countries. The average production of rice per hectare in India is around 1,756 kgs compared to 5,475 kgs of North Korea; we are harvesting only 2117 kgs of wheat per hectare compared to 7,716 kgs by the Netherlands. Similarly, India produces only 1606 kgs of corn per hectare compared to 9091 kgs of corn per hectare by Greece.

It is the same story when it comes to soyabean and groundnut. The production of soyabean per hectare in India is 804 kgs compared to 3,453 kgs in Zimbabwe. As for groundnut, the country harvests only 929 kgs per hectare compared to 4,600 kgs per hectare harvested by Israel. In other words, Israel is getting five times the groundnut per hectare as against India. Similarly, India produces 15,817 kgs of potatoes per hectare compared to 45,349 kgs produced by Belgium. As for sugarcane we produce 65,382 kgs per hectare as against 135,448 kgs per hectare produced by Peru. [1]

With such low levels of productivity, foodgrain production is slowing at a pretty alarming pace. According to the latest economic survey, the rate of growth of foodgrain production has decelerated to 1.2 per cent during 1990-2007, which was lower than the annual growth of population at 1.9 per cent. This has resulted in a decline of per capita availability of foodgrain. The per capita consumption of cereals has fallen to 412 grams per day, indicating a decline of 13 per cent, while pulses consumption declined to 42 grams per day, a 33 per cent fall.

If that is not enough, more than 10 per cent of our foodgrain production gets wasted every year. As per the report of the 11th Planning Commission[2], preventable post-harvest losses of foodgrains are estimated at about 20 million tonnes a year, which is nearly 10.5 percent of the total production.

To put things in perspective, India wastes more than 50 per cent of Australia's annual foodgrain production (considering the latest available foodgrain production data provided by Food and Agricultural Organisation) every year due to improper storage and transportation facility. Can anything be more eye popping?

Infact, about 30 per cent of farm produce is stored under open condition, leading to wastage and distress sales. As per the Planning Commission estimate, if the domestic consumption level shoots up from current 100 gms of fruits and 200 gms of vegetables per capita per day to the recommended dietary level of 140 gms and 270 gms respectively by 2010, the domestic market for fresh fruits and vegetables could be as large as Rs 50,000 billion at present price structure.

This clearly requires substantial investment to build up commensurate supply chain infrastructure in terms of handling, storage, and transportation. Instead, we fritter away our precious resource in the name of populism. The latest Budget provision is a case in point, where we are allowing for Rs. 600 billion worth of farm loan waver, despite concerning level of deficit (refer to my article: The real dangers facing Indian economy). Who really cares for the rural infrastructural deficit? And many experts are now talking about food crisis being round the corner.

While these are supply side factors that result in elevated food price inflation, issues like marketing that encourages layers and layers of middlemen exacerbates the problem. Direct marketing encourages farmers to undertake marketing of farm produce at the farm gate and obviates the necessity to haul produce to regulated markets for sale.

Direct marketing enables farmers and processors and other bulk buyers to economize on transportation costs and to considerably improve price realization. In South Korea, for instance, as a consequence of expansion of direct marketing of agricultural products, consumer prices declined by 20 to 30 per cent while the producers received 10 to 20 percent higher prices.

Direct marketing results in curtailing of middlemen and not only becomes more remunerative for farmers but also ensures that the economy benefits through lower prices. However, in the present marketing system, it is estimated that only 10 percent of the total produce is marketed through the above channel and the remaining is sold through other marketing channels. Marketing through other channels involve considerable amount of marketing cost.

Studies indicate (Acharya, 2003) that 77 percent of the marketing cost amounting to Rs 50,000 crore (Rs 500 billion) is estimated as avoidable loss. Even our policy of not allowing FDI in retail trade ensures that the middlemen thrive at the cost of the consumers.

Big retail companies could have brought in much more efficiency in the system through their superior supply chain management and, concomitantly, could have reduced the end price. Ironically, alarming food price inflation is only fostering a class of profiteering middlemen (aided in a great measure by our politician turned policy makers) but the actual producers (viz the farmers) barely see any improvement of their lot.

What is more galling is that these are not new problems. Yet, year after year, government after government, precious little gets done to reverse this trend. Agriculture continues to be a neglected sector and the devised policies hardly gets translated into meaningful actions.

A potential crisis is, therefore, always round the corner. And, as inflation reared its ugly head, the government gets into fire fighting mode like encouraging imports, banning exports etc. These, however, are proving to be less than successful attempts since the basic structural problems remain unaddressed.

Some politicians, with their half baked knowledge are even clamouring for a ban on future trading in agricultural commodities. Fact remains though, our previous such attempts have been futile. We banned futures trading in wheat, urad, tur and rice last year.

Prices of tur went up during the entire year due to a shortfall in production. Wheat prices are also rising, and now even rice prices have also gone up sharply. Also, prices of fruits, vegetables, milk, coarse cereals, pulses like urad, tur and masoor, which are not traded on the exchanges have registered very high increases. In almost all the cases it's a case of lower supply.

The other weapon at the hand of the government to flight inflation is to use monetary policy that aims to curtail demand through higher interest rates and lower liquidity. However, when the problem is not because of elevated level of demand but because of lower level of supply, monetary policy can hope to achieve precious little.

Time indeed it is to wake up and face the reality.

Kunal Kumar Kundu is the Head of Economic Research at Infosys BPO. The views expressed are his own

[1] Strengthen Agricultural Sector, Where is the surplus foodgrain? By Dr. Vinod Mehta

[2] Report of the working group on Agricultural marketing infrastructure and Policy required for internal and external trade for the XI Five Year Plan 2007-12

Also read:

The real dangers facing Indian economy