Rediff Business presents the TCS Smart Manager Case Contest # 31 along with The Smart Manager, India's first world class management magazine! So don your thinking caps, test your analytical skills once again and place yourself among industry experts. All you have to do is study the case and post your solution by clicking here, in 500 words or less.

The best solution will win a cash prize of Rs 25,000 with your opinion being featured along with the industry experts and one year complimentary subscription to The Smart Manager magazine!

Hurry! The last date to post your solution is November 21, 2007.

An unsteady balancing act

It was 10 o'clock in the night and the CEO of Ghosh Gilts and Securities, Shatrupa Bhattacharya, was still in her office in Kolkata. This was a normal routine for her, and she had just finished talking with Anuradha Raman, her HR head.

Anuradha was in her early thirties, married with two children. She has been working with Shatrupa for the last six years, since GGS' inception in fact. Shatrupa wanted Anuradha to go to Delhi the next day. GGS had recently opened an office there, and employee problems had emerged because of the organization being new to the Delhi market. Anuradha refused to go because her elder son was to be admitted to school the next day. Anuradha told Shatrupa that she found it difficult to do justice to her role of mother because of constant travel and late working. As a result she did not have enough time to spend with her children.

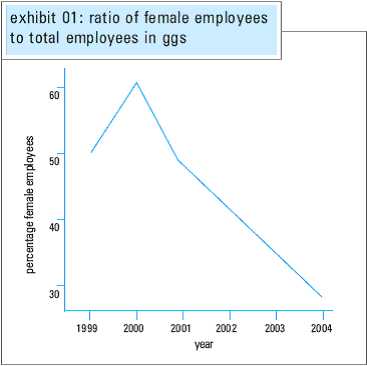

This was not a one-off problem. When Shatrupa started GGS, she sought equal opportunity for men and women, and recruited accordingly. She expected her female employees to be as mobile as their male counterparts but they were reluctant to travel or work late. Two nights back, Shatrupa had asked a male employee to fly to Bangalore at one hour notice and he had agreed instantly. Worried that female immobility could become an obstacle for GGS' growth, Shatrupa had begun reducing the proportion of females in her workforce (Exhibit 01).

This was not a one-off problem. When Shatrupa started GGS, she sought equal opportunity for men and women, and recruited accordingly. She expected her female employees to be as mobile as their male counterparts but they were reluctant to travel or work late. Two nights back, Shatrupa had asked a male employee to fly to Bangalore at one hour notice and he had agreed instantly. Worried that female immobility could become an obstacle for GGS' growth, Shatrupa had begun reducing the proportion of females in her workforce (Exhibit 01).

As she sat alone in her tenth floor office in Kolkata, Shatrupa struggled to understand how to handle this cognitive dissonance between business and personal goals. Why could not these women work as hard and as independently as she did, she asked herself frustratedly and nostalgically. She had faced tremendous challenges, including biases from men, in order to create her organization.

When Shatrupa started out in 1997, GGS' activities were limited to selling secondary debt instruments, primarily government securities. Slowly but steadily, she expanded by including other services like issue management, distribution of mutual funds, distribution of insurance, and the private placement of bonds and equities. Not only did Shatrupa expand her product range but she also expanded geographically to seven other cities. The firm's rapid growth inspired other women.

Shatrupa was born in a small town in Dibrugarh district in Assam into a family of Bangladeshi immigrants, who arrived there after the partition of India and Pakistan. She was the third child. According to a childhood friend, "She was very ambitious right from her childhood and was a brilliant student. She was slightly different from others and showed good leadership skills during her school days." Shatrupa however felt that she was a normal child but one who was good at taking initiatives.

Her father was a key influence on Shatrupa. A self made person who established himself after the family was reduced to penury during the post-partition days, the way he treated Shatrupa left a big impression on her life. He made her feel special, which induced confidence in Shatrupa and also helped her to think big.

After schooling in Assam, her parents sent her to Kolkata for higher studies, where she stayed with her uncle. Coming from a small town to a metropolitan city was a cultural shock for Shatrupa. The way youngsters talked, what they talked, how and what they wore, what they ate, the music they listened to: everything was different. She resolved to put in extra effort not to lag behind the other boys and girls of her class.

As she recalled, "Small town kids, when they land up in big cities, either they get lost in the crowd or they make it big. I had decided not to get lost

a friend of mine, who is also a director of GGS, told me that the fact that you are from a small town is the reason that you are successful. If you had been from the city you would not have made it. I think, in a way, he was right."

After completing her college, Shatrupa married to an engineer, who also went on to become entrepreneur - but after Shatrupa. Soon she gave birth to a daughter. After some time she felt she did not want to be a mere housewife and started looking for job. Her first job was as a public relations officer in a small company manufacturing paints and dyes. After some time, she joined a stockbroker as an assistant manager.

Before joining the broker, she hardly had any idea about the trading of stocks, how markets operate, how a settlement is made, how a primary issue is managed and so on. She learnt it all at her first job as well as knowledge about with her boss, with whom she had a good relationship, giving significant help. Soon she was reasonably well versed in broking, and both the fixed income and equity markets.

Three years later, she was in charge of a division but the firm could not function well and was closed subsequently. Shatrupa again had to find job, which was not difficult to come by. Her new job was in the merchant banking division of a well known PSU (public sector undertaking) with seven employees, including Shatrupa. She was entrusted with primary market operations.

In her pervious job, Shatrupa had developed a strong network of sub-brokers and had good relationships with most of them. This network helped Shatrupa in being effective in her new job. She did equally well when the focus of the division shifted slowly but steadily from merchant banking to fixed deposits. Within one year, she and her associates were able to take the fixed deposits operations from Rs10mn to Rs30mn. The number of employees in the division grew from seven to forty and Shatrupa earned two promotions in a year.

These promotions opened a Pandora's Box of problems for Shatrupa. There were many employees in the organization who thought that Shatrupa got business through underhand means. She was accused of association with a director of the company though the director always treated her like his daughter. These accusation pained Shatrupa. She decided to leave the company and joined the retail banking division of another company as its head. Again, the attitude of males was deplorable in the new organization. After an ugly incident in her office, she decided to be her own boss.

Shatrupa had always dreamt of working for herself rather than under someone. "But I did not tell anyone in my organization about this decision," she recalled. "I was afraid that they would want me to be back. I also did not tell my husband the first day but when he asked me the reason for not going to the office then I told him that I would not go to office anyone. I also told him that I wanted to start something of my own .He supported me and told me that he was with me."

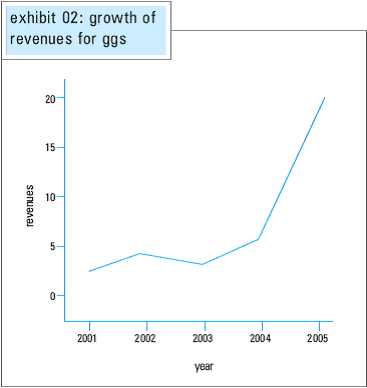

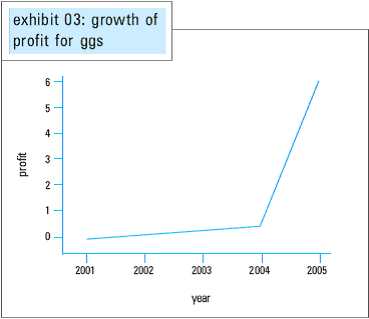

She had quit. She was free. But what should she do? After much thought, given her experience and expertise, she decided do something in the fixed income market and the broking of debt instruments. Debt markets were doing well during that phase (exhibit 02) while equities were not (see exhibit 03). The equity game was extremely competitive with many players in the market including several giants. Nor did she have competent people to handle the equity research.

When Shatrupa started a lot of people thought that it was just youthful exuberance and everybody expected her to leave this craze of hers after the initial enthusiasm was over and the realities of business dawned upon her. When the license issue was sorted the issue of office space cropped up. She again did not have money to buy office space and furniture. She decided to operate from corner of the broker's (Ghosh) office in Park Street. However, this did not solve the problem. Having a license and office space was one thing and ability to get customers was another. This was the biggest challenge to Shatrupa when she started the organization. No client wanted to risk his money with a novice especially when big names were already there in the market.

She used to work in the market for the whole day, scouting for customers, door to door. The task was further complicated by the fact that debt (gilt) funds were traded in large number as it was not profitable to trade in small numbers. Reserve Bank of India had put the lower limit of 1,000 securities for secondary market operations. The average number of securities traded, per deal, however was large, in the range of five million securities. Because of this reason, the debt market was not really accessible to individual small investors and most of the trade was conducted by small or big institutional investors.

She felt frustrated. At this juncture, one of her friends helped her in clinching the first deal from an educational institution. The deal was worth Rs0.5mn of investment in debt instruments. Soon, the next deal from a government organization followed. She met people and followed up almost endlessly, and built trust and good relationship. She provided her customers with average returns only.

But what was special about her was the commitment and prompt delivery. She educated them in terms of possible returns; if someone else had promised customers with above average returns she made them realize that they were being fooled. This policy initially was not rewarding. However over a period of time when the customers compared her returns and services with that of the competitors, they came back to GGS.

Competing with the sharks

During the course of her interaction with different customers, Shatrupa soon realized that big customers were not going to give her any business. Hence she started to focus on small customers such as schools, NGOs (non-governmental organizations), charitable trusts, religious organizations, small businesses, and other organizations in rural areas. Not only did the bigger players neglect this segment, but these customers were also apprehensive of dealing with the bigger players as they lacked confidence and trust in big players. As a director of a charitable trust snorted, "They think we are foolish and illiterate."

GGS started to grow slowly but steadily. It took the company three years to break even. However, Shatrupa was not interested in being called just a broker, who operated in secondary debt market operations. She wanted to grow and be recognized as a person operating in the financial services industry. So the company expanded its product portfolio and started offering services such as provident funds, GOI bonds, PSU bonds, mutual funds, insurance and fixed deposits.

In 2000, the government allowed provident funds to invest in gilt funds. This provided an excellent growth opportunity for GGS. Firstly, Shatrupa and her organization had a good knowledge about the gilt market. Secondly, the edge that major competitors had over GGS could be blunted by the fact that, in some respects, everyone had to start afresh and were on equal footing.

As the organization grew Shatrupa realized that she needed people with operational and technical competence in the debt and mutual funds industry. Though she was good at client handling, selling and marketing, she needed someone who had an in-depth knowledge of financial instruments and market. At this juncture Satyajit Sen, a former colleague who had more than one and half decades of experience in the debt market, joined GGS. He looked after and managed accounting and planning. Soon the organization's financial and operational health started to improve. Shatrupa decided that GGS needed to have its own independent office and moved into a spacious office on the tenth floor of a high rise on one of Kolkata's busiest streets, Shakespeare Sarani.

In 2001, GGS entered the primary market. These operations were personally handled by Shatrupa. In 2002, the company earned profits for the first time and the firm continued focusing on smaller organizations in small towns and the rural areas of West Bengal untapped by the bigger players. This segment soon started to give GGS substantial revenues. But dealing with this segment was not easy. GGS and its team had to pursue many clients for almost two to three years before they could get the business.

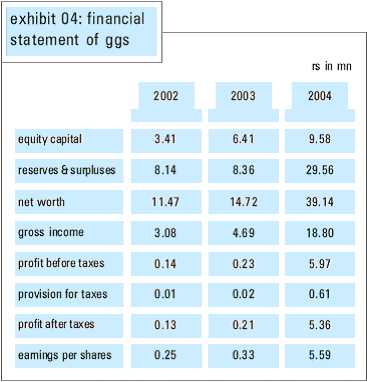

By 2002, the firm's total income was Rs3mn. It rose to Rs4.7mn by 2003. The profit before taxes were Rs64,000 in 2002 and Rs139,000 in 2003. The period after 2003 showed rapid growth in terms of both revenue and profits (see exhibits 02, 03 and 04). Sales rose to Rs15bn in 2005.

People power

However, contacts and opportunity were not enough. More resources were required, including good people. The challenge of finding people was compounded by the fact that GGS did not have the financial resources to pay attractive salaries. So Shatrupa started searching for talented but inexperienced people who were willing to work for the relatively low salaries she could afford. In addition, she wanted to have equal number of men and women in the firm as she wanted to give equal opportunities to women. However, female employees were difficult to find.

The broking business requires a high level of client handling skills and product knowledge. As the imparting of these skills was costly if she hired someone from outside. Shatrupa decided to take up the cudgel herself for the initial batch of two girls and two boys. Apart from providing the training inputs, she took a personal interest in checking their progress. Their competency encouraged her to dream big. Shatrupa was no longer interested in being called a mere broker who was operating in secondary debt market operations. She wanted to be called as person operating in financial services industry.

Keeping the faith

Even as the business grew healthily, there were many times when Shatrupa felt like giving up. Family members, friends and well-wishers often advised her to quit. This negative attitude really hurt her. Ironically, Shatrupa realised that as she became successful, a part of negative attitude of others towards her gradually declined and she started to get tremendous respect from all quarters.

"People could not digest the fact that a lady was successful in such a business. A lot of things happened in my life. I grew up through very difficult stages in my life. So many times I cried in my life but then I overcame some of the problems. I'm lot mature now and most of the things do not really affect me any more. I'm very strong now. Even otherwise, because I'm successful, people accept me easily. They cannot raise fingers against me because they know that I'm powerful enough to retaliate.

So the hostile attitude of others has also decreased. I'm established player and people talk good about me but hat was not the case when I started off or when I was working in different organization as an employee. Market values me. People ask my advice. Bankers ask me for help, other people ask me for help. I also have to add value to myself then only will I be able to lead so many people. Then only would I have internal conviction to convince others. If you are not right then you cannot expect others to listen to you."

Besides the personal problems, there were problems when employees whom she had personally trained, were poached by competitors. Shatrupa was heartbroken. "Most of employees who I trained left our organization after spending one or two years after they pick up some experience. It was as if my organization has become institution for training employees for other organizations."

They went to greener pastures the moment they got better opportunities. This was the flip side of training unemployed youngsters. Shatrupa knew that her organization was not big and this was one of the primary reasons that these employees left GGS. However, once Shatrupa grew big, some of her former employees wanted to come back to GGS. But now Shatrupa was selective. "Two or three people have joined back but I will not pick up all those who are interested in coming back. This indicates that our image as a major player is improving in the minds of investors, potential and in industry."

Shatrupa slowly reconciled herself to the fact this was part and parcel of organizational creation and growth. She could not change reality but certainly she could make efforts to reduce the pain.

Next step up

In 2000, the government allowed provident funds to invest in gilt funds. This was an excellent opportunity for Shatrupa for two reasons. In 2000, the government allowed provident funds to invest in GILT funds. This provided an excellent growth opportunity for GGS. Firstly, Shatrupa and her organization had a good knowledge about the GILT market. Secondly, the edge that major competitors had over GGS could be blunted by the fact that, in some respects, everyone had to start afresh and were on equal footing.

Shatrupa knew that she would require the operational and technical competence of a person in debt and mutual funds industry to handle the growing business. At this juncture Satyajit Sen a former colleague who had more than one and half decades of experience in the debt market joined GGS. He looked after and managed accounting and planning.

Soon the organization's financial and operational health started to improve. Shatrupa decided that GGS needed to have its own independent office and moved into a spacious office on the tenth floor of a high rise on one of Kolkata's busiest streets, Shakespeare Sarani.

It was a defining moment. "I brought this spacious office of my own [money]. I never told my husband. I just showed him the office. I do not like telling anybody it may be a good quality or bad quality [in me] I do not know but then that's the way I am If I tell other people in advance, the thing does not happen That is why I say that I do not work for money."

In 2001, GGS entered the primary market. These operations were personally handled by Shatrupa. In 2002, the company earned profits for the first time and the organization took a conscious decision to target rural banks and educational institutions in small towns of West Bengal. The big players did not target these customers for various reasons. They found the segment to be small, unsophisticated and expensive to service. Nonetheless, this segment soon started to give GGS substantial revenues. But dealing with this segment was not easy. GGS and its team had to pursue many clients for almost two to three years before they could get the business.

By 2002 the firm's income was Rs3mn, by 2003, Rs4.7mn by 2003. The profit before taxes were Rs64,000 in 2002 and Rs139,000 in 2003. The period after 2003 showed rapid growth in terms of both revenue and profits (see exhibits 02, 03 and 04). Revenues touched Rs15bn in 2005.

Gender benders

Shatrupa worked hard to ensure that GGS was known for quality and customer delight. Quality did not mean better returns for customers but reasonable returns. As 'better' returns were not possible in the sector GGS was operating in, Shatrupa chose to differentiate GGS on the basis of excellent service, trust and relationship. "I'm quite transparent in my deals with customers. I never over-promise the returns

I have even incurred losses to deliver the promised returns," she maintained.

Another art which Shatrupa considered important was client-handling and relationship-building. "I develop relationship with my client. This is evident from the fact that some of my clients visit me regularly. This is quite in contrast to industry norms where organizations have to go to clients," she said. Shatrupa claimed she was not in the business of financial services but of building trust based relationship with all the clients. Some of customers she had were developed over a long time through building trust and rapport.

Recounting her past, Shatrupa said, "My rapport with my clients has been such that I am looked upon as a personal consultant by them. I can proudly say that 75 to 80 per cent of my business has come from these relationships .People have a soft corner for their children. One of my client's son was studying in Kolkata staying away from his parents. I went to visit him many a times and made sure that he is comfortable. I also took him for dinner."

Shatrupa had interesting ways of building good relationship with customers. She always made sure that she never annoyed anyone. She had a philosophy of not saying 'no' to anyone unless it was unavoidable. Meeting people was not about socialising but about getting to know them well. Typically she would carefully prepare herself before meeting people, studying and analysing their interests, and tailoring the conversation accordingly. For example, though she did know much about spirituality, somehow she was able to talk about it with the head of a charitable trust who then invested Rs1.5bn through GGS.

Growing up

Financial and operational stability combined with an upward trend in sales naturally led to a desire for a bigger presence. The strategy was geographical expansion and not diversification. Given their knowledge of the PSU sector, the obvious choice of the city in which GGS would enter would be determined by its PSU population ie Delhi, the headquarters of many PSUs.

Expansion meant the setting up of new infrastructure and systems. To accomplish this task Shatrupa recruited some managers in Delhi but was also keen to send some of her older and experienced managers from Kolkata. But some of GGS' female employees were not willing to travel to Delhi. With expansion into Delhi, there was requirement for mobility of work force between Kolkata and Delhi.

Despite these early warning signs of future stress, Shatrupa continued scouting for office space in other cities. She had an emotional attachment to her state of birth along with some contacts in Assam so she decided that she would have a branch in Guwahati. As Shatrupa's organization was headquartered in Kolkata, it also decided to expand into other cities of Eastern India like Jamshedpur and Bhubaneshwar.

She chanced upon an opportunity to move into the Chennai market through a close friend there who was in the communication business. A year later, in 2005, Shatrupa decided to move to Bangalore because Bangalore had a significant PSU presence among all the cities in Southern India. Similarly, because she wanted to engage in the primary market activities, Shatrupa chose Mumbai and Ahmedabad. Mumbai was chosen as India's commercial capital, Ahmedabad because of its numerous big brokers.

As Shatrupa's organization expanded geographically, the different branches had to be coordinated. This required frequent travelling for Shatrupa and her managers creating a dilemma as GGS employed a significant number of women who were reluctant to travel. Male managers hardly had any problem with mobility. This was source of dissonance for Shatrupa.

She had two options. First, allow the women managers to be immobile. But then the business might suffer. But the women managers were also unwillingness to stay n office beyond office hours. Maternity, children and marriages further compounded the problems of managing women. Shatrupa had personally undergone all these stages in life and appreciated how difficult it is for women to balance all the pulls and pressures.

The second option was to ask all women who were unwilling to undertake geographical mobility to leave the organization. This would mean losing the ideological ground which was one of the important reasons for Shatrupa to start the organization.

Your question: What should Shatrupa and GGS do?

© 2025

© 2025