| « Back to article | Print this article |

Markets: 13 things to look forward to in 2013

Like all new years, 2013 brings with it a ray of hope, some wild dreams and a lot of reasonable expectations. N Sundaresha Subramanian & Samie Modak went around asking for some of the most-watched counters. Here are the Dalal Street's 13:

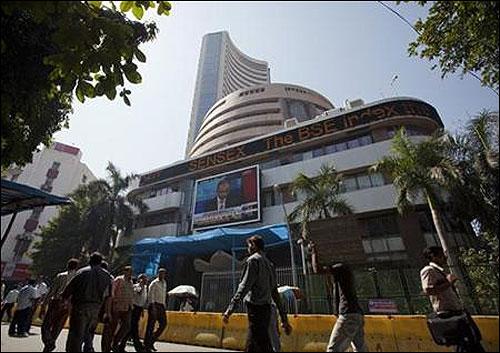

1. BSE listing:

Asia's oldest bourse is likely to come up with its much-awaited initial public offering.

A gang of fourteen i-bankers are already on the job. The lister will get listed. Many old time broker-shareholders will finally get an exit.

Click on NEXT for more...

Markets: 13 things to look forward to in 2013

2. Sensex @ 25,000:

Though no one has stuck their necks out on the number yet, the number does not look very far away.

The index gained over 26 per cent in 2012. Just an encore this year would get the benchmark there, though the Street would not mind a few thousand points more.

Click on NEXT for more...

Markets: 13 things to look forward to in 2013

3. New bank stocks:

Parliament has cleared the decks. The mint street will begin the process of granting the new banking licences. A number of listed players are in the fray. One or more of them could be multi-baggers.

Click on NEXT for more...

Markets: 13 things to look forward to in 2013

4. Mid-cap M&As:

The mid-cap space is buzzing in anticipation of deal activity.

As environmental clearances and land acquisitions for new projects become ever complicated and time-consuming, smaller companies with necessary clearances and facilities are likely to be picked up by deep-pocketed new entrants.

Click on NEXT for more...

Markets: 13 things to look forward to in 2013

5. 25% public float:

Come June, all private companies have to have at least 25 per cent of their shares held by public.

If Sebi ensures this, it will pave way for a deeper and more liquid market in 2013.

Click on NEXT for more...

Markets: 13 things to look forward to in 2013

6. Real divestment:

Due to various reasons including rigidity in pricing, endless tweaking of rules and poor reading of sentiment have made disinvestment a euphemism for bailout by state-owned institutions.

Street hopes the New Year will bring good quality shares at reasonable price where everyone sees value, not only LIC.

Click on NEXT for more...

Markets: 13 things to look forward to in 2013

7. Better corporate governance:

With the new companies law expected to come in place soon and several proxy advisory firms watching moves of the companies closely, quality of disclosures are likely to improve considerably.

Listed entities are increasingly realising the importance of good governance.

Click on NEXT for more...

Markets: 13 things to look forward to in 2013

8. TAX relief:

The recommendations of General Anti-avoidance Rules (GAAR) panel headed by Parthasarathi Shome had suggested exclusion of equity market transactions from capital gains tax.

The move could be a big boon for investors with a short-term focus.

On the other end, there is always the die-hard anti-STT lobby hoping against hope that the Chidambaram brain child is scrapped.

Click on NEXT for more...

Markets: 13 things to look forward to in 2013

9. End of the gold rally:

Stagnating gold prices will be godsend for the equities as an asset class. For the past couple of years, yellow metal had given a stiff fight.

Some resistance around Rs 30,000 (per 10 gram) levels could be just what the broker ordered. Realty prices showing weakness in some areas is also seen as a good omen.

Click on NEXT for more...

Markets: 13 things to look forward to in 2013

10. MCX-SX entry:

Though the newest stock exchange got the key regulatory clearances, it is yet to begin its much-hyped and awaited equity trading.

Like in other segments, the bourse floated by Jignesh Shah-led Financial Technologies group is expected to bring in competition and therefore better value for investors' money.

Click on NEXT for more...

Markets: 13 things to look forward to in 2013

11. Regime change at NSE:

After over a decade at the helm, Ravi Narain will step down soon. Chitra Ramakrishna, who will take over in April, will hit the ground running with competition trying to break fresh ground.

While NSE's dominance is unlikely to be threatened in 2013, how much ground it yields in the first year will be interesting to see.

Click on NEXT for more...

Markets: 13 things to look forward to in 2013

12. Sinha's climax:

Two years have rushed past for U K Sinha at the hot seat in Bandra-Kurla Complex. This will be the last full year for him as the Sebi chairman, before the government decides on his extension in February 2014.

That will in turn depend on his performance in key areas such as Safety net for IPOs, Direct plans for MFs and pending high profile cases.

Click on NEXT for more...

Markets: 13 things to look forward to in 2013

13. Politicians:

Some on the Street feel while 2012 was the year of central bankers, the new year is likely to belong to the policy makers.

The men in white are likely to make crucial calls, which are likely to have an economic and market cap in the run up to the 2014 elections, street will keep a close watch.

Even globally, political calls will make or break, like the fiscal cliff stand-off in the US showed.