| « Back to article | Print this article |

5 corporate honchos who will rule Indian business in 2012

It's not often that everyone wants to fast-forward the calendar to bypass a new year.

For, the pundits say the slowdown will intensify in 2012 and the mantra is stick to the basics, sit on cash, and generally do nothing.

So, it's not a surprise that everyone -- well, almost everyone -- in corporate India is waiting for 2013 when the good times will supposedly be back.

But, Mukesh Ambani is certainly not one of them, as 2012 will be the year when the Reliance Industries chairman will relive his telecom dreams.

Click NEXT to read further. . .

5 corporate honchos who will rule Indian business in 2012

Buying up Infotel Broadband, which bid the most in the broadband wireless access spectrum auctions and secured 20 MHz of spectrum in every one of India's 22 telecom circles, RIL now controls more spectrum than any of the established telecom players.

The initial plan for 4G, expected to be launched in April-June next year, is to offer plug-in USB modems, set-top boxes that combine TV channels, on-demand video and video conferencing, and a few tablet PCs, in 35 towns in the first year itself.

His trump card as usual will be pricing -- the whisper in the corridors is that RIL, true to its track record, will disrupt the data/broadband services market with just Rs 10/GB tariffs.

Click NEXT to read further. . .

5 corporate honchos who will rule Indian business in 2012

It did the same with voice in 2003 -- a strategy that helped Reliance Communications (now under Mukesh Ambani's brother) to quickly build operating scale and volume of minutes.

Ambani's problem this time is that regulation does not allow domestic calls from a phone to another phone using voice over Internet Protocol, though calls can be made from one computer to another.

Hence, the growing buzz over his close alliance with another telecom company -- probably, his brother's.

If the 54-year-old Ambani is going to be super-busy in 2012, there are at least four others who will not let the year pass by without much ado.

Click NEXT to read further. . .

5 corporate honchos who will rule Indian business in 2012

Take Pawan Munjal, managing director of Hero MotoCorp.

The year 2012 will be the year when the elder son of Brijmohan Lall Munjal will have a real taste of life after Honda.

The buzz is that come March, Honda will launch a model that will target Hero where it could hurt the most: the 100-cc segment where Munjal has two best-sellers, the Splendor and Passion.

Munjals' biggest challenge in the new year will be to get the technology in place as early as possible.

Though he is already in talks with a group of Japanese companies, the task is a formidable one, as buying technology off the shelf is the easier part.

Click NEXT to read further. . .

5 corporate honchos who will rule Indian business in 2012

The more difficult job is to adapt the technology to Indian conditions.

What Hero will also be working on next year is beefing up its distribution in metros and big cities -- from 4,500 touch points now to 5,000 by March 2012.

That's a presence very few companies can match.

The New Year will see Hero going abroad with a bang.

It will be a demanding job, as Munjal will have to fight a bruising price war with the ubiquitious Chinese brands as well as India's own Bajaj, and of course, Honda, in markets such as Africa, Latin America, South East Asia, etc.

Click NEXT to read further. . .

5 corporate honchos who will rule Indian business in 2012

There will be yet another automobile czar who will have little time to reflect on the slowdown in the new year, charged up as he is after a spectacular show in 2011, one of the worst years in MoTown.

Consider this: M&M's total vehicle sales during the first half of FY12 grew over 26 per cent compared to just 2.8 per cent for its nearest rival, Tata Motors. Its market share in the utility vehicles segment has gone up to 52 per cent.

The challenge before Anand Mahindra, vice-chairman and managing director of Mahindra and Mahindra, now is to achieve scale.

Though it is the world's largest tractor maker and the 13th largest utility vehicle maker (after the acquisition of Ssangyong Motor), it needs higher scale to fulfil its ambition of becoming competitive globally.

Click NEXT to read further. . .

5 corporate honchos who will rule Indian business in 2012

The entry of Chinese players is another concern it wants to address in 2012.

In the tractor business also, multinational players have seen their market share rise significantly, and that's something M&M wants to plug quickly.

That explains why M&M is giving final shape to its plan of entering the over 100-HP tractor segment where it has zero presence now.

The New Year will surely see Mahindra step on the gas on Ssangyong's financial turnaround and bring in greater synergies between the Indian and foreign operations of the company.

That's quite some work, which will keep the 55-year-old Mahindra busy throughout the year.

Click NEXT to read further. . .

5 corporate honchos who will rule Indian business in 2012

A banker who will give company to Mahindra in his 'busy-ness' is Chanda Kochhar.

For somebody who started her stint as MD & CEO of India's largest private sector bank by speaking a new idiom of 'no growth', Kochhar is now talking about boosting ICICI Bank into the ranks of the world's 20 top banks, as measured by market value.

At the moment, it isn't even in the top 50.

That may be just a dream for the moment, but shows how the 51-year-old CEO has tasted blood after a couple of years of deliberate growth stagnation.

Two years and many battles later, Kochhar has enough to prove her point. Apart from Casa, unsecured loans as a percentage of total loans have come down from around 11 per cent in mid-2008 to less than three per cent.

Click NEXT to read further. . .

5 corporate honchos who will rule Indian business in 2012

The net non-performing assets ratio has come down from around two per cent to 0.9 per cent.

Provisioning costs have come down from 2.2 per cent annually to 80 basis points every year.

The number of branches has grown from 1,300 to 2,500 and still the bank's cost-to-asset ratio is about 1.7 per cent.

Kochhar has already said the bank would get to a 15 per cent return on asset next year and is carving out a strategy to build a portfolio that is profitable over a long term.

Her biggest task, of course, is to achieve growth in a year which many say would be worse than in 2008.

Everyone would be watching the lady, no doubt.

Click NEXT to read further. . .

5 corporate honchos who will rule Indian business in 2012

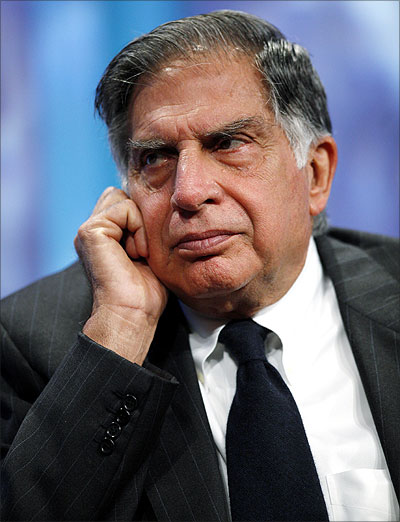

The last one in this list of CEOs who will leave an impact on 2012 is a man who will officially take over his new role only in December, that is, when his apprenticeship under Tata Sons Chairman Ratan Tata will end.

If he still figures in this list of CEOs who will make a difference in the new year, the reason is simple: as the vice-chairman of Tata Sons and the winner of the most coveted crown in corporate India, every move of Cyrus Pallonji Mistry will be under constant public glare.

A person who has shown a preference for the shadows, Mistry will now have to put up with the arclights.

He is somebody whose Wikipedia profile got created only after the succession announcement of India's largest conglomerate.

Click NEXT to read further. . .

5 corporate honchos who will rule Indian business in 2012

But, we all now know that he is a foodie, has a fascination for cars, especially SUVs, is a devoted family man, owns houses in London and Pune, is an avid golfer and an equally avid reader.

But, what everyone is waiting to see are some examples of his business acumen that will prove he has what it takes to step into the rather large shoes of his predecessor.

Observers are already seeing the Mistry 'stamp' (he has been on the Tata Sons board since 2005) in the induction of young guns in several Tata Group companies over the past couple of years.

Click NEXT to read further. . .

5 corporate honchos who will rule Indian business in 2012

There are many other lessons Mistry has to learn quickly.

For instance, the mantra how Ratan Tata managed a 22 per cent-plus compounded annual growth rate between FY1992 and FY2011, how he managed the dramatic pace of acquisitions, etc.

Mistry's main challenge, therefore, will be to keep the momentum going on many fronts, including innovation.

Plus, there is the job of streamlining the group comprised of 98-odd operating companies, but heavily dependent on just the top three.

The year 2012 will thus be extremely busy for both the guru and the disciple.