| « Back to article | Print this article |

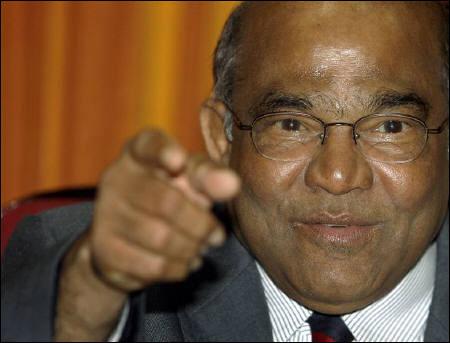

Y V Reddy to head 14th Finance Commission

The government on Wednesday constituted the 14th Finance Commission under former Reserve Bank of India ( RBI) governor Yaga Venugopal Reddy. Besides recommending the share of states and the Centre in divisible pool of tax receipts, Reddy will primarily review finances of these governments keeping in mind the fiscal consolidation road map that was laid out by his predecessor Vijay Kelkar.

The commission, set up every five years, will also have a host of new terms of reference compared to the usual ones given to the constitutional body.

These include suggestions on making the public sector competitive and market-oriented, suggest ways to absorb the impact of the proposed goods and services tax ( GST) on the finances of the Centre and states, and insulating the pricing of public utility services from policy fluctuations, Finance Minister P Chidambaram told reporters in New Delhi.

The commission has been asked to submit its report by October 31, 2014, covering a period of five years from April 1, 2015, said Chidambaram.

The commission comprises former finance secretary Sushma Nath, public finance expert M Govinda Rao and former acting chairman of the National Statistical Commission Sudipto Mundle as members. Planning Commission member Abhijit Sen is also part of the Commission as a part time member, according to an official statement.

Among the new areas of recommendations on public sector units ( PSUs), the commission will suggest how to list these units on the bourses and will also give its prescriptions on the disinvestment process. The commission has also been asked to recommend how non-priority PSUs be relinquished.

According to Chidambaram, the commission will recommend measures for segregating the pricing of public utility services such as drinking water, irrigation, power and public transport from policy fluctuations through statutory provisions.

It will also suggest measures for maintaining a stable and sustainable fiscal environment consistent with equitable growth including suggestions to amend the Fiscal Responsibility Budget Management Act.

At a time when the Centre is struggling to keep pace with its Budget targets for tax mobilisation, the commission will give its inputs to the Centre as well as the states on how to raise the tax-GDP ratio from 2015-16.

"The taxation efforts of the Central government and each state government, and the potential for additional resource mobilisation to improve the tax-GDP ratio in the case of the Union and tax-GDP ratio in the case of the states" would also be part of the recommendations of the finance commission, said the official statement.