| « Back to article | Print this article |

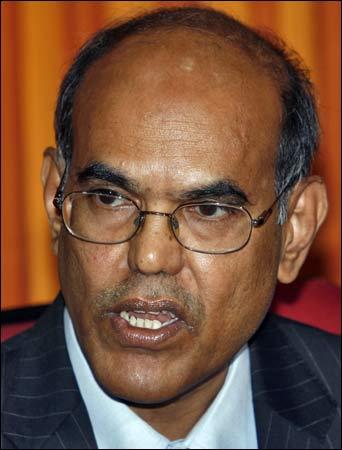

Will Subbarao check or boost market rally?

Whether the market continues to add to the spectacular gains since the New Year would largely depend upon the Reserve Bank of India's third-quarter monetary policy review and the Federal Open Market Committee meet in the US, both slated for the coming week.

The domestic market has posted its third straight weekly gain, supported by positive global cues, strong foreign fund inflows and good numbers from some companies.

During the week, the benchmark Sensex added 3.6 per cent to 16,739.01, while the Nifty closed above the 5,000 mark.

For Rediff Realtime News on Subbarao, click here!

Click NEXT to read further. . .

Will Subbarao check or boost market rally?

Although not many are expecting a rate cut from the credit policy to be announced on Tuesday, a lot of bets are riding on the central bank signalling a change in its stance in favour of growth.

Hence, the policy announcement and the accompanying guidance will be closely watched by market participants, some expecting a cut in the stipulated Cash Reserve Ratio.

The Sensex has surged 8.3 per cent, while the Nifty has gained 9.2 per cent so far in January, the best start to the year in more than a decade.

Click NEXT to read further. . .

Will Subbarao check or boost market rally?

India is the second-best performing market so far in calendar 2012, after Brazil, thanks to the $1.3 billion poured by foreign institutional investors in Indian stocks.

According to a technical analyst at BNK Securities, the trend continues to remain positive with key supports to the Nifty at 4,930 and 4,830, with key resistances at 5,100 and 5,260.

The third quarter earnings season continues with important index components such as Larsen & Toubro, Maruti Suzuki, Sterlite and Idea Cellular announcing their earnings on Monday.

Click NEXT to read further. . .

Will Subbarao check or boost market rally?

The stock of index heavyweight Reliance Industries was under pressure on Monday, despite announcing a share buyback, after it posted its first decline in quarterly net profit in more than two years.

The future and options expiry on Wednesday (Thursday is a market holiday) will give an indication of the mood among traders.

"There is still some room for further gains if global markets are supportive.

"However, the upside for Nifty is capped at 5,300, till the fog of uncertainty over policy paralysis in India and the euro zone debt crisis lifts," said Ajay Bodke, head–investment strategy and advisory, Prabhudas Lilladher.

Click NEXT to read further. . .

Will Subbarao check or boost market rally?

In the US, the two-day FOMC meeting starting on Tuesday will be crucial for the market.

Although the Federal Reserve is not expected to announce any policy changes, markets are interested in whether it signals another round of quantitative easing.

In Europe, a finance minister's summit tomorrow will indicate progress towards the 'fiscal compact' treaty.

Under this, member-nations will have to incorporate a rule that a budget deficit will not be higher than 0.5 per cent of their gross domestic product.

"After strong gains so far this year, shares are getting a bit overbought and vulnerable to a correction.

"Europe is likely to remain a source of volatility," wrote Shane Oliver, head of investment strategy at AMP Capital.