Malini Bhupta in Mumbai

Why the US downgrade is a boon for India

Image: School girls perform during celebrations to mark India's Independence Day.Photographs: Reuters.

During the Lehman collapse, "vulnerability" rankings became quite the fad, which simply added up the current account deficits and forex reserves to short-term debt ratios. BoAML believes the RBI should be able to withstand any possible contagion following S&P's US downgrade.

However, S&P has warned that even as there is no immediate impact on the Asia-Pacific sovereign ratings, the potential longer-term consequences of a weaker financing environment, slower growth and higher risk aversion are negative factors.

Why the US downgrade is a boon for India

Image: kite maker stands besides a kite made of notes of the Indian currencyPhotographs: B Mathur/Reuters.

Economists believe things could get tough only if oil crosses $135/bbl, which seems unlikely in a slowing growth environment.

G Chokkalingam, ED & CIO of Centrum Wealth Management, says the expected depreciation of the dollar could reduce India's import bill (for oil and fertilizers), which, in turn, can strengthen India's fiscal condition by reducing the subsidy bill significantly.Moreover, a sell-off will tighten the liquidity in the domestic system, easing the job of the regulator in contracting liquidity for taming inflation.

The next big question is if India can fund its high current account deficit if risk aversion dries up capital flows?

Why the US downgrade is a boon for India

Image: Pedestrians walk on the street in front of the New York Stock Exchange.Photographs: Reuters.

Economists believe India can fund it as risk aversion will also lead to lower oil prices, which will have a positive impact on the current account.

For every $10/bbl rise or fall in oil prices, the impact on the current account deficit is of $8 billion. Clearly, falling oil prices are a bigger boon than the threat of capital outflows.

For now, it's widely believed there won't be any massive sell-off in equities, as was the case in 2008-09.

The US, Europe and Japan have their own problems and are expected to post very low GDP growth or fall into recession in the near future, claim experts. Moreover, a sell-off will further pull down India's valuation to 12x FY13 EPS, making it a rather attractive destination.

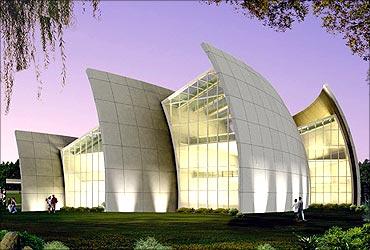

No 2008 this time, India Inc is prepared

Image: Patni Knowledge Park.Heads of companies across sectors are sanguine that unlike 2008, they are "better prepared" to withstand the impact of the troubled US and European markets.

That includes those from the information technology, pharmaceutical and infrastructure industries, more likely to be singed due to their higher exposure to these markets.

Capital markets across the world reacted negatively on Monday, following Friday's downgrade of the US sovereign rating.

Analysts say these developments have heightened the risk perception and uncertainties in a global economy. Managements of Indian IT companies are monitoring, since the US and Europe account for 80-85 per cent of the revenue of most companies.

Why the US downgrade is a boon for India

Image: TCS office.The MD of Infosys, S Gopalakrishan, is also in a positive state of mind, despite "fears of another recession in the US and a debt crisis in Europe".

"We were able to react very quickly in the past (2008) when the recession happened. These responses are still fresh in our memory and I believe the industry may be able to withstand another global downturn," he asserted.

Why the US downgrade is a boon for India

Image: Wipro, Noida.Software body Nasscom stated "although the global economic environment is a cause for concern, it is not likely to impact the IT industry in the near-term future".

'WAIT & WATCH'

Companies from other sectors also displayed a wait and watch attitude. Consider the case of the Aditya Birla Group. About 60 per cent of its revenues flow from operations abroad.

Why the US downgrade is a boon for India

Image: Reuters.Why the US downgrade is a boon for India

Image: Reuters."I think the situation is volatile and there no point in speculating the impact. But since we are not going to raise any money, the impact will be to the extent which interest rates will move up or down and the effect of that. Also, how currencies are going to move. A substantial part of our debt is foreign currency debt and most of it is hedged. The effect, if at all, is likely to be marginal," said Y M Deosthalee, director & CFO, L&T.

Pharmaceutical companies expressed similar sentiments. Glenn Saldanha, MD & CEO of Glenmark Pharmaceuticals, said, "In the long term, the economy will remain with a robust growth, despite such short-term pressure."

Why the US downgrade is a boon for India

Image: Reuters.Iron ore producer and exporter Sesa Goa's managing director, P K Mukherjee, also felt the country "is better equipped to handle the current economic crisis".

He, however, stressed that "the government should bring the reforms back on track".

Industry body Assocham fears the downgrading of US sovereign debt rating "will have cascading effect on markets across the world and could slow foreign direct investments into India".

Why the US downgrade is a boon for India

Image: ITPL, Bengaluru.India is the 14th largest creditor to the United States, with an overall exposure estimated at $41 billion (Rs 184,500 crore).

However, the industry body added, "India remains a potentially good growth story, with a strong domestic market, driven by 1.2 billion people."

Meanwhile, rating agency Crisil cautioned that the primary impact of the US downgrade would be on the availability and cost of funding, both domestic and international.

According to Roopa Kudva, MD & CEO, "the manner in which financial markets and governments react over the next few weeks will determine how the prevailing fragilities in the global sovereign and financial sectors play out".

Indian economy is strong: Ficci

Image: A Durga Puja pandal built in the shape of Eiffel Tower of Paris, in Ranchi.Photographs: Reuters.

However, they saw situation in the US leading to market volatilities in the short term and, at the same time, impacting India's exports through slackening demand.

The Federation of Indian Chambers of Commerce and Industry said while the short-term impact would be more obvious in terms of market uncertainties, the long-term effect might be more prolonged, but less obvious.

Indian economy is strong: Ficci

Image: Central Bank of India.Photographs: Reuters.

"On the downside, an uncertain global environment could depress India's exposure to global markets in terms of exports of goods and services, that make more than a quarter of India's GDP," a statement from the federation said.

The Confederation of Indian Industry though agreed the recent crisis was a matter of concern, it felt India was likely to have a stronger rupee against the dollar following the downgrading of the US economy.

Indian economy is strong: Ficci

Image: Reuters."If monetary measures (Q3) are resorted to by the US, then we shall see inflow of funds to India, which has its positive and negative impact," said CII.

The decline in growth rate in India as compared with its trend growth was not as severe as in other advanced and emerging economies in 2008-09, when the global financial crisis deepened.

"So, going forward, India is expected to be able to maintain a comfortable growth trajectory of 7.5-8 per cent supported by strong domestic demand," said Salil Bhandari, president, PHD Chamber of Commerce and Industry.

Indian economy is strong: Ficci

Image: Reuters."The information technology industry will feel the heat, as uncertainty and negative sentiments blow across global businesses," said D S Rawat, secretary general of the Associated Chambers of Commerce and Industry of India, or Assocham.

Assocham's GDP growth rate projections continue to hover around eight per cent during 2011-12, with a variation of half a percentage point.

The Reserve Bank of India would need to maintain sufficient rupee and foreign currency liquidity to prevent any excessive volatility in local markets, he added.

Notably, India's foreign currency long-term sovereign credit rating by S&P remained unchanged at "BBB ", which is the lowest rating in the investment grade.

article