Photographs: Babu Babu/Reuters

The rupee depreciation is likely to hurt the inflation fight and restrict the Reserve Bank from cutting its policy rates at the forthcoming monetary policy review by month end, says ratings agency Crisil.

"If the rupee averages at 58 to the dollar this fiscal, average headline inflation could rise to 6 per cent compared to our baseline call of 5.3 per cent.

“This leaves little room for monetary easing despite the sharp slowdown in gross domestic product growth," Crisil said in a report on Thursday.

. . .

Why RBI will be forced to hold rates on July 30

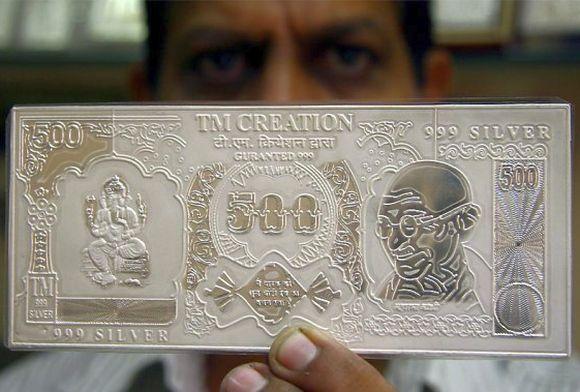

Image: A jeweller displays a silver plate in the form of a rupee note.Photographs: Ajay Verma/Reuters

The central bank would cut rates by a maximum of 0.50 per cent in the remainder of the fiscal, it added.

The Reserve Bank will announce the first quarter monetary policy on July 30.

Headline inflation has declined for three consecutive months till May, when it came to 4.7 per cent from 7.3 per cent in February.

The rupee has depreciated by over 12 per cent since the beginning of the fiscal.

It has slid heavily since May 20, ever since an announcement was made by the US Federal Reserve

that it might pull back its liquidity-infusing bond repurchases as the domestic employment situation and the economy improved.

. . .

Why RBI will be forced to hold rates on July 30

Image: A worker counts Indian currency at a money changer.Photographs: Rupak De Chowdhuri/Reuters

The rupee touched a lifetime low of Rs 61.21 to a dollar earlier on Wednesday, forcing the central bank and capital markets regulator Sebi to take unconventional measures to arrest the slide.

Courtesy the measures from Reserve Bank of India and Securities and Exchange Board of India, the rupee has recovered in the last two days.

Crisil said the rupee fall gets passed on in the prices of petrol, fuelling inflation while for diesel, whose prices are partially still controlled, the under-recoveries will shoot up.

article