| « Back to article | Print this article |

Why inflation will remain high in India

Changing aspirations and strong rural demand could explain why core inflation may not decline fast enough, says Soumya Kanti Ghosh.

Recently, the Reserve Bank of India governor exuded confidence that the Indian economy will do fairly better in the current fiscal.

While it is difficult to envisage a significant turnaround, we believe interpreting the recent inflation uptick may be the key to such optimism. We also think that inflation (both wholesale and retail) will continue to show an uptrend, at least, in the current quarter.

The idea of inflation inching up is also important for policy prescription, with the focus possibly shifting to using more of the consumer price index (CPI) as a measure of inflation guidance, and more so of using core CPI as a nominal anchor (the idea of core CPI as guidance may also be noted from the fact it is less volatile than core wholesale price index [WPI]).

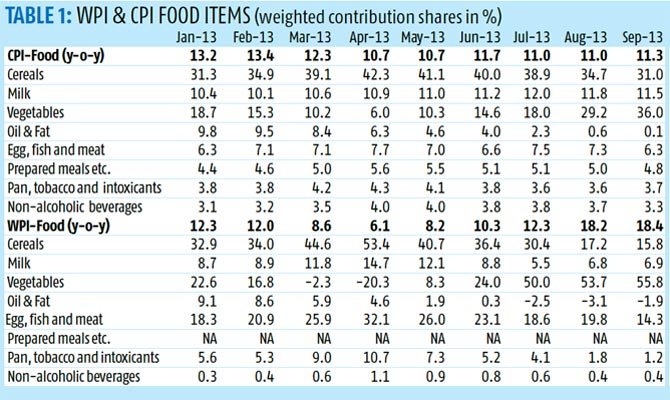

First, why our belief that inflation, particularly retail, will move up? In the last four months, there has been a significant divergence between the WPI and CPI food component in the inverse direction (WPI-food component higher than CPI-food), with the WPI-food outstripping the CPI counterpart by more than 700 basis points.

Click NEXT to read more...

Why inflation will remain high in India

If we look at Table 1, while CPI-food inflation has remained range bound (10 to 11 per cent) since April, WPI-food inflation exhibits considerable volatility (6 to 18 per cent).

The noise in WPI data may be explained by significant variations in items such as vegetables, cereals and so-called protein items over the time period under consideration.

Interestingly, while vegetables and protein items seem to have pulled up WPI food more than CPI food, and still being at elevated levels, we believe that CPI food items will adjust in the coming weeks, and hence may push the CPI up.

This, however, presupposes that core CPI may also rise, or remain sticky. Our contention is that such a trend is also an eventuality.

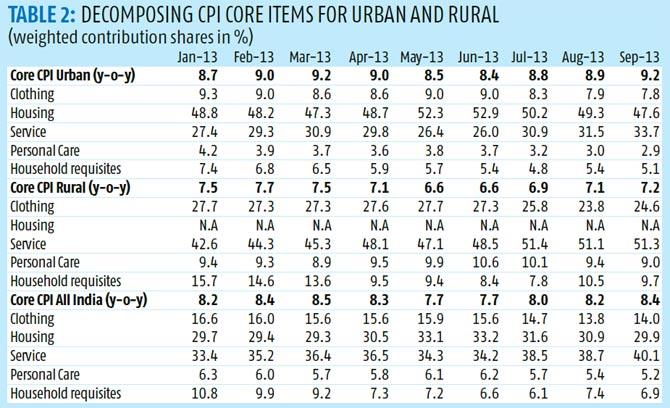

To understand core CPI, we analysed the components of core CPI for rural and urban areas (after stripping out fuel and food) that are still at elevated levels. Clothing and bedding continue to drive core rural CPI, with a marginal increase in weighted contribution from 23.8 per cent in August '13 to only 24.6 per cent in September '13.

Click NEXT to read more...

Why inflation will remain high in India

The service components of core CPI (medical care, education, recreation, transport and communication) in both rural and urban areas continue to show an uptick in weighted contribution.

As far as the housing sector in urban services is concerned, it is refusing to budge since January '13. The only component where there has been a perceptible decline over the same time period is household requisites, and to some extent personal care.

We believe, there could be an uptick in clothing and footwear in coming months, as the impact of higher input costs is factored in.

The trends in the housing index in the urban CPI requires more research to understand some specific trends.

For example, notwithstanding the significant increase in the housing index after July 2009, it is not clear why the sub-index was subdued and growing at only 3 to 4 per cent prior to the Lehman crisis, when the property market was buoyant and real estate prices were significantly higher.

Click NEXT to read more...

Why inflation will remain high in India

Additionally, housing prices had declined after the crisis, but data show that there was a big jump in 2009 that continued till 2010 and only moderated thereafter.

We are convinced that the larger contribution of clothing and other components in rural areas reflects the changing aspirations of India's young population and it may be difficult to break it down significantly from current levels.

Alternatively, such consumer spending is non-discretionary and mostly non-leveraged.

A similar argument holds true for recreation and amusement. Regarding the service component in the basket, most of these items (medical, education etc) are necessary and it may be difficult to envisage them trending downwards.

Click NEXT to read more...

Why inflation will remain high in India

Alternatively, in segments such as health care and education there are significant supply bottlenecks. Thus, it may be difficult to conjecture the core CPI net of items of necessary consumption declining significantly from current levels.

So, what's the linkage between inflation numbers and optimism? India's rural population is now more fashionable and is willing to sacrifice consumption of consumer durables/non-durables (as reflected in the declining share of household requisites) to maintain such a lifestyle.

If this is true, then obviously, there is a definite reason to celebrate with strong agricultural growth propelling rural demand this fiscal.

However, the bad news is that such behaviour may also explain in part why India's core inflation is not declining fast enough and may not do so, however hard we may try.

The author is chief economic advisor, State Bank of India. These views are personal.