Photographs: Reuters Arijit Barman in Mumbai

Mahindra & Mahindra's chairman-designate, Anand Mahindra, refuses to beat around the bush.

Explaining corporate India's rush for strategic alliances in the media space, he says, "You just can't ignore media in a growing economy with rising discretionary spending."

But, for all his plain-speak, Mahindra prefers a nuanced play.

"The definition of media is constantly evolving.

"The road to profitability will come from clearly segmenting the industry and in finding a niche.

"Our company, Mumbai Mantra, is looking at opportunities to create niche content and also at infrastructure that will be like an intersection between media and lifestyle," he adds.

. . .

Why India Inc is in rush for deals in media space

Photographs: Reuters

Many others, however, have a wider generic interest.

Sanjiv Goenka, chairman, RP-Sanjiv Goenka Group, already owns Open magazine but says he would continue to look at media aggressively.

He says he is looking at both greenfield ventures and also opportunities where he can come in as a strategic investor.

Goenka would not comment, but sources confirmed he was equally interested in Living Media India (popularly, the India Today group) but was eventually outbid.

The man who outbid him was Kumar Mangalam Birla, chairman, Aditya Birla Group.

The power of marquee brands, distribution reach, management bandwidth and the wider spread of the group was exciting enough for Birla to seek a toehold in the evolving mediascape with a financial investment.

According to reliable investment banking sources, this was Birla's second attempt for an entry into the media space.

. . .

Why India Inc is in rush for deals in media space

Two years ago, UTV's founder-promoter Ronnie Srewvala had approached Birla with an offer to buy into his business news channel, Bloomberg-UTV.

The deal subsequently fell through over valuations and 'other structuring issues', allowing Anil Ambani to step in and further expand his ever-growing media and entertainment pie.

Explaining his investment rationale, Birla says, "The media sector is a sunrise sector from an investment point of view. I believe Living Media offers one of the best opportunities for growth and value creation."

That may be the reason why corporate newsmakers are in a frenzied rush to create news themselves.

In fact, smart CEOs and savvy industrial houses think this is the opportune time to tweak their strategies to relook at the sector.

. . .

Why India Inc is in rush for deals in media space

Image: Kumar Mangalam Birla (C) speaks during a news conference in Mumbai.Photographs: Punit Paranjpe/Reuters

Apart from the Birlas, the Ambanis and the Goenkas, many others including Sunil Mittal, the Tatas, Vijay Mallya and even the lesser known Abhey Oswal are all looking at media -- be it through personal investments or strategic corporate diversifications.

And, media watchers expect the Adani Group to also jump onto the juggernaut sooner than later.

Last year, sources said feelers were sent to Gautam Adani to buy into TV channels.

This year, senior executives of a Mumbai-based industrial group had also approached Prannoy Roy to explore a strategic equity alliance for NDTV's business channel, Profit, but were turned down.

. . .

Why India Inc is in rush for deals in media space

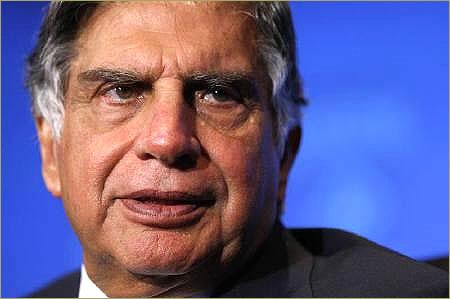

Image: Ratan Tata.Photographs: Reuters

The Tatas are, however, clear they do not want to invest in news media but, as a senior group official explained on condition of anonymity, the group is interested in media-related enabling infrastructure like carriers.

The year's first big-bang headline in this space, of course, came from Mukesh Ambani, who managed a content coup with Ramoji Rao of Eenadu (ETV) and Network18's Raghav Bahl.

Ambani bailed out Bahl's cash-strapped media group with funds only to help Reliance integrate its previous loss-making investments in ETV with Network18.

By bankrolling one, the Ambani flagship could control a significant chunk of two nationwide media properties.

. . .

Why India Inc is in rush for deals in media space

Image: A newspaper vendor waits for customers on a street in Jammu.Photographs: Pawel Kopczynski/Reuters

Some wonder why India Inc is so enthusiastic about investing in media, given the hyper competition and draconian regulations governing the sector.

The cluttering, according to Nikhil Vora, MD, IDFC Securities, and a veteran media analyst, happened far too fast and that destroyed the economics of the business.

Besides, some media companies expanded into newer verticals like retail, power and NBFC or extended their existing brands into new media distribution platforms of e-commerce, digital and online a bit too fast.

But, their leveraged balance sheets became a millstone around the neck and in the ongoing slowdown, many have been unable to arrange refinancing.

That, precisely, is what is triggering the large deals.

. . .

Why India Inc is in rush for deals in media space

"One finds large Indian corporates bringing their balance sheet strength to complement leading media brands," explains Jagat Dave, director, Ambit Corporate Finance, the investment banker behind the recent Aditya Birla-Living Media deal.

For the corporations, this is a great chance to get a piece of the action and centres of influence at reasonable valuations.

"Smart corporates are getting in first. They are well capitalised with enough free cash flows and can test the waters," feels STAR India's former CEO, Peter Mukherjea, currently a mentor to several cross-media professionals.

As a Birla group professional puts it, "The India Today group is not too low-profile to be ineffective or too high-profile to burn cash. We have made a financial investment. Obviously, we'll look at financial returns."

. . .

Why India Inc is in rush for deals in media space

Adds another company official, "Synergies with ideas on content-sharing can be an effective consequence, but not a conscious one. Digitisation actually gives an enormous opportunity."

A shake-up was anyway inevitable.

The first phase of business was led by creative entrepreneurs like Prannoy Roy or Raghav Bahl or India Today's Aroon Purie.

But now when the sector is becoming large and relevant, large corporations are moving in through M&As. Their outlook and sustenance is naturally long-term.

"Mavericks always create businesses. But, by nature, they are non-scalable.

"Then larger consolidators buy them out. This is true across the world and sectors," reminds IDFC's Vora.

. . .

Why India Inc is in rush for deals in media space

Photographs: Reuters

But behind the arch lights, hype and the hoopla, some do see other layered motives creeping in. When corporates continue to buy into news media, it gets viewed with suspicion.

"I do not know if there's a pure profitability motive in each of these deals. This, to me, is part of managing the ecosystem in the current hostile business environment.

"The question is do you use it as an overt weapon or a covert one?" cautions a former media CEO, who requested anonymity.

"Corporates can also use media as a surrogate tool to peddle influence. Media is as corruptible a business as any other.

Now they even have a fig leaf of acquiring content," says a Tata official.

. . .

Why India Inc is in rush for deals in media space

Photographs: Danish Siddiqui/Reuters

"The desire to own media is largely a perception game.

"It is a deterrent against a possible attack," feels Shivnath Thukral, group president, corporate branding and strategic initiatives at Essar.

Since media ownership gives power to inform, influence and even instigate, Thukral hopes corporates will behave responsibly.

Vinod Mehta, editorial chairman of the Outlook Group, says he has no problem in private business owning media.

"But, I do have a problem if two or three business groups start controlling media either directly or through cross-holdings. We need to watch out for cartelisation," he warns.

The situation also gets aggravated when some media promoters and corporations offer selective disclosures.

. . .

Why India Inc is in rush for deals in media space

Photographs: Jayanta Dey/Reuters

"In some of the recent media M&As, we think disclosures have been murky," says Vora.

But, many say this is all barking up the wrong tree and there are enough ways to safeguard the newsroom. Most corporate investors ridicule the prospects of influencing content.

In fact, for them, ownership means self-governance as "the sole equity of these media brands is their credibility".

"Credit us with some intelligence," says a Mumbai-based industrialist with significant media interests.

"None of us are looking at media investments as a power base. We can wield enough influence without owning a media house through advertising or other pressures."

. . .

Why India Inc is in rush for deals in media space

Moreover, media companies like Bennett, Coleman & Co or Dainik Bhaskar themselves have become diversified conglomerates.

So, Mukherjea is confident that maturity will ensure clear ownership and transparent reporting.

Paid content and private treaties are also media company creations, not designed by any corporate sector owner.

A Tata Group official says a media transparency index to pinpoint the degree of dependence on advertising may work.

"Every quarter, listed or unlisted media companies should also disclose percentage shareholding of any shareholder above a five per cent threshold."

article