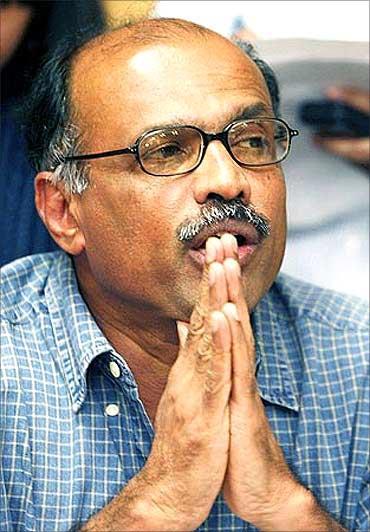

India's low-cost pioneer, Gorur Ramaswamy Iyengar Gopinath, is a serial entrepreneur whose DNA dictates that he constantly throws himself into one kind of venture or another until something sticks.

"I reared cattle to sell milk, got in poultry farming, silkworm farming, then turned a motorcycle dealer, an Udupi hotel owner, a stockbroker, irrigation equipment dealer, an agriculture consultant, a politician and finally an aviation entrepreneur -- struggling, falling, rising, falling, rising again and taking off," he says in his autobiography Simply Fly.

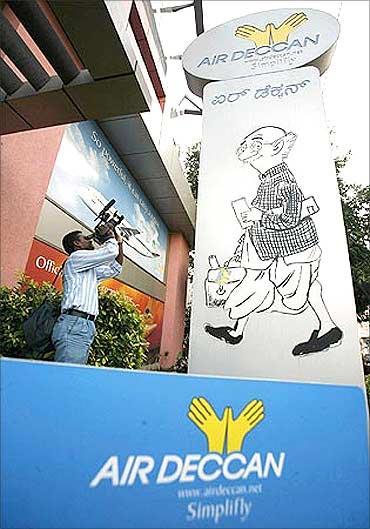

As of late, however, Gopinath has been doing a lot more falling than rising. His latest venture, an express logistics company called Deccan 360 -- of which Mukesh Ambani's Reliance Industries owns a 26 per cent stake -- has imploded in just under two years of operations, with its cargo operations shutting shop in May.

However, the news has gotten worse for Gopinath who is legendary for halving airfares in India when he launched low-cost airline Air Deccan in the 1990s. The Directorate General of Civil Aviation last week put a spanner in Gopinath's plan to start an intra-state charter service in Gujarat with which he had hoped to connect tier-II and III towns with metros, by denying him permission to operate.

. . .

Realising that he was running out of options, Gopinath asked 600 of his employees a few weeks ago to look for jobs elsewhere or go on a long leave without pay.

The company has cited business and funding constraints as a reason. Speculation is also rife that Reliance may buy out the cargo company but both Reliance and Deccan denied any such move.

"While we have done our best to hold the company with minimal operations, we could not succeed due to business and funding constraints. Hence, we opted for restructuring and are in the process of discussing with investors and lenders," the company's HR department wrote to its employees.

Deccan 360 is reportedly saddled with a Rs 120 crore (Rs 1.20 billion) loss and has just two turboprop planes left in its fleet.

. . .

How did things go into such a tailspin for a veteran of the airline business? While Gopinath didn't respond to calls and emails, Shesh Kulkarni, CEO of Universal Freight Management, a cargo and logistics company, says the difference lay in the way Air Deccan and Deccan 360 functioned.

"Air Deccan's growth was gradual. Planes were added and services expanded as revenue started trickling in," he says.

Not so with Deccan 360. While there is nothing intrinsically wrong with Deccan 360's business model, its costs grew faster than revenues because of Gopinath's ambition to scale up quickly.

The alternative route would have been to rent space on other aircraft and use road transport, but this would have grown the company at a far slower pace.

. . .

"There is a long gestation period in this business. You require deep pockets and holding power to sustain yourself" says Kulkarni.

Blue Dart and Deccan 360 are the only two companies which have freighters. Gati had leased planes from Air India but does not fly them anymore. Other cargo and logistics companies simply book space in bulk through a common agent in freighters and passenger planes.

Operational issues soon became the bane of the company with rising fuel prices its Achilles' heel. Jude Fonseka, who served as a chief executive officer in Deccan 360 till last year, refused to comment on the airline's current state but says that volatile fuel prices has affected the entire cargo industry.

In some of the markets, the fuel surcharge was higher than freight charges, a clear indication that the aviation fuel cost was the most significant handicap for the industry.

. . .

Moreover, Deccan 360 started operations in November 2009 when the global economy was just coming out of recession.

"Air freight industry has still not recovered from the slowdown as the confidence in general has been somewhat slow to come back," Fonseka added.

At the time, airline yields were under pressure and Deccan -- whose rates were already a hefty 30-40 per cent cheaper than Blue Dart -- could not sustain its prices when other airlines began dropping freight rates, says a source.

Ultimately, "there was a mismatch between cost and pricing. The revenue stream was not adequate and the company did not break even financially," says an industry expert.

. . .

Issues with its fleet of aircraft also hobbled the company. Deccan 360 began with three Airbus A310 planes and five ATR planes but the Airbuses had maintenance issues and were often grounded.

Deccan returned these planes to the lessor two months ago apparently amidst a dispute over non-payment of lease rentals which Deccan denies.

One of the most serious issues contributing to the firm's unravelling has been a flawed business strategy that ignored lucrative tie-ups that could have pumped up its low loads.

Typically, cargo planes operate during the night. Deccan 360 had hoped to increase the utilisation of its planes by chartering the Airbus A310s on international routes during day time.

. . .

"But the plan was not marketed enough. It did not partner with foreign airlines which could have given it a cargo feed from abroad," says a cargo expert. For any cargo venture to be successful it must attract bi-directional traffic.

Another oversight was ignoring possible partnerships with companies that were catering to India's retail boom.

"Deccan was unable to tie up with big retail chains. This would have got them good loads," says the cargo expert. "Unlike Air Deccan, Deccan 360 also lacked a first mover advantage in the market. Its competitors already had long term contractors," he adds.

To add to Gopinath's woes, his Gujarat charter plan -- to connect smaller towns such as Bhuj, Bhavnagar, Surat, Jamnagar with bigger ones like Ahmedabad -- also seems to be going belly-up.

. . .

The company's CEO Jayanth Pooviah had claimed that the DGCA has given verbal permission for the wet lease -- where the plane is rented with a crew -- of two ATR 72 planes and the service will begin in a month.

"We are waiting for the aircraft. The pilots will require security clearance. We hope to start the service in a month's time," he stated.

Yet, Director General of Civil Aviation, Bharat Bhushan has insisted that no permission has been given to Deccan 360 and until certain conditions are met, Deccan will not be allowed to wet lease the planes.

Apparently, the DGCA felt that allowing the wet lease of planes could provide a back door entry for foreign companies in the aviation sector.

. . .

This has forced Deccan to let go around 40 employees. It also filed an appeal with civil aviation ministry against the DGCA order.

Despite these major setbacks, the ex-army captain seems to be soldiering on. Last month, a senior Deccan executive had told Business Standard that Deccan plans on adding four more planes to its fleet and will tap e-commerce to expand the business.

Currently, it has two ATR-72s which fly between Delhi-Mumbai and Mumbai-Chennai. Each plane has a capacity of 8 tonnes and is suitable for domestic operations. "We are looking at a daily capacity of 40 tonnes. We are in discussion with e-commerce companies," an executive said.

This makes sense as India is experiencing an e-commerce boom with a growing middle class increasingly surfing the Net for deals on everything from LCDs to diapers, leading to more express delivery of goods and a potential avalanche of business for the logistics company.

However, for Deccan to soar, Gopinath may have to first get his feet back on the ground, methodically build his capacity and get his operations right in order to convince his investors that this isn't a venture that's going to crash and burn soon.