| « Back to article | Print this article |

Why best of stock experts are nervous about 2014

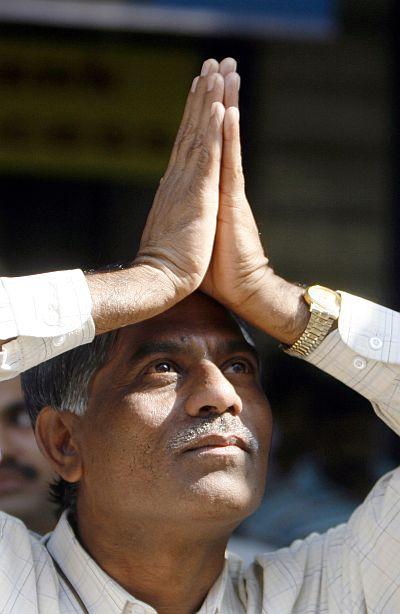

“It is going to be a very difficult year.” That's how Sankaran Naren, one of India’s top performing equity fund managers, chooses to sum up his outlook for 2014 as the buzz surrounding the general elections gets louder.

While the uncertainty over the impact of US Federal Reserve’s decision to withdraw its stimulus package could also play a big part in driving sentiments over the year, the election outcome will be more keenly watched as investors are pinning hopes on the new government to revive the flagging economy, said fund managers.

“Politics will be the biggest trigger. Uncertainty is high because investors will find it very difficult to determine what will happen on the political front,” said Naren, chief investment officer, ICICI Prudential Mutual Fund.

General elections: A lot at stake

Notwithstanding the uncertainty surrounding the election results, Dalal Street is betting on a Bharatiya Janata Party (BJP)-led government coming to power.

Investors are hoping Narendra Modi, BJP’s prime ministerial candidate, would introduce policies to boost investor sentiment and revitalise the economy.

Click NEXT to read more…

Why best of stock experts are nervous about 2014

The rally on Dalal Street after September has been partly aided by expectations of a BJP-led government coming to power. The Nifty has risen almost 16 per cent from September 1 to date.

“The sharp performance of Indian equities since the beginning of September 2013 clearly indicates the market has shrugged off taper fears and now appears much more optimistic on a stable and strong political outcome for the mid-2014 elections,” said Bhuvnesh Singh, managing director and head of India research at Barclays.

India’s economic growth has almost halved to 4.8 per cent in the past year or so as investors blame the current Congress-led United Progressive Alliance (UPA) government for its lax economic management and damaging economic sentiment.

Although Finance Minister P Chidambaram and Reserve Bank of India Governor Raghuram Rajan have managed to repair part of the damage by improving the sentiment in the stock market and the rupee, the economy continues to be in doldrums in the absence of fresh investments and high fiscal deficit.

Click NEXT to read more…

Why best of stock experts are nervous about 2014

The election results will also be closely watched by the rating agencies, which have threatened to downgrade India's sovereign ratings to junk status. In November, S&P said its ratings action would depend on the new government policies.

Market participants shudder to think about the impact of an election outcome that does not result in a BJP-led coalition government coming to power on stocks.

“There is very little room for disappointment in the markets because expectations of a pro-business political party coming to power are high,” said Saumil Shah, managing director and head of equity sales trading at Bank of America Merrill Lynch.

Fed tapering: Underestimating the impact?

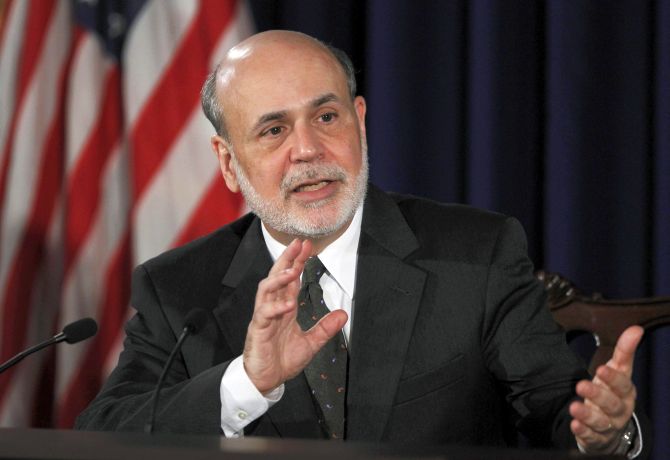

Amid the excitement surrounding the general elections, investors will keep a close watch on the effect of the US Federal Reserve’s withdrawal of its monthly $85-billion-bond-buying programme, known as Quantitative Easing (QE), on foreign institutional investor (FIIs) flows into emerging markets, including India.

Click NEXT to read more…

Why best of stock experts are nervous about 2014

Recently, the American central bank announced it would start the cut in the QE by $10 billion every month from January, but the market took the announcement in their stride because it promised to keep the low interest rate regime longer than what the markets expected.

Brokers and analysts said the relief could be temporary if the dollar starts strengthening against other currencies, including the rupee.

This could result in FII flows into Indian shares slowing down as a weaker rupee against the dollar would erode the value of their local stock holdings.

“Emerging markets, including India, could come under pressure if the dollar strengthens on account of tapering,” said Shah. FIIs have pumped over Rs 1 lakh crore into Indian stocks in 2013 so far, one of the highest among emerging markets.

Click NEXT to read more…

Why best of stock experts are nervous about 2014

The Nifty has gained four per cent, while the Sensex has risen 6 per cent in the period.

However, the positive is that the market perceives India is better prepared to deal with a slowdown in FII inflows, thanks to the shrinkage in current account deficit and increased forex reserves.

Inflation: A dark horse?

While investors will scour through macro-economic data for hints that the worst may be over, what can spring a surprise for the markets would be indications of softening inflation. However, few market participants are willing to bet on falling prices.

Fund managers believe a drop in inflation later in 2014, which is least-expected, could well be a key trigger for the economy and the markets.

“We expect inflation to soften and interest rates to come down in 2014. It will be taken positively the markets,” said Naren of ICICI Prudential.

Macquarie expects headline consumer price inflation to moderate to eight to nine per cent over the coming months versus 10.1 per cent in October.