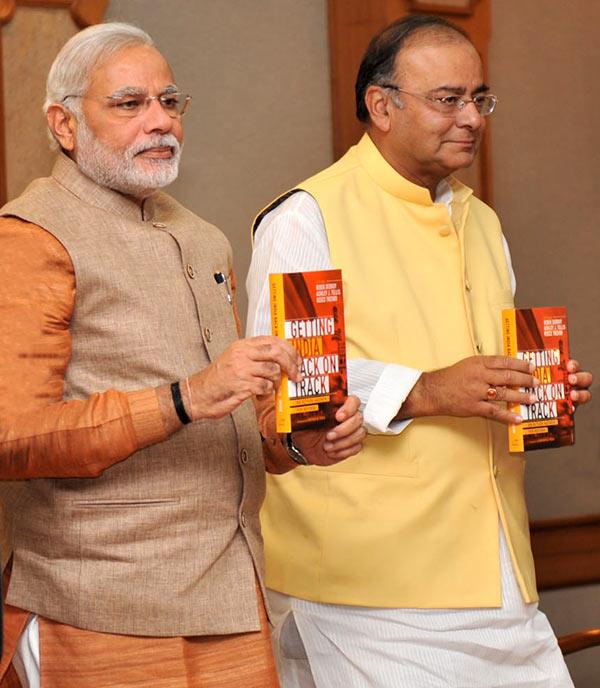

Photographs: Courtesy, PIB

Following are the highlights of the Union Budget 2014-15 presented by Finance Minister Arun Jaitley in Parliament on Thursday:

Highlights of the Budget:

* Income tax exemption limit raised by Rs 50,000 to Rs 2.5 lakh and for senior citizens to Rs 3 lakh

* Exemption limit for investment in financial instruments under 80C raised to Rs 1.5 lakh from Rs 1 lakh.

* Investment limit in PPF raised to Rs 1.5 lakh from Rs 1 lakh

* Deduction limit on interest on loan for self-occupied house raised to Rs 2 lakh from Rs 1.5 lakh.

* Committee to look into all fresh tax demands for indirect transfer of assets in wake of retrospective tax amendments of 2012

…

Please click here for the Complete Coverage of Budget 2014 -15

Highlights of the Union Budget 2014-15

Image: IIT DelhiPhotographs: Simplyme.ananth/Wikimedia Commons.

* Fiscal deficit target retained at 4.1 pc of GDP for current fiscal and 3.6 pc in FY 16

* Rs 150 crore allocated for increasing safety of women in large cities

* LCD, LED TV become cheaper

* Cigarettes, pan masala, tobacco, aerated drinks become costlier

* 5 IIMs to be opened in HP, Punjab, Bihar, Odisha and Rajasthan

* 5 more IITs in Jammu, Chattisgarh, Goa, Andhra Pradesh and Kerala.

* 4 more AIIMS like institutions to come up in AP, West Bengal, Vidarbha in Maharashtra and Poorvanchal in UP

…

Please click here for the Complete Coverage of Budget 2014 -15

Highlights of the Union Budget 2014-15

Photographs: Reuters

* Govt proposes to launch Digital India' programme to ensure broad band connectivity at village level

* National Rural Internet and Technology Mission for services in villages and schools, training in IT skills proposed

* Rs 100 cr scheme to support about 600 new and existing Community Radio Stations

* Rs 100 cr for metro projects in Lucknow and Ahmedabad

* Govt expects Rs 9.77 lakh crore revenue crore from taxes

* Govt's plan expenditure pegged at Rs 5.75 lakh crore and non-plan at Rs 12.19 lakh crore.

* Rs 2,037 crore set aside for Integrated Ganga Conservation Mission called 'Namami Gange'.

…

Please click here for the Complete Coverage of Budget 2014 -15

Highlights of the Union Budget 2014-15

Photographs: Reuters

* Kisan Vikas Patra to be reintroduced, National Savings Certificate with insurance cover to be launched

* FDI limit to be hiked at 49 pc in defence, insurance

* Disinvestment target fixed at Rs 58,425 crore

* Gross borrowings pegged at Rs 6 lakh crore

* Contours of GST to be finalised this fiscal; Govt to look into DTC proposal.

* 'Pandit Madan Mohan Malviya New Teachers Training Programme' launched with initial sum of Rs 500 crore

* Govt provides Rs 500 crore for rehabilitation of displaced Kashmiri migrants

* Set aside Rs 11,200 crore for PSU banks capitalisation

* Govt in favour of consolidation of PSU banks

* Govt considering giving greater autonomy to PSU banks while making them accountable

…

Please click here for the Complete Coverage of Budget 2014 -15

Highlights of the Union Budget 2014-15

Photographs: Reuters

* Rs 7,060 crore for setting up 100 Smart Cities

* A project on the river Ganga called ‘Jal Marg Vikas’ for inland waterways between Allahabad and Haldia; Rs 4,200 crore set aside for the purpose.

* Govt proposes Ultra Modern Super Critical Coal Based Thermal Power Technology

* Expenditure management commission to be setup; will look into food and fertilizer subsides

* Impasse in coal sector will be resolved; coal will be provided to power plants already commissioned or to be commissioned by March 2015

…

Please click here for the Complete Coverage of Budget 2014 -15

Highlights of the Union Budget 2014-15

Photographs: Reuters

* Long term capial gain tax for mutual funds doubled to 20 pc; lock-in period increased to 3 years

* Rs 4,000 cr set aside to increase flow of cheaper credit for affordable housing to the urban poor/EWS/LIG segment.

* EPFO to launch the 'Uniform Account Number' service to facilitate portability of Provident Fund accounts

* Mandatory wage ceiling of subscription to EPS (Employee Pension Scheme) raised from Rs 6,500 to Rs 15,000

* Minimum pension increased to Rs 1,000 per month

* War memorial to be set up along with a war museum; Rs 100 crore set aside for this

* Income from foreign portfolio investors to be treated as capital gains

* Investment allowance to manufacturing companies, to incentivise small entrepreneurs

…

Please click here for the Complete Coverage of Budget 2014 -15

Highlights of the Union Budget 2014-15

Photographs: Reuters

* Rs 100 crore for development of organic farming

* Indian Custom Single Window Project to be taken up for facilitating trade

* Clean Energy cess increased from Rs. 50/ tonne to Rs 100/tonne

* Excise duty on footwear reduced from 12 pc to 6 pc

* Net effect of direct tax proposals is revenue loss of Rs 22,200 cr

* Tax proposals on indirect tax front would yield Rs. 7,525 crore

* Free baggage allowance increased from Rs 35,000 to Rs 45,000

* PSUs to invest to over Rs 2.47 lakh crore this fiscal.

Please click here for the Complete Coverage of Budget 2014 -15

article