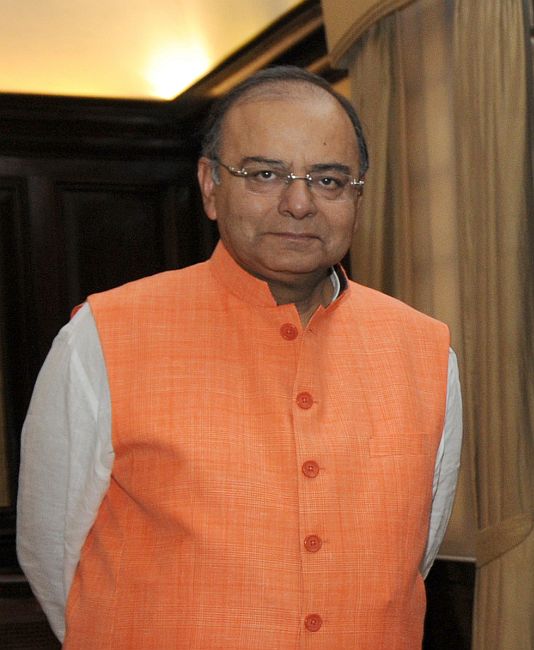

Photographs: Courtesy, PIB

Finance Minister Arun Jaitley's maiden Budget on Thursday is expected to be a tightrope walk of trying to meet demands for tax sops especially from the middle class and pursuing fiscal prudence to spur investment and growth.

The Budget for 2014-15 will be presented by the new BJP-led government, which rode to power on promises of providing relief to inflation-hit common man, amid falling growth, stagnating investments, high fiscal deficit and external crisis.

There are high hopes from the new government that it will raise tax slabs and also significantly hike the annual tax exemption limit to provide a much-needed relief to salaried class, which is reeling under the stubbornly high inflation.

For boosting investment, Jaitley is expected to announce tax incentives for industry. As a prelude to the Budget, the government has already extended the excise duty concessions for automobile and consumer durable sectors till December.

Please …

Please click here for the Complete Coverage of Budget 2014 -15

Can Jaitley meet the expectations of the common man?

Photographs: Reuters

The Finance Minister is also expected to take a call on reducing duties on gold import, which were increased last year to check ballooning current account deficit.

He could also provide relief to farmers to help them tide over the impact of deficient monsoon which could lead to fall in agricultural output. The government may set up a price stabilisation fund, as promised in the BJP's manifesto.

On the other hand, Jaitley, though not a hard-core economist, is expected to pursue the path of fiscal prudence and not sacrifice it at the altar of populism.

He has already indicated that the government will have to refrain from mindless populism.

"If you indulge in mindless populism you burden the exchequer...you convert yourself into a high taxation society. It does not work. Therefore, if you have to follow a path of fiscal prudence, (you should) have a certain amount of discipline," Jaitley had said recently.

Please …

Please click here for the Complete Coverage of Budget 2014 -15

Can Jaitley meet the expectations of the common man?

Image: Primi Minister Narendra Modi.Photographs: Amit Dave/Reuters

Setting the tone, Prime Minister Narendra Modi recently hinted at tough actions in the Budget.

"I am well aware that my steps may dent the immense love that the country has given to me. But when my countrymen would realise that these steps would result in getting the financial health back, then I will regain that love.

"If these tough measures were not taken, the financial situation would not improve. We need to take action wherever required. We will have to take tough and bitter financial decisions to put the country on the path to good fiscal health," Modi recently said in Goa.

Budget may be harsh on smokers as excise duty on cigarettes and tobacco products is expected to go up.

At the same time, the government may impose higher tax on people earning more than Rs 10 crore annually.

Please …

Please click here for the Complete Coverage of Budget 2014 -15

Can Jaitley meet the expectations of the common man?

Photographs: Reuters

India Inc has already presented its wish list during the customary pre-budget meeting to Jaitley, while the issues of common man have been put forward by various stakeholders including trade unions and other bodies.

In order to provide clarity and improve investor sentiment to foreign investors, there would be reference to retrospective tax amendment in Budget.

The foremost problem that the minister would have to deal with is the retrospective tax amendment issue. The Vodafone case is stuck in arbitration and not much can be done to resolve the impasse as the amount involved is Rs 20,000 crore (Rs 200 billion).

The Modi government is expected to make a general statement of intent to clarify its position with regard to retrospective tax amendment with a view to ensuring a stable tax regime. This would help both - the government as well as the investors.

Please click here for the Complete Coverage of Budget 2014 -15

article