| « Back to article | Print this article |

Budget 2014: The 10 biggest announcements

There were a lot of expectations from Narendra Modi government’s maiden Budget. The party came to power promising development, economic growth, inflation control, and job creation.

Though there were very few concrete steps towards these promises, experts feel that the announcements have set the ball rolling.

Let’s take a look at the 10 biggest announcement made in the Budget.

Do tell us in the comment section if you think these announcements will lead to Modi government fulfilling its promise in the future years.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

Budget 2014: The 10 biggest announcements

Housing For All By 2022

Government wants every family to own a house by 2022. To encourage people, especially the young, to buy property, FM has extended additional tax incentive on home loans.

He also proposed to set up a Mission on Low Cost Affordable Housing that will be anchored in the National Housing Bank.

A sum of Rs 4,000 crore (Rs 40 billion) has been earmarked for National Housing Bank with a view to increase the flow of cheaper credit for affordable housing to the urban poor, Economically Weaker Section, and Low Income Group segment.

The government also outlined some other incentives such as easier flow of Foreign Direct Investment (FDI) in this sector and is willing to examine other positive suggestions.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

Budget 2014: The 10 biggest announcements

100 Smart Cities

The government proposed an allocation of Rs 7,060 crore (Rs 70.60 billion) in this financial year for developing 100 'smart cities' in the country.

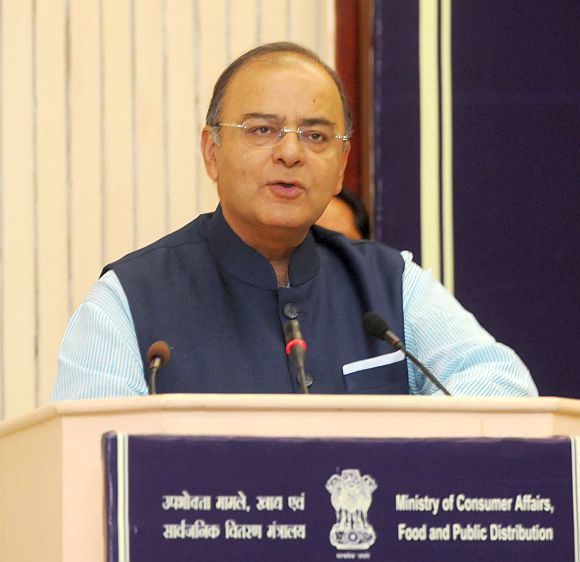

"The Prime Minister has a vision of developing 100 smart cities as satellite towns of larger cities and by modernising the existing mid-sized cities. With development reaching an increasingly large number of people, the pace of migration from the rural areas to the cities is increasing," Finance Minister Arun Jaitley said while presenting the Budget for 2014-15.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

Budget 2014: The 10 biggest announcements

Boosted Investors Confidence

Assuring investors that retrospective amendments to tax laws will be undertaken with extreme caution, Finance Minister Arun Jaitley on Thursday said all fresh cases arising out of the 2012 amendment of I-T Act will be looked into by a high level CBDT committee.

Will this help firms such as Vodafone to settle the tax dispute with the government? Only time will tell.

Please click NEXT to read more

Please click here for the Complete Coverage of Budget 2014 -15

Budget 2014: The 10 biggest announcements

Ambitious Fiscal Deficit Target

Jaitley has kept a target of limiting fiscal deficit to 4.1 per cent for the current fiscal. He aims to reduce it to 3.6 per cent and 3 per cent for 2015-16 and 2016-17 respectively.

Announcing this in his maiden Budget Speech in the Lok Sabha, the Finance Minister said that considering the two years of low GDP growth, static industrial growth, large subsidy burden and not so encouraging tax buoyancy, these targets are daunting.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

Budget 2014: The 10 biggest announcements

Tax Exemption Limit Under 80C Raised To Rs 1.5 lakh

Salaried class has got something to cheer with Finance Minister Arun Jaitley raising tax exemption limit to Rs 250,000 from Rs 200,000, providing a relief of at least Rs 5,000.

The proposal, according to an estimate, is likely to benefit about two crore tax payers.

In case of senior citizens, tax exemption limit is hiked from Rs 250,000 to Rs 300,000 in the case of senior citizens.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

Budget 2014: The 10 biggest announcements

TV And Computers Cheaper, Cigarettes Expensive

Items that will now cost more are cigarettes (hiked by 11 to 72 per cent), aerated drinks and imported clothes. Colour TV and computers will be cheaper.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

Budget 2014: The 10 biggest announcements

Modi Govt Makes Rs 1,000 Monthly Pension A Reality

All the subscribers of EPFO will get a minimum of Rs 1,000 per month pension. This will benefit 28 lakh pensioners who get less than this amount at present.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

Budget 2014: The 10 biggest announcements

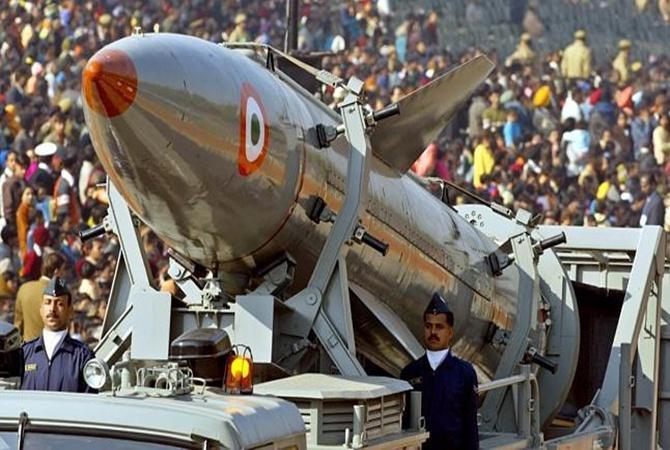

Hiked FDI Limit In Defence Sector

Jaitley said he would raise caps on foreign investment in the defence and insurance sectors from 26 per cent to 49 per cent, but still bar non-residents from taking majority control in projects to supply the world's largest arms buyer.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

Budget 2014: The 10 biggest announcements

Implementation Of GST

In another signature initiative, the government expects to find a solution to implement the goods and services tax that will unify India's 29 states into a common market, a measure that economists say will boost revenue and at the same time make it easier to do business.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15

Budget 2014: The 10 biggest announcements

Govt To Set up 5 New IIMs And IITs

Finance Minister Arun Jaitley allocated Rs 500 crore (Rs 5 billion) to set up five new IIMs (Indian Institute of Management Studies) and five new IITs (Indian Institute of Technology) in the Union Budget 2014-15.

The premier engineering IIT colleges will be added to Jammu, Chhattisgarh, Goa, Andhra Pradesh and Kerala.

Top-ranked business schools or IIMs will be set up in Himachal Pradesh, Punjab, Bihar, Odisha and Maharashtra.

Please click NEXT to read more…

Please click here for the Complete Coverage of Budget 2014 -15