| « Back to article | Print this article |

The good, bad and ugly of the RBI policy

'CRR cut a welcome step in right direction'

Lauding the Reserve Bank of India's decision to cut cash reserve ratio, Planning Commission Deputy Chairman Montek Singh Ahluwalia said on Monday it would have a positive impact on the system and boost confidence in the economy.

"..what RBI has done is that they have acted in the market by releasing resources. It is the release of resources that will make an impact on the rest of the system. It is a step in the right direction, " Planning Commission Deputy chairman Montek Singh Ahluwalia told reporters.

In its mid quarter review, the Reserve Bank on Monday cut cash reserve ratio by 0.25 per cent -- the percentage of deposits banks keep with central bank.

This will release Rs 17,000 crore (Rs 170 billion) of primary liquidity into the system.

Click NEXT to read further. . .

The good, bad and ugly of the RBI policy

Ahluwalia said that people would also read this as some sense of confidence that the totality of action taken by the government, possibly more to come, is going to bring back better macro balance into the system.

It is all of these things that will affect the cost of credit.

About whether the RBI action would help in reviving economic growth, he was of the view that the revival of growth require many actions and monetary policy adjustments are just one component of that.

However he said, "It is a welcome step."

On industry's expectations on interest rate cut by the RBI which would have reduced cost of credit, he said: "When more credit becomes available that will ease pressure. . . the reduction in the cost of credit is going to come over a longer period when more finances flows into the system".

Click NEXT to read further. . .

The good, bad and ugly of the RBI policy

"I don't believe that you can lower the interest rate through some administrative action," he added.

The repo rate, he said, "does not directly influence the cost of money unlike the Fed fund rates in the United States, where it basically undertakes to keep that interest rate at that level by injecting all the money that's needed".

"The repo rate is not a rate at which RBI guarantees to provide funds.

"So I think it is a complete mistake to think that the repo rate performs the same role as Fed fund does.

On inflation he said, "Controlling inflation is very important.

"Although the inflation rate is lower than it was a year ago which is welcome, it is actually above the level of comfort. Over medium term, we have always said that 5 to 6 per cent rate of inflation is reasonable".

Click NEXT to read further. . .

The good, bad and ugly of the RBI policy

After big ticket reforms announced by the government last week like opening multi-brand retail and aviation for foreign investment, he indicated that more such decision are in store.

"There is a lot of scope for more interventions by the government.

"The most important priority is to revive the growth momentum in the economy.

"That can be done by demonstrating that in the second half of the year, people see

that growth rate is higher than it was in the first half.

"That is the first priority," he said.

He also that the proposals like setting up an investment board for clearance of projects would essentially revive animal spirit.

Click NEXT to read further. . .

The good, bad and ugly of the RBI policy

'Lending rates could moderate further'

Borrowers could see better days ahead as banks are expected to cut lending rates following the RBI's decision to unlock Rs 17,000 crore (Rs 170 billion) by slashing cash reserve ratio by 0.25 per cent.

Soon after the Reserve Bank unveiled its mid-quarter review of the monetary policy, several bankers hinted that they may reduce lending rates in the coming days.

Commenting on RBI's action, State Bank of India chairman Pratip Chaudhuri said the bank will review its rates in the light of policy decision.

The asset liability committee of bank is expected to meet soon to take a view on rate revision.

Click NEXT to read further. . .

The good, bad and ugly of the RBI policy

"It is a very positive move. I think the RBI has given a clear signal that they (banks) are willing to respond and that they (banks) have taken note of the signs of deceleration in economy," Chaudhuri said.

Terming the policy action strongly positive for the markets, Bank of Baroda chairman and managing director M D Mallya said as much as Rs 720 crore (Rs 7.2 billion) of additional fund would come to the bank.

The liquidity infusion would ensure adequate flow of credit to productive sectors of the economy, Mallya said, adding that the bank's ALCO would meet soon to take stock of the situation.

Click NEXT to read further. . .

The good, bad and ugly of the RBI policy

Oriental Bank of Commerce chairman and managing director S L Bansal also said that the bank would take a view on the rate revision in its ALCO meeting soon.

"I am of the opinion that there will be fall in the interest rate," Bansal said, adding that the lending rate would moderate further.

OBC has already cut its base rate or the minimum lending rate by 0.1 per cent to 10.40 per cent last month.

According to Central Bank of India Chairman and Managing Director M V Tanksale the CRR cut will infuse Rs 515 crore (Rs 5.15 billion) into the bank.

He said, however, that he did not anticipate cut in the base rate. There could be moderation in certain segments, he added.

Credit growth is expected to pick up during the upcoming festival season, Tanksale said.

Click NEXT to read further. . .

The good, bad and ugly of the RBI policy

On the similar lines, Dena Bank chairperson Nupur Mitra said the bank will decide about base rate cut in the committee's meeting.

RBI's action will definitely help in the credit growth, she added.

Indian Overseas Bank executive director A K Bansal said, "We will take a call in ALCO soon taking into consideration liquidity condition and credit offtake."

If credit picks up further from here on, he said, there is a possibility of moderation in the interest rate.

It was not a surprise that RBI maintained status-quo on policy rates and provided a token 0.25 per cent cut in CRR, said Moses Harding, IndusInd Bank head (ALCO and economic & market research).

It was a balancing act with one eye on inflation and the other on the government's action on pushing reforms, and fiscal consolidation, he said.

Click NEXT to read further. . .

The good, bad and ugly of the RBI policy

Industry disappointed with RBI not cutting key interest rate

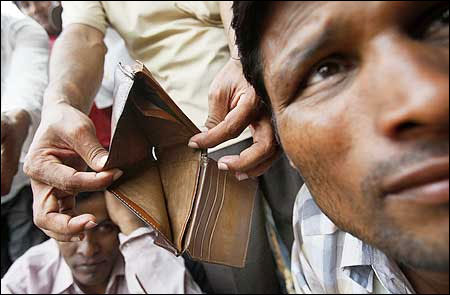

The Reserve Bank's decision to cut the cash reserve ratio by 0.25 per cent -- the percentage of deposits banks keep with central bank -- has received mixed response from India Inc, which has been demanding a reduction in interest rate to spur growth.

Interest rates on home and car loans may ease despite the key policy rates left unchanged by the RBI which lowered the CRR by 0.25 per cent to unlock Rs 17,000 crore of liquidity into the system.

Industry body CII welcomed the move: "Additional liquidity in the system would help the current situation, where availability and cost of credit have been a challenge, particularly for the SMEs."

Click NEXT to read further. . .

The good, bad and ugly of the RBI policy

However, RBI's cautious stance of keeping short-term lending and borrowing rates unchanged in view of high

inflation disappointed the industry.

Assocham said, "The Reserve Bank of India has once again deeply disappointed the industry which was expecting it to worry about a sharp deceleration in growth and go in for a substantial cut in the interest rates."

"The 25 basis points cut in the CRR rate would somewhat address the problem of liquidity and the banks may also be prodded into marginally reducing the retail loan, but these steps will certainly not curb the problems that the Indian industry is facing," he said.

Ficci president, R V Kanoria has described the RBI's decision to reduce CRR as "a calibrated attempt" to inject liquidity into the banking system.

"Both the regulator and the Government seem to have recognised the problem equally and have shown proactivity in their respective domains," he said.

Click NEXT to read further. . .

The good, bad and ugly of the RBI policy

"We hope that the RBI continues with this stance and we look forward to a rate cut and repo rate cut in RBI's second quarter review of monetary policy next month," Kanoria said.

CII Director General Chandrajit Banerjee said, "Demand pressures according to RBI have eased and therefore, a cut in headline rates is a reasonable expectation from the Central Bank."

CII also shares the concern with RBI on the fluctuating international oil prices and suggests that a separate window be created out of the foreign exchanges reserves to fund the Petroleum imports by the OMCs directly.