| « Back to article | Print this article |

10 smart tips to counter recession

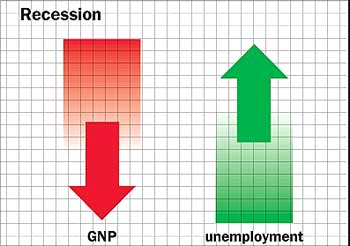

Fiscal year 2008-2009 will go down in world history as the year of financial meltdown, recession and job losses. Many banks closed down and savings rate dropped. As a result, many people are scared and investors shying away from investing in stock markets.

Are you scared that the dreaded 'R' word may also adversely affect your life? Take heart, we have a few tips that will help you to tide over the crisis.

1. Check your expenses and adhere to your budget

People tend to forget that good times don't last forever. Remember that your spending pattern during recession or slowdown can't be similar to that when times were good. If you continue to splurge when things are bleak, then you are simply calling for trouble.

It is thus imperative that you prepare a budget and religiously follow it. Let's say that if you have allocated Rs 500 towards entertainment, then you must ensure that not an extra paisa is spent. This does not only bring about fiscal discipline but will develop your willpower by delaying instant gratification.

10 smart tips to counter recession

2. Don't rely on future income

Depending on future income in order to spend today, is one of the biggest mistakes we make. This has been evident in the recent crisis, where people racked up huge credit card debt and took heavy loans. But when the salary cuts and job losses occurred, they were unable to pay off their debt.

If your monthly income is Rs 20,000 always ensure you don't spend more than Rs 20,000 as pay cut or job loss may land you in trouble.

3. Reduce your debt

Got a bonus? Then pay off any loans that you have taken. If you have multiple loans, first pay off the loans with the highest interest rate, then the one with the second highest rate and so on.

If you have a credit card debt, personal loan and home loan, first clear off the credit card debt, then personal loan and finally home loan. For this you will have to plan out your debts and then go on following it systematically and steadily. It will not only save you money but will also give you mental peace.

4. Opt for strategic asset allocation

Though experts have consistently stated the importance of asset allocation, many investors tend to overlook this fact and invest only in the hottest asset. But remember market conditions do change and what is hot today may be out in the cold later for a long time.

So ensure you divide your portfolio amongst stocks, bonds, gold and real estate to get the maximum returns from your portfolio. Though your portfolio may underperform for some time, it will end up protecting you when the things get rough.

10 smart tips to counter recession

5. Keep emergency cash

You never know when a crisis can strike your family. Death, disease or job loss can end up upsetting your investments. You might be forced to sell your investments though they have not given you any profits. Hence it is advisable to keep at least 3-6 months of your household expenses aside as emergency cash.

6. Sort out your finances

Agreed, keeping tabs and handling your finances closely, may not sound like an interesting job, but it is a necessity. However you can reduce the boredom by putting a system in place. Once it is done, you can spend a few hours a month on this job.

On Sundays, you can spend 1-2 hours to find out how your investments are performing, reading up any news concerning them or talking with your financial planner about the performance of your investments.

10 smart tips to counter recession

7. Plan in advance

One of the reasons many people land in financial mess is that they don't plan their finances ahead. So it is imperative to plan your finances properly. Find out your current position, where you intend to go and set up a feasible plan to achieve your objectives.

Unforeseeable events may occur and make you stray away from your plan for a short time, but ensure you get back on track at the earliest. Always remain focused and keep a watch on your progress. Let's say, you are saving to buy a home and have started investing for the same. But six months after you started investing, you lose your job. If that happens, stop your investment, get a new job and restart your investment.

8. Invest systematically and gradually

The biggest problem is that most people don't bother saving till it is quite late. So they don't have any money to fall back on in case of emergency. Hence it is essential to start small, but regularly and then increase the amounts later. You can start a SIP (systematic investment plan), in which a particular sum is debited from your bank account and invested in a mutual fund.

Or you can open a recurring deposit, which acts like a SIP, initiated by the bank. All this will occur automatically, so you have no excuse not to save.

10 smart tips to counter recession

9. Be in charge of your investments

The markets have crashed and the real estate sector is down in the dumps. What do you do? Sell off? Wrong! Unfortunately, this is what most investors do. In this situation, it is advisable to hold on to your portfolio as selling will just end up causing you financial loss.

Instead, increase your emergency cash reserves and periodically review your asset allocation of your portfolio.

10. Set a realistic outlook

The days of stocks giving a return of over 40 per cent are over. While it is possible that select few may still give high returns, you will be in for some disappointment if you keep your outlook very high. Instead keep a practical outlook of earning 12-15 per cent returns from your investments.

We cannot control outside events like recession. No matter what you do, it is going to affect all of us in some way or other. However some simple tips like optimum asset allocation, debt reduction, keeping emergency cash will help you tide over the rough times, without much damage.

Powered by

BankBazaar.com is an online marketplace where you can instantly get loan rate quotes, compare and apply online for your personal loan, home loan and credit card needs from India's leading banks and NBFCs.

Copyright 2025 www.BankBazaar.com. All rights reserved.