| « Back to article | Print this article |

'Wipro to continue inorganic growth'

Wipro, the country's third largest information technology services company, which last week announced an acquisition in Canada for $195 million (Rs 1,200 crore), will continue with its 'string of pearls' inorganic growth strategy.

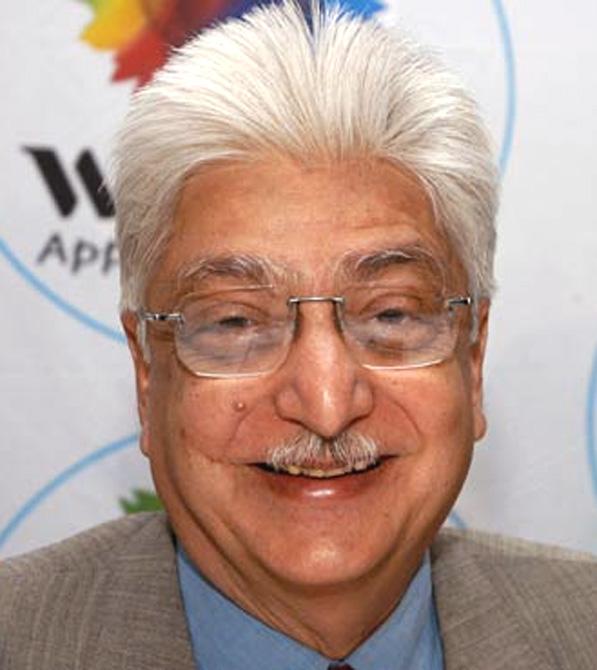

Addressing shareholders at the company's 68th annual general meeting here, Chairman Azim Premji said Wipro would continue to look at acquisitions to strengthen its presence in growth areas.

This comes less than a week after Wipro announced its plans to acquire Canada’s ATCO group's subsidiary, ATCO I-Tek.

Please click NEXT to read further. . .

'Wipro to continue inorganic growth'

The company had said it would fund this acquisition through its cash-in-hand, of close to $2 billion at the end of FY14.

“We have sufficient liquidity on our balance sheet.

“So, we don’t foresee funding as a problem at all,” had said Jatin Dalal, chief financial officer for the IT business.

Over many years, Wipro has been actively making tuck-in acquisitions to bridge the gaps in its offerings and strengthen presence in domains and places that it believes are key for growth.

According to some experts, Wipro has made over 20 acquisitions in IT.

Please click NEXT to read further. . .

'Wipro to continue inorganic growth'

Some of the significant acquisitions ones in recent years have been in the oil and gas space, its chosen area of focus, and in the key markets of America and Europe.

Business Standard had reported in April that Wipro, whose financial performance has largely stabilised, was understood to be closing in on a mid-to large-sized acquisition that could be valued at more than $400 mn (Rs 2,400 crore).

According to sources, it is evaluating some fairly large options in the US and Germany.

The company's merger & acquisition team is learnt to be working overtime to ensure the deal is closed in the current quarter.

Please click NEXT to read further. . .

'Wipro to continue inorganic growth'

Asked about the plan, Chief Financial Officer Suresh Senapaty had earlier confirmed the company was scouting for an acquisition, adding size and scale would not be a constraint, as Wipro had in the past successfully executed many acquisitions, some fairly large.

Separately, Sangita Singh, head of its health care and life sciences business, had earlier this year said that in line with the company's strategy, her division was open to building competencies inorganically and was doing so on an ongoing basis.

Additionally, addressing the investors on Friday, Premji said there was a strong leadership succession plan in place, discussed with the company's board periodically.

Concerns over leadership succession planning at IT services companies have risen after Wipro's close peer, Infosys, saw a slew of top-level exits in the past one year.

It was Infosys' focus on having a strong succession plan that enabled the company to quickly fill all the positions that fell vacant, ensuring minimal impact on business.