| « Back to article | Print this article |

Murthy magic: Analysts see bright future for Infosys

Infosys, India's second-largest software services exporter, posted quarterly profit that missed analyst estimates on a charge related to visa use in the United States, but raised the lower end of its fiscal full-year revenue guidance.

The results were the first for a full quarter since co-founder Narayana Murthy came out of retirement on June 1 to be executive chairman after two years of mostly disappointing earnings that saw the long-time industry bellwether lose ground to rivals.

Several analysts said the company has set conservative revenue guidance that they expect it to beat.

"There's still a lot of work to be done, but they're turning around," said Bhavin Shah, CEO of Equirus Securities.

"I think they're seeing deal wins, client traction and revenue momentum. I'm sure Murthy is spending a lot of energy in sort of assuring clients that Infosys means business."

Click NEXT to read more…

Murthy magic: Analysts see bright future for Infosys

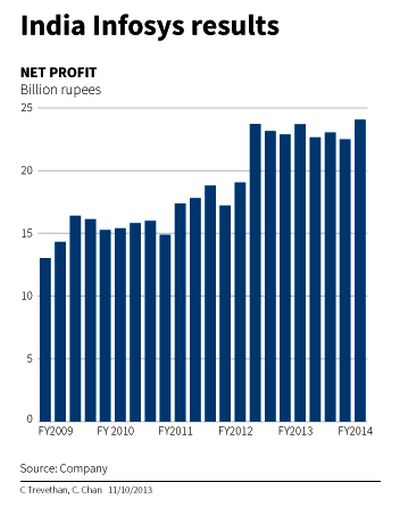

Consolidated net profit for the three months to September 30 was Rs 2,407 crore (Rs 24.07 billion) compared with Rs 2,369 crore (Rs 23.69 billion) in the same period a year earlier, the Bangalore-based company said in a statement Friday.

Shares in Infosys, which in recent quarters have reacted violently to its results and guidance statements, rose a relatively modest 5 per cent soon after markets opened.

The result missed the Rs 2,626 crore (Rs 26.26 billion) average of analyst estimates according to Thomson Reuters I/B/E/S, though the earnings suffered from a Rs 219 crore (Rs 2.19 billion) provision for "visa related matters."

Infosys has been under investigation in the US, its biggest market, over the past use of temporary employment visas and the company said it had made the provision based on discussions with US government agencies and is seeking a "civil resolution" to the matter.

Click NEXT to read more…

Murthy magic: Analysts see bright future for Infosys

Infosys, which trails market leader Tata Consultancy Services by revenue, counts among its customers Bank of America Corp, BT Group PLC, Procter & Gamble Co and Volkswagen AG.

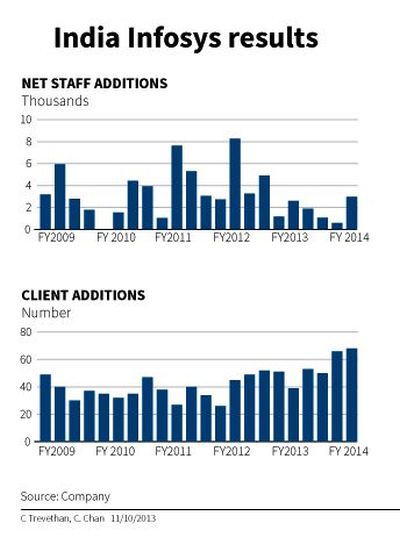

As widely expected, Infosys, one of the relatively few Indian companies to give guidance, narrowed the range of its fiscal year revenue growth outlook to 9-10 percent from 6-10 percent.

Several analysts said Infosys was being conservative after a series of guidance misses, and some said they expect revenue to exceed the current guidance for the full year.

"Infosys is back to its days of under-promising and over-delivering," said Manik Taneja, an analyst at Emkay Global Financial Services.

The company's forecast compares with 12-14 per cent for the sector, according to an estimate by the National Association of Software and Services Companies.

Click NEXT to read more…

Murthy magic: Analysts see bright future for Infosys

Murthy, who had retired at 65 under company rules at the time, has said Infosys took its eye off its growth target to earn a bigger share of revenue from higher-margin proprietary software and consulting.

He is attempting to re-focus on large plain-vanilla IT outsourcing contracts that boost growth and have long been the industry staple.

Infosys and Tata Consultancy Services are being helped by a revival in demand from investment banks in their largest market, the US, and growing appetite for outsourcing in Europe as companies seek to reduce IT costs.

The industry, which generates most of its revenue in dollars, is also benefiting from weakness in the rupee.

Consolidated revenue for the September quarter was 129.65 billion rupees, up nearly 32 percent from a year earlier.

(Additional reporting by Aradhana Aravindan and Abhishek Vishnoi in Mumbai)

© Copyright 2025 Reuters Limited. All rights reserved. Republication or redistribution of Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Reuters. Reuters shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.