| « Back to article | Print this article |

Lenovo bets big on smartphones in India

In May this year, when Sudhin Mathur, a mobile industry veteran with almost two decades of experience, joined Lenovo India to head their mobile phones business, he got a simple brief: “Let’s ride the smartphone wave in India”. By June, he was already spearheading launches for India.

India’s smartphone market has been growing at a scorching pace - four times that of the global average. Research consultancy, Strategy Analytics, in a just-released report for January-March, 2013, ranked India as the third-largest smartphone market in the world, after United States and China.

Smartphone sale volumes, worldwide, expanded by 39 per cent year-on-year, compared to an increase by 163 per cent in India. That is faster growth than China (86 per cent), Japan (24 per cent), the United States (19 per cent) and almost all other major markets in the same time.

Click NEXT to read more…

Lenovo bets big on smartphones in India

The Beijing-based Lenovo group, the world’s second-largest personal computer manufacturer with revenue of $29.5 bn in 2012, entered the smartphone space only in 2011.

With a strong market in China, it is looking to grow beyond its homeground. India plays a pivotal role in furthering its smartphones business in emerging markets (which also include Brazil, Russia, Africa and West Asia). Lenovo is targetting to ship 50 mn smartphones globally in 2013, up from 29 mn in 2012.

It debuted its smartphones in India in November, last year, test-launching six handsets in the south of India and and Gujarat. Marking a wider launch with mainstream advertising in June, 2013, it has now brought in five additional models, to cater to both entry-level and premium users. The prices start from just below Rs 8,000 to sub-Rs 30,000 (street prices).

Click NEXT to read more…

Lenovo bets big on smartphones in India

Mathur, the director (smartphones) at Lenovo India, is quick to counter the perception that Lenovo is late to the Indian smartphone party. “We want to connect with consumers on all devices - PCs, smartphones, tablets, smart TVs,” he says.

“The smartphone market in India is just about taking off, so the brand is not late in the market”, he rationalises.

According to Mathur, the market size of smartphones is expected to grow from 16.3 mn units in 2012 to 32 mn units in 2013, and is likely to touch the 150 mn-mark by 2017.

Lenovo, like other PC manufacturers such as HP, is trying to diversify into handhelds fast. Lenovo had, in fact, sold off its mobile phones business in 2008 for $100 mn, only to buy it back from the same investors in 2009, for $200 mn.

Click NEXT to read more…

Lenovo bets big on smartphones in India

In India, Lenovo topped the PC sweepstakes in 2012 with 15.9 per cent market share, ahead of HP (15.2 per cent). It plans to build on its PC business success, while capturing the shift in consumer demand for mobile devices.

It has officially announced a target of selling 1 mn smartphones and 300,000 tablets in 2013, with new launches in both in the next six months.

Lenovo has made all its handsets 3G-compatible. “The product will be the hero in smartphones, rather than the brand,” insists Mathur. Rahul Gupta, an independent IT consultant who advises many international mobile phone brands on their India strategy, agrees, “Smartphone consumers do not go by brands but by what runs in the system.”

Click NEXT to read more…

Lenovo bets big on smartphones in India

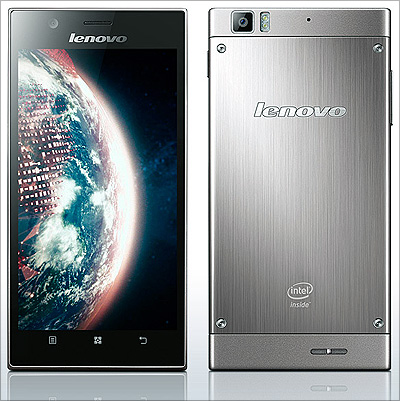

Rather than highlight screen-size or processor-speed, Lenovo will club products according to their end-use. For example, the K-series (K900) targets the early-adopters of latest gizmos and comes for Rs 25,000-30,000.

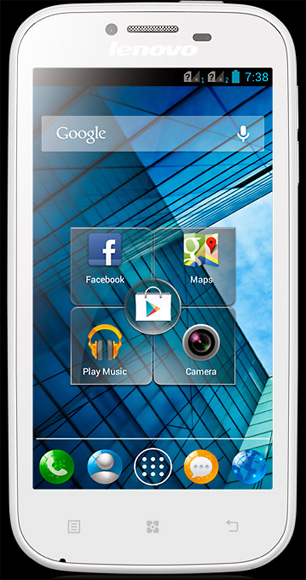

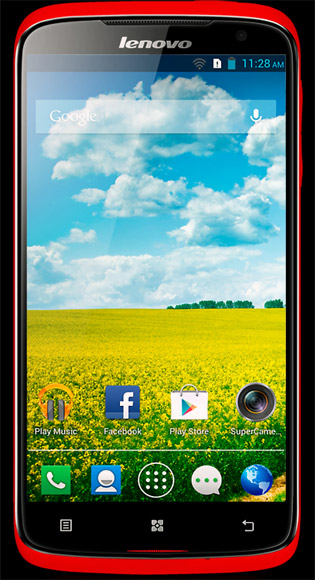

The S-series is for the fashion-conscious user (priced between Rs 15,000 and 22,000; S820, S920). For the professional, it has the P-series which allows for heavy data usage with more battery life and data storage (Rs 15,000-18,000; P780). The A-series is for the entry-level user, keen on social media (sub-Rs 8,000; A706, A390).

Lenovo is clear about the need to refresh its portfolio frequently - it plans on no less than six-eight new phones every quarter.

Industry analysts point out that the market for smartphones, comprising some 30 brands, is getting polarised between two price bands - Rs 8,000-10,000 at the entry-level, and Rs 25,000-30,000 at the top-end. The average selling price of smartphones hovers around Rs 11,000-12,000.

Click NEXT to read more…

Lenovo bets big on smartphones in India

There will be 360-degree multimedia campaigns to mark its quarterly refreshes of its portfolio.

However, the brand promise and tagline remain the same for both its IT products and smartphones: ‘For people to do more’, raising doubts about efficacy. “There has to be separate branding for smartphones that does not dovetail with the PC-brand,” says Gupta.

Apprehensions rise because of the forays of global PC players in smartphones. HP and Dell have failed to leverage their PC businesses when entering the mobile space.

“The mobile and IT distribution channels are very different from each other. The strategies, accordingly, have to be different while seeding the market,” says Llyod Mathias, director, GreenBean Ventures, and former CMO at Tata Docomo and Motorola.

Click NEXT to read more…

Lenovo bets big on smartphones in India

Mathur points to Lenovo’s success in the Chinese market. By the end of 2012, Lenovo became the second-largest smartphone vendor in China, shoring up its market share from 4.1 per cent in 2011 to 11 per cent in 2012, when market leader, Samsung Electronic, had 17.4 per cent share.

“Our confidence comes from the current position in the market” he says. Lenovo will leverage its 1,200 exclusive stores - that currently sell hardware such as PCs - in the next six months, with each of them flaunting an experience zone for smartphones.

Lenovo will start with the metros and tier I towns, covering 70- 80 per cent of the smartphones market. It has partnered with three national distributors - Ingram Micro, Advance Computers (both for the telecom channel) and Redington (IT hardware channel).

Click NEXT to read more…

Lenovo bets big on smartphones in India

HCL, with 110 service centres across the country, will be the national service partner. Distribution is the key as entry-level smartphones see very thin margins, making them a volume-driven segment.

Over the last eight months, Lenovo has built a network of national and regional retailers and already has 3,000 retailers. However, the results of the foray will only start showing in the next two quarters, says Manasi Yadav, senior market analyst (mobile phones and tablets), IDC India.

The biggest challenge, Mathias says, will be to crack the distribution while creating product differentiation in a cluttered market. A senior executive, from a leading Indian mobile handset player, points out that MNCs like Samsung and Nokia had to tailor their products to India. “Why should Lenovo be any different?” he asks.