| « Back to article | Print this article |

Infosys records biggest single day fall in 10 years

Shares of Infosys on Friday nosedived by 22 per cent, eroding Rs 35,740 crore from its market value, as the IT major reported disappointing fourth quarter numbers and lower-than-expected guidance for 2013-14 fiscal.

Infosys stock saw its biggest single day loss since April 2003.

The disappointing revenue forecast prompted investors to offload the stock, pulling it down by over 22 per cent to Rs 2,268 during the day.

Click NEXT to read more...

Infosys records biggest single day fall in 10 years

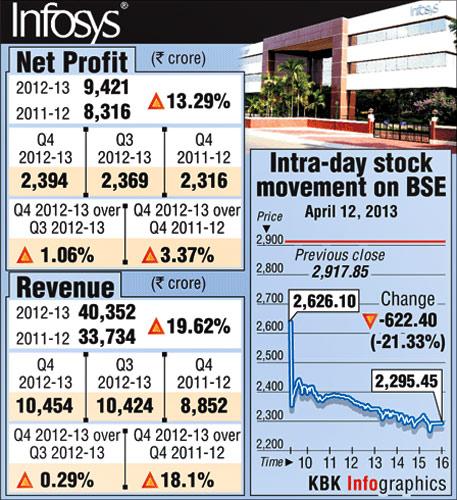

The heavyweight scrip closed 21.33 per cent lower at Rs 2,295.45 on the BSE, pulling down the overall stock market by around 300 points. Infosys weight on BSE 30-stock index, Sensex, declined to 7.19 per cent.

At NSE, the stock crashed 22.07 per cent to settle at Rs 2,273.05. The company's market-cap tanked Rs 35,740 crore to Rs 1,31,813 crore.

Analysts said that Infosys results were disappointing across parameters.

Click NEXT to read more...

Infosys records biggest single day fall in 10 years

"Infosys Q4 FY13 results were below our estimate on revenue and EBITDA front," said Daljeet S Kohli, Head Research IndiaNivesh Securities.

Another expert, Nagji K Rita, Chairman & MD, Inventure Growth and Securities said: "The disappointment was triggered by several factors. The company expects its FY'14 dollar revenue to grow between 6-10 per cent. This is below street expectation of 12 per cent."

Click NEXT to read more...

Infosys records biggest single day fall in 10 years

Infosys Ltd, country's second-largest software services exporter, today reported 3.3 per cent rise in fourth-quarter net profit but forecast lower-than-expected revenue growth on challenging global economy.

The company reported a consolidated net profit of Rs 2,394 crore for the January-March quarter of 2012-13 fiscal and posted 18.09 per cent rise in revenues at Rs 10,454 crore.

The IT bellwether pegged revenue guidance at 6-10 per cent for this fiscal, which is lower than that of IT body Nasscom, which expects the industry to grow at 12-14 per cent.

Click NEXT to read more...

Infosys records biggest single day fall in 10 years

On the muted sales guidance for FY'14, Infosys CEO and Managing Director S D Shibulal said: "That is a reflection of the volatility, which we have seen over the last two quarters. The environment remains volatile as well as mixed. There are challenges in the US and Europe."

Selling was also seen in other IT stocks where Wipro lost 4.72 per cent, Hexaware Tech (1.78 pc), HCL Tech (1.73 pc) and TCS (1.63 pc).

Tracking weakness in these frontline stocks, the BSE IT index slumped 11.09 per cent to settle at 6,040.48 and was the top loser among the 13 sectoral indices.

Weakness in Infosys counter sent the BSE benchmark Sensex down by 299.64 points to 18,242.56.